Pa Business License Sole Proprietorship

The business purpose may be given for fictitious names professional corporations and the classification for trademarks. Sole proprietorships present a few advantages over other business structures.

Amazon Com Small Time Operator How To Start Your Own Business Keep Your Books Pay Yo Starting Your Own Business Credit Card Statement Small Business Trends

Amazon Com Small Time Operator How To Start Your Own Business Keep Your Books Pay Yo Starting Your Own Business Credit Card Statement Small Business Trends

Current licensees the opportunity to renew their license.

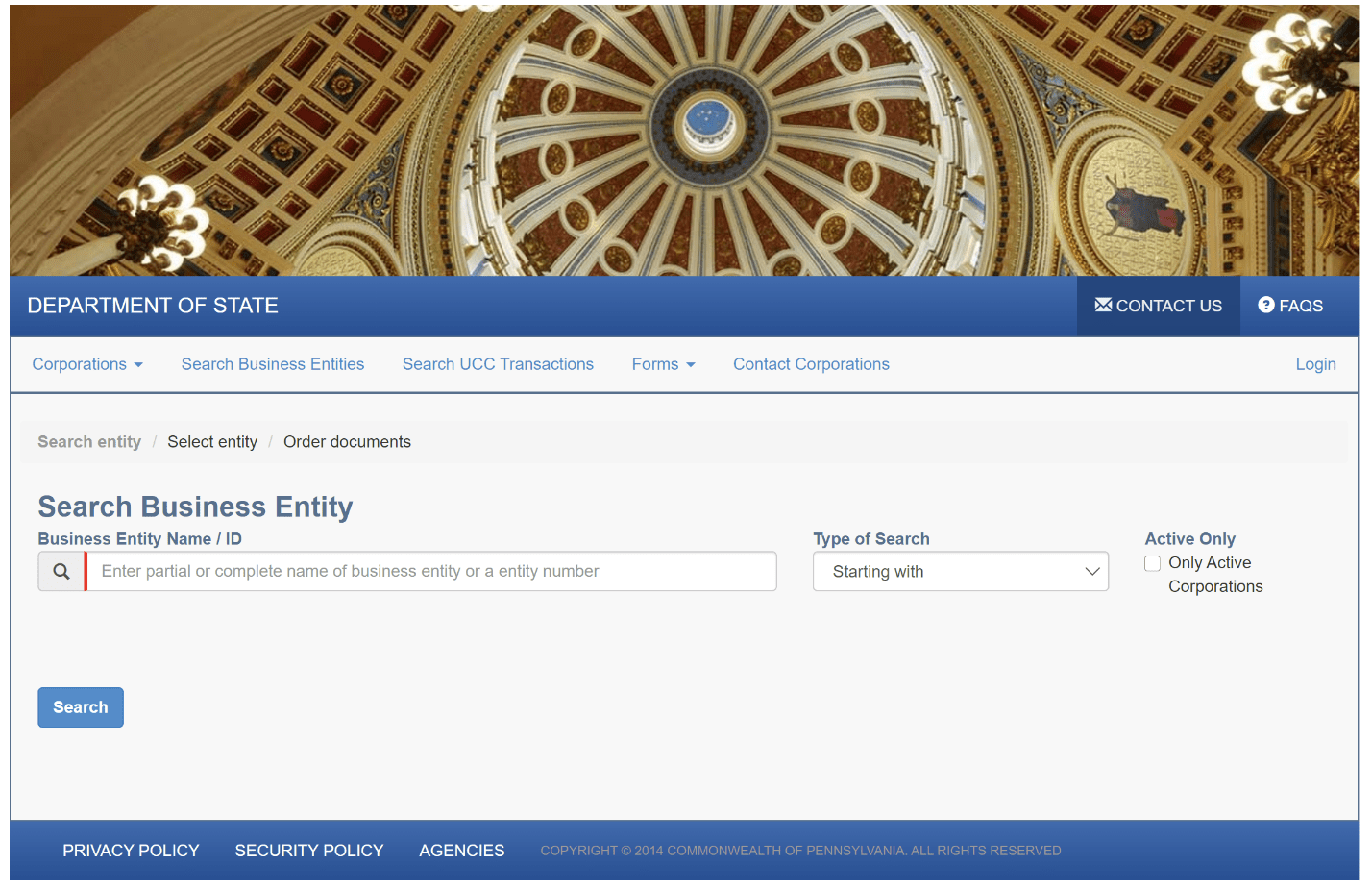

Pa business license sole proprietorship. Before registering check out our Planning Section and verify that youve completed the necessary preliminary steps prior to registration. As a business grows owners may decide to expand and form another structure such as a partnership or LLC. To register your business for state tax and employer accounts in Pennsylvania you will need to complete the PA Enterprise Registration Form called the PA-100.

You will pay taxes on business profits on your personal income tax return and at your personal income tax rate. It is an unincorporated business owned and run by one individual with no distinction between the business and you the owner. Although you do not have to register the business with the state you must register a fictitious.

Include an income statement and a balance sheet in the business plan. Write a Business Plan. You do not have to take any formal action to form a sole proprietorship.

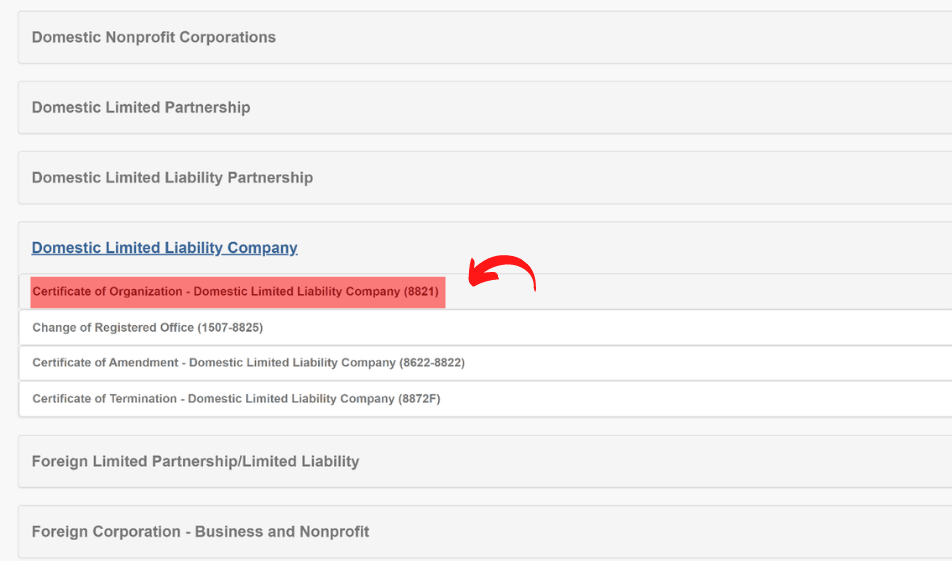

The IRS deems a sole proprietorship a disregarded entity for tax purposes. Domestic Limited Liability Company. Pennsylvania sole proprietors must provide the name and address of the business the business type as well as a Social Security number or EIN.

For example if you are Joe Greene you can do business as Joe Greene sole proprietor. Pennsylvania does not require sole proprietorships to register with the state or to obtain a. Open a Business Bank Account.

Sole Proprietorship Domestic General Partnership. You may complete the form online by visiting wwwpa100statepaus. Forming a Sole Proprietorship.

Pennsylvania makes it easy for you to complete your regular tax and business update filings online. If you structure your craft business as a sole proprietorship and you have no additional employees this step is not necessary. Choose a Business Name You may use your own given name or use a fictitious business name.

Any entity including an individualsole proprietorship corporation partnership association or other combination or group of persons which conduct s any business in Pennsylvania under an assumed or fictitious name must register the fictitious name by filing a Registration of. Alternatively you can create a fictitious business name like. They require fewer forms to establish and have fewer.

And licensees employers and the general public the opportunity to conduct searches of licensed professionals via our secure PALS website. Obtain permits and licenses to operate the Pennsylvania sole proprietorship. A sole proprietorship is limited to a single owner or to a husband and wife operating as a joint venture.

This is the simplest form of organization and allows a single owner to have sole control and responsibility. A corporate entity limited partnership or limited liability entity is considered to be in good standing if it has not been dissolved canceled merged withdrawn. The Requirements of a Sole Proprietor in Pennsylvania Business Registration.

Closing Actions Documents by Business Structure. There isnt a requirement in Pennsylvania for sole proprietors to acquire a general business license but depending on the nature of your business you may need other licenses andor permits to operate in a compliant fashion. You are entitled to all profits and are responsible for all your businesss debts losses and liabilities.

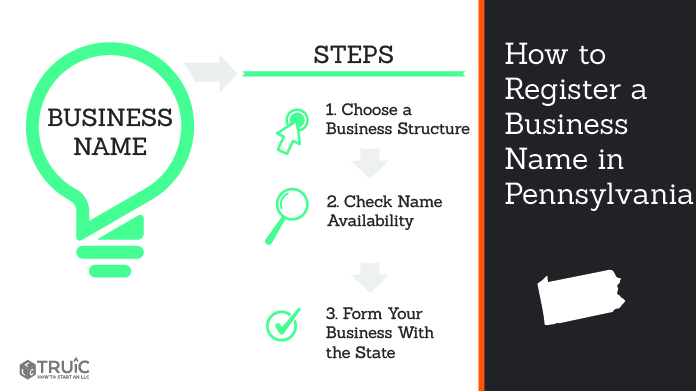

Starting a Business in Pennsylvania Simple Step-by-Step Guide. Choose a Business Idea. This process will vary slightly depending on your business structure so its important to know that information before embarking on this step.

Develop a business plan that outlines the goals for your craft business along with a projected cash flow analysis. Most small businesses operate as sole proprietorships. Get your own personalized business registration checklist.

The permits and licenses needed to legally operate a Pennsylvania sole proprietorship depend upon the business type. The purpose for other entities may or may not be listed. Apply for Business Licenses Permits.

Select a Business Entity. Register a Business Name. Let us look at the four steps required to start a sole proprietorship in Pennsylvania How to Establish Sole Proprietorship in Pennsylvania.

The Bureau of Professional and Occupational Affairs now offers prospective licensees the opportunity to apply for initial licensure.

Starting A Business In Pa The Ultimate Guide 2021

Starting A Business In Pa The Ultimate Guide 2021

Starting A Business In Pa The Ultimate Guide 2021

Starting A Business In Pa The Ultimate Guide 2021

Checklist Pre Incorporation Agreement Template Free Pdf Word Apple Pages Google Docs Templates Checklist Word Doc

Checklist Pre Incorporation Agreement Template Free Pdf Word Apple Pages Google Docs Templates Checklist Word Doc

How To Form A Pennslyvania Llc Startingyourbusiness Com

How To Form A Pennslyvania Llc Startingyourbusiness Com

Business Postcard Design Business Postcards Business Postcards Postcard Design Graphic Postcard Design Business

Business Postcard Design Business Postcards Business Postcards Postcard Design Graphic Postcard Design Business

5 Steps To Success Articles And Internet Branding Are You Ready To Become An Internet An Marketing Articles Marketing Method Marketing Strategy Social Media

5 Steps To Success Articles And Internet Branding Are You Ready To Become An Internet An Marketing Articles Marketing Method Marketing Strategy Social Media

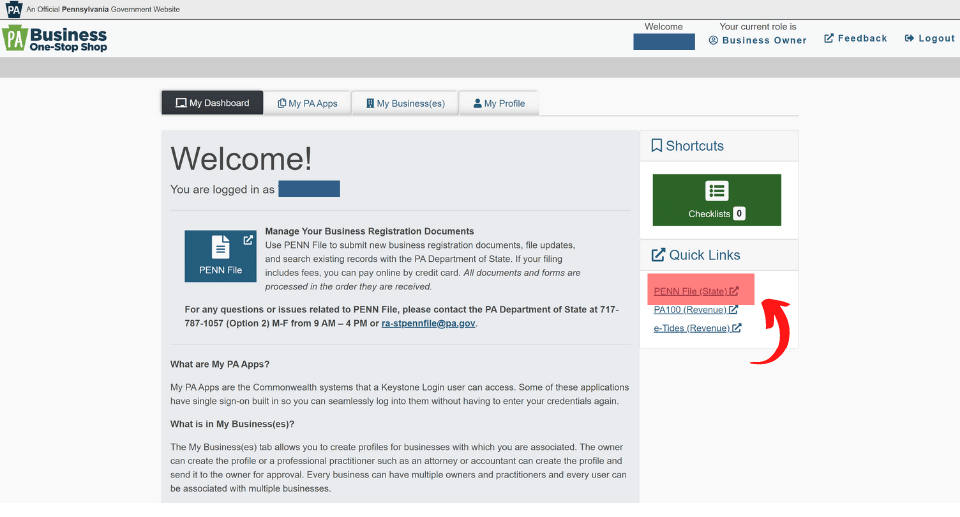

Pa Business One Stop Shop Registering Your Business

Pa Business One Stop Shop Registering Your Business

Assumed Name Certificate Fictitious Business Name Doing Business Name Dba Business Names Names Business Solutions

Assumed Name Certificate Fictitious Business Name Doing Business Name Dba Business Names Names Business Solutions

Guide To Starting A Sole Prop In Pa

Guide To Starting A Sole Prop In Pa

How To Register A Business Name In Pennsylvania How To Start An Llc

How To Register A Business Name In Pennsylvania How To Start An Llc

Pa Business One Stop Shop Registering Your Business

Pa Business One Stop Shop Registering Your Business

Http Www Dot State Pa Us Public Dvspubsforms Bmv Bmv 20fact 20sheets Fs Idreq Pdf

Pa Business One Stop Shop Registering Your Business

Pa Business One Stop Shop Registering Your Business

Printable Daycare Business Plan Daycare Business Plan Business Planning How To Plan

Printable Daycare Business Plan Daycare Business Plan Business Planning How To Plan

Starting A Business In Pa The Ultimate Guide 2021

Starting A Business In Pa The Ultimate Guide 2021

Apply Sales Tax Registration State Tax Tax What S The Number

Apply Sales Tax Registration State Tax Tax What S The Number

6 Questions To Ask Before Taking On A New Business Partner Video Business Motivation This Or That Questions Business Management

6 Questions To Ask Before Taking On A New Business Partner Video Business Motivation This Or That Questions Business Management

Starting A Business In Pa The Ultimate Guide 2021

Starting A Business In Pa The Ultimate Guide 2021