Where To Send 1099 Misc Forms In Massachusetts

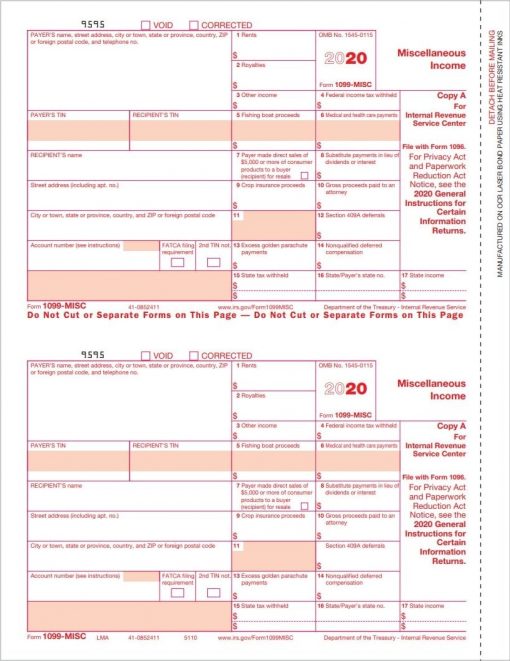

Then you are on your own and there is a lot to take into consideration. Due to the creation of Form 1099-NEC we have revised Form 1099-MISC and rearranged box numbers for reporting certain income.

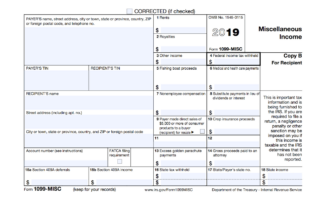

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Form Copy A Federal Discount Tax Forms

It is important to understand the differences.

Where to send 1099 misc forms in massachusetts. Mailing Address for IRS Form 1099-MISC. Learn more about combined state and federal filing. Payer made direct sales of 5000 or more checkbox in box 7.

Where To Send 1099 Misc Forms Irs 2019. Does Massachusetts participate in combined federal and state filing. Updated on December 29 2020 - 1030 AM by Admin ExpressEfile.

Mail 1099-MISC forms to. I received a Form 1099 but dont remember receiving a check from the Commonwealth for this tax year. Where To Send 1096 And 1099 Forms.

If not filing Form 1099-K for federal purposes Form M-1099-K must be filed. IRS approved Tax1099 allows you to eFile Massachusetts forms online with an easy and secure filing process. Yes Massachusetts requires you to file 1099s to the Department of Revenue.

Where To Send 1099 Misc Forms Irs 2018. Mail all paper 1099 reports to. The IRS address you should mail Form 1099-NEC to depends on your state.

Planning to paper file Form 1099-MISC this tax year. Our 1099 tax software can also import data. Department of Revenue Services.

Our 1099 MISC software allows users to print 1099 forms on paper or to generate 1099 electronic filing submissions that comply with IRS Specifications for Filing Forms 1098 1099 3921 3922 5498 8935 and W-2G Electronically. Contact for Request your unemployment benefits 1099-G DUA Interactive Voice Response. You will need to file Form CT-1096 with Forms 1099-MISC.

Massachusetts Department of Revenue PO Box 7045 Boston MA 02204. Learn more about Massachusetts Form 1099. Massachusetts Department of Revenue Form 1099 Reporting PO.

It takes the values that were in Box 7 of the 1099-MISC and move them to box 1 of the 1099-NEC. Box 7045 Boston MA 02204. Changes in the reporting of income and the forms box numbers are listed below.

The IRS address you should mail Form 1099-NEC to depends on your state. When filing state copies of forms 1099 with Massachusetts department of revenue the agency contact information is. EFile Massachusetts 1099-MISC 1099-NEC W-2 and 1099-K directly to the Massachusetts State agency with Tax1099.

Department of the Treasury Internal Revenue Service Center Austin TX 73316. Department of Revenue Services State of Connecticut PO. You must e-file forms if submitting 25 or more Forms W-2 or 1099-MISC.

Here is your state-by-state address guide. In most cases if you participated in combined filing for your 1099s then you do not need to send 1099s to the states Department of Revenue. Box 2930 Hartford CT 06104-2930.

Crop insurance proceeds are reported in. The 1099-NEC form has replaced what used to be recorded on Form 1099-MISC Box 7. When filing federal copies of forms 1099 with the IRS from the state of Massachusetts the mailing address is.

Massachusetts requires Form 1099-K to be filed when the gross amount paid in a calendar year is 600 or greater. Mail W-2 forms to. Contact the DUA Interactive Voice Response IVR at 617 626-5647 and follow the prompts to request your 1099-G.

Beginning in 2009 the Massachusetts Department of Revenue requires all 1099 forms to be submitted in machine-readable form What this means essentially is that you must submit any 1099 forms your employees received to the DOR electronically via their website. It also moves certain legal payments from the 1099-MISC Box 14 to 1099-NEC Box 10. Check the filing requirements of reconciliation Form M-3.

Some businesses will need to file both 1099-NEC and 1099-MISC forms. Previously nonemployee compensation was reported on Box 7 of Form 1099-MISC but the IRS has recently released Form 1099-NEC to replace that option. Sign date and mail state 1099 copies along with a photocopy of the US Form 1096 Annual Summary and Transmittal of US Information Returns to Massachusetts Department of Revenue PO Box 7045 Boston MA 02204.

Where To Send 1099 Misc Forms In Massachusetts. You will need to file Form CT-W3 with Forms W-2. Does Massachusetts require state 1099 tax filing.

File Form 1099-NEC MISC INT DIV directly to the Massachusetts State agency with TaxBandits. Let us manage your state filing process. Learn more about Form 1099-HC requirements.

The primary change is that instead of reporting nonemployee compensation on Form 1099-MISC such payments should now be reported on Form 1099-NEC. You will complete and send a 1099-NEC form to any independent contractors or businesses to whom you paid over 600 in fees commissions prizes awards or other forms of compensation for services performed for your business. The 1099-NEC is a new form for Tax Year 2020.

1099 Misc Forms Set Discount Tax Forms

1099 Misc Forms Set Discount Tax Forms

1099 Misc Forms Set Discount Tax Forms

1099 Misc Forms Set Discount Tax Forms

Quickbooks 1099 Misc Forms Set Discount Tax Forms

Quickbooks 1099 Misc Forms Set Discount Tax Forms

Where To Send 1099 Misc Forms In Massachusetts Vincegray2014

Where To Send 1099 Misc Forms In Massachusetts Vincegray2014

Form 1099 Misc Due Date Archives Cozby Company

Form 1099 Misc Due Date Archives Cozby Company

1099 Misc Forms Set Discount Tax Forms

1099 Misc Forms Set Discount Tax Forms

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Misc Form 3 Part E File Self Mailer Discount Tax Forms

1099 Misc Form 3 Part E File Self Mailer Discount Tax Forms

1099 Misc Forms Set With Envelopes Discount Tax Forms

1099 Misc Forms Set With Envelopes Discount Tax Forms

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Form Copy B Recipient Discount Tax Forms

1099 Misc Form Copy B Recipient Discount Tax Forms

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Where To Send 1099 Misc Forms In Massachusetts Vincegray2014

Where To Send 1099 Misc Forms In Massachusetts Vincegray2014

1099 Misc Form 5 Part Carbonless Discount Tax Forms

1099 Misc Form 5 Part Carbonless Discount Tax Forms

1099 Misc Form 4 Part Carbonless Self Mailer Discount Tax Forms

1099 Misc Form 4 Part Carbonless Self Mailer Discount Tax Forms

1099 Misc Form 1 Part E Filing Carbonless Form Discount Tax Forms

1099 Misc Form 1 Part E Filing Carbonless Form Discount Tax Forms

About Tax Forms Deluxe Business Checks And Solutions

About Tax Forms Deluxe Business Checks And Solutions

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service