How Do You Find A Company's Vat Registration Number

Businesses can find their VAT registered number on the VAT registration certificate issued by HMRCHM Revenue Customs. Using a Trading Name to find the VAT Number Enter a minimum of 5 characters to get a listing of possible matches continue to add characters to the search criteria until it narrows the results to the trade name you looking for.

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

Start by checking the invoices and other legal documents issued by that company.

How do you find a company's vat registration number. The total of the above calculation is 24423030321210180. 3 x 8 24. By doing so you will be registering for VAT and creating a VAT online account Government Gateway account.

There are a number of things you can do to find the VAT registration number of a company both online and offline. Some must be contacted by fax mail or telephone often in the home countrys language. If you use this search you will be able to view if a company exist and if so what the Enterprise Name Enterprise Number Registration Date is and the status of the enterprise if the enterprise is in business as well as the Registered and Postal Address of the enterprise.

Most businesses can be registered online. When you register youll be sent a VAT registration certificate. Deduct 97 twice from this to make the result negative and the result is 180-97-97-14 which is the same as the last two digits so the VAT number is valid.

4 x 3 12. You must register your business for VAT with HM Revenue and Customs HMRC if its VAT taxable turnover is more than 85000. Look at an invoice or insurance document to find a VAT number.

Click Do the search and the details will appear on your screen within a few seconds. Follow the prompts to make a payment. The VAT or value added tax ID number is used for company tax identification in many countries particularly in Europe.

A business may also register voluntarily if the income earned in the past 12-month period exceeded R50 000. On the Individual portfolio select Home to find the SARS Registered Details functionality On the Tax Practitioner and Organisations eFiling profiles the SARS Registered Details functionality is under the Organisations menu tab 3. Confirming the correct VAT Number.

6 x 5 30. 5 x 2 10. VAT Vendor Search To use the VAT Vendor Search facility you must have 128 bit encryption installed on your browser.

They are occasionally printed on insurance forms or claims as well. Get company information including registered address previous company names directors details accounts annual returns and company reports if its been dissolved. You can also check VAT.

You must register your business for Value Added Tax VAT if the total value of taxable goods or services is more than R1 million in a 12-month period or is expected to exceed this amount. On the CIPROZA website select company search and enter the registration number using the format YYYY. 8 x 4 32.

6 x 7 42. 51 rows VAT lookup enables you to lookup and verify VAT numbers. Results are limited to a maximum of 19 possible companies in the results list.

Terms and Conditions The VAT Vendor Search is subject to the general Terms and Conditions of SARS e-Filing. Select Maintain SARS Registered Details. EU businesses for example list their VAT ID along with their name and contact details on invoices.

A person or business is required to register for VAT in Canada at the moment they start to make taxable supplies. VAT-Search has more than 600 clients including By using VAT -Searchie you agree that this website stores cookies on your local computer in order to enhance functionality such as remembering your input for further queries. The various national databases do not all have websites to supply VAT information.

It is worth noting that trusts and associations are also required to register for VAT in Canada in case they sell goods or services. VAT numbers are usually printed on an invoice or receiptespecially if the company includes the VAT tax in their prices. Register or log in to access your account.

5 x 6 30. To find a VAT number look for 2 letters followed by a hyphen and 7-15 numbers. VAT registration is not mandatory until the entity or individual has made taxable supplies of goods and services of at least 30000 CAD in a quarter.

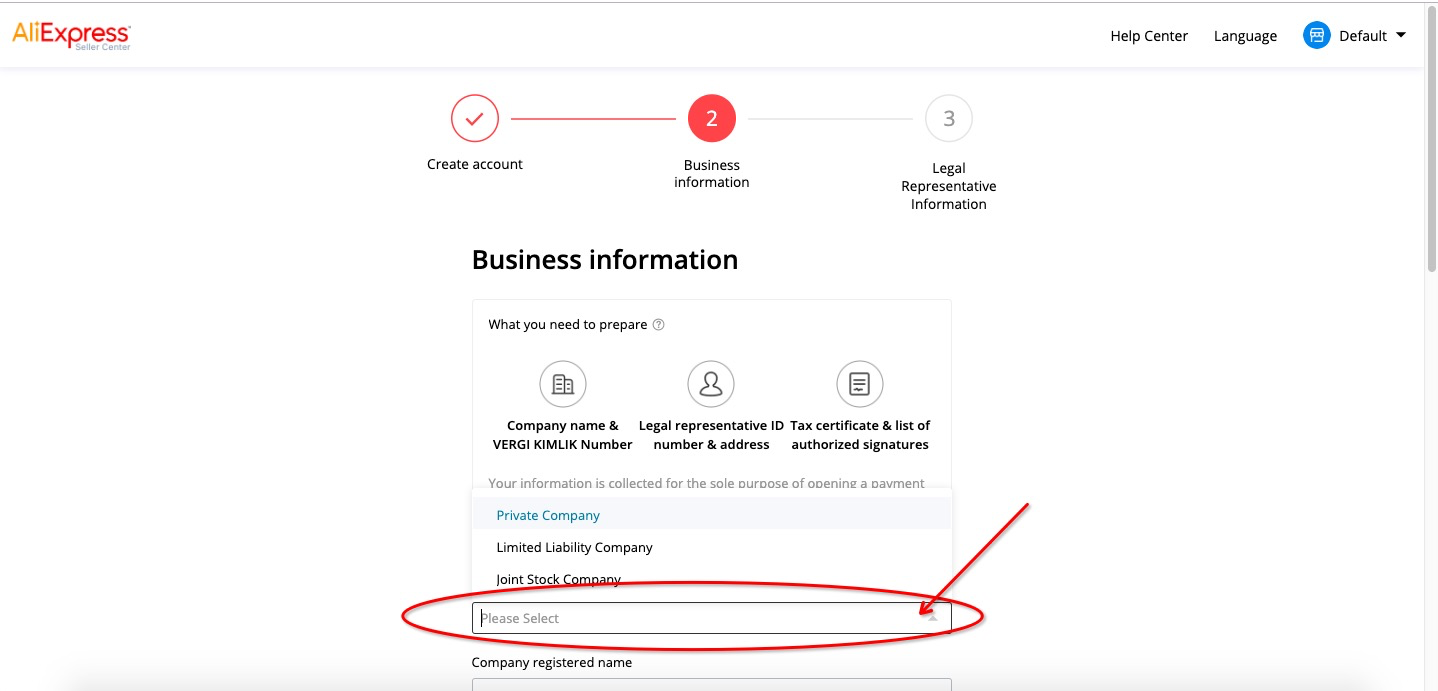

Registering Your Company For VAT.

Automatic Vat Validation For Eu Sap Blogs

Automatic Vat Validation For Eu Sap Blogs

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

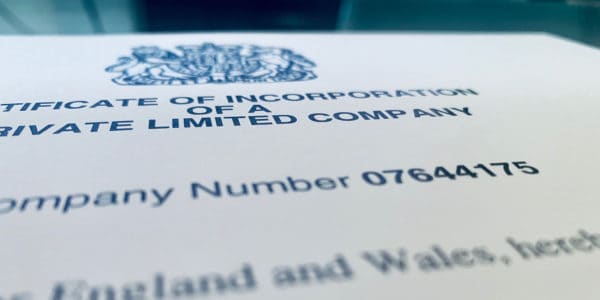

The Company Registration Number Everything You Need To Know

The Company Registration Number Everything You Need To Know

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

Where Can I Find My Company Registration Number Crn

Where Can I Find My Company Registration Number Crn

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

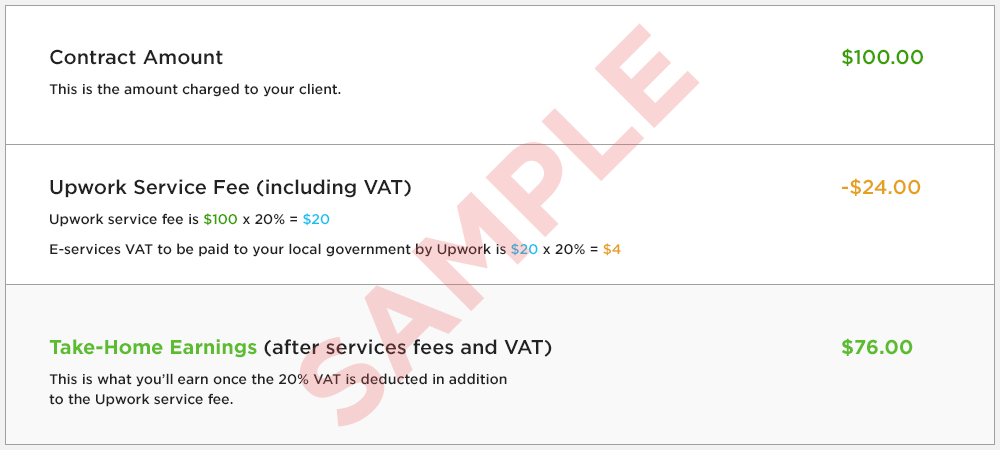

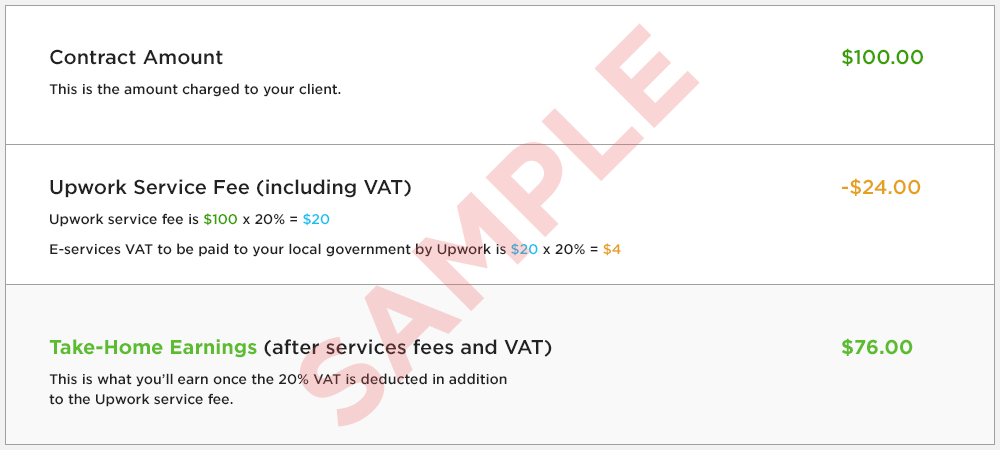

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

An Introduction To The Standard Vat Method Inniaccounts

An Introduction To The Standard Vat Method Inniaccounts

Company Registration Number What Is It

Company Registration Number What Is It