How To Start Microfinance Business In Philippines

Lending Company shall refer to a corporation engaged in granting loans from its own capital funds or from funds sourced from not more than nineteen 19 persons. To operate a legitimate micro-lending business not only are you required to register with the Securities and Exchange Commission SEC you also need to comply with all the necessary permits and put up a capital of at least Php1 million.

101 Best Catchy Micro Lending Business Names Business Names Company Names Names

101 Best Catchy Micro Lending Business Names Business Names Company Names Names

You will need a minimum of one million pesos paid-up capital.

How to start microfinance business in philippines. You may wonder how you can raise the money needed to start your small business. All you need to know on how to open start and setup a lending investor in the Philippines Lending Business or Loan Company Definition. Besides the SEC you also have to register with the barangay City Hall BIR SSS HMDF and Philhealth.

V Microfinance in Action. In actual practice how you allocate your capital will affect the viability of the business. Viii The study.

If you are planning to start a micro-finance company or you are already into it and want to conduct it legally. Computation for amortization and documentations is a must. You must know and comply with the laws pertaining to the micro lending.

Decide on a business model such as a microfinance bank or a credit union and define your target audience. This includes urban and rural lending community owned banking and asset development strategies. Start with sketching out a business plan that details how each transaction will work and how everything will be recorded.

Start with three employees- one to take care of releasing. Be knowledgeable of the laws governing the business. It is a strategy used to combat poverty particularly in the rural areas.

In this way your customers would be aware and confident that they are being billed. The financial industry is highly regulated and the fines for non-compliance can be hefty. Conserve on expenses like renovation and expensive furnishings as this will allow you to have more funds available for lending out.

Know the current legal requirements. This comprises consumer-owned businesses social businesses and social investment. Its one way to help support their families and to ease pove.

One major reason why small businesses fail is because the owner lacked necessary funds. Micro Lending businesses require you to have a paid up amount of P1M but if you just wish to start lending money to people around your area or people in your workplace you can have that ceiling lower. A key defining characteristic of a microfinance loan is the ability to secure credit without collateral.

An Extensive Business Plan. Register your business with the Securities and Exchange Commission or SEC wwwsecgovph get a Mayors permit certification from the Bureau of Internal Revenue BIR and Social Security System Philhealth and Pag-IBIG coverage for the people you will be employing in the business. In the Philippines microfinance loans cannot exceed PhP 150000 US3218ii Mi-crofinance providers in the Philippines often employ a.

Vii Bangko Sentral ng Pilipinas Website www. Issued in the form of a specific business loan for mi-croenterprise purposes. There must be a minimum paid up capital of P1 million.

Like and share this article. Have at least 3 years experience in the microfinance field Have at least 1000 current clients. This is a list of microfinance providers who are members of the Microfinance Council of the Philippines.

Click here to register section 8 company as a micro credit organisation. The Philippine Experience Stephen Daley and Federic Sautet February 2005. In order to become a member of this group each of these organizations must.

Even with a limited amount of clients at the beginning all of your loans will add up quickly. Money is needed for equipments property and more essentials for your small business. Group members must often undergo business training.

For more information email to us at parashubcoin or agamhubcoin. There is a law called the Lending Company Regulation Act of. Before starting a microfinance business consult an attorney and research the legal requirements.

During these hard times a lot of people would seek the help of those engaged in micro lending. Vi National Statistics Office Republic of the Philippines 2009 latest available poverty census data is for 2006. In the Philippines microfinancing is an activity dominated by rural banks non-government organizations NGO and people organizations PO with support from international donor organizations.

Owners also need to have enough capital to start the business. Here are some Funding Source Financial and Lending Institutions in the Philippines.

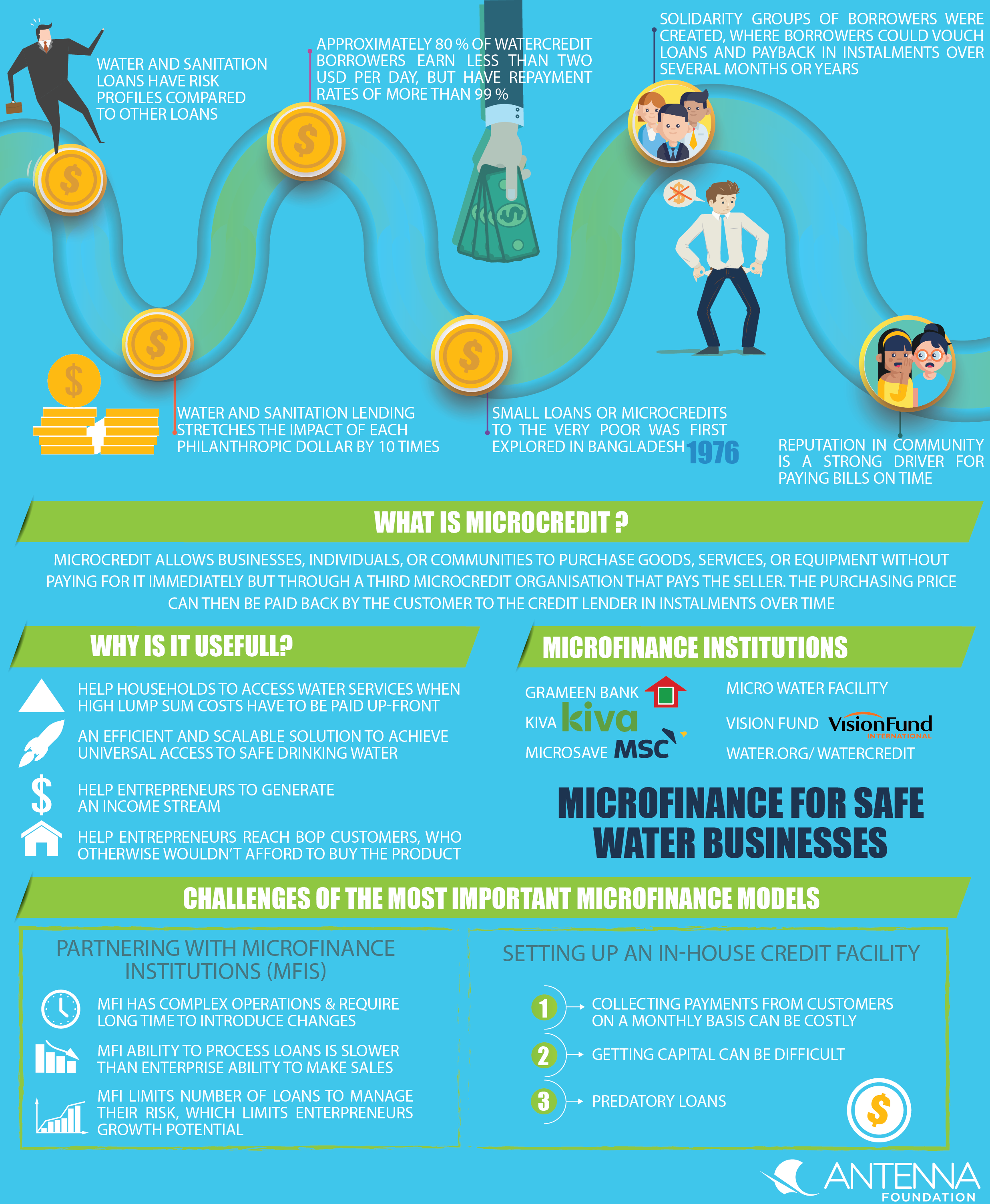

Microfinance For Safe Water Businesses Sswm Find Tools For Sustainable Sanitation And Water Management

Microfinance For Safe Water Businesses Sswm Find Tools For Sustainable Sanitation And Water Management

Microfinance In The Philippines Report Card Asian Development Bank

Microfinance In The Philippines Report Card Asian Development Bank

Not Found Educacion Financiera Estados Financieros Educacion

Not Found Educacion Financiera Estados Financieros Educacion

How To Start A Micro Lending Business Youtube

How To Start A Micro Lending Business Youtube

Despite A Online Business Registration System Rolled Out Starting A Company In Cambodia Has Only Become Harder News Online Cambodia Starting A Company

Despite A Online Business Registration System Rolled Out Starting A Company In Cambodia Has Only Become Harder News Online Cambodia Starting A Company

Microlending A Helping Hand Helping Hands Business Trends Hands

Microlending A Helping Hand Helping Hands Business Trends Hands

Mr Houssam Chahin Head Of Private Sector Partnerships Unhcr Mena Private Sector Mr Partnership

Mr Houssam Chahin Head Of Private Sector Partnerships Unhcr Mena Private Sector Mr Partnership

Websoftex A Bangalore Based Company Extending Its Services In Loan Software Banking Software Ngo Microfinance Software Mi Banking Software Banking Software

Websoftex A Bangalore Based Company Extending Its Services In Loan Software Banking Software Ngo Microfinance Software Mi Banking Software Banking Software

Billing Software Gift Software Chitfund Software Payroll Software Nb Billing Software Payroll Software Banking Software

Billing Software Gift Software Chitfund Software Payroll Software Nb Billing Software Payroll Software Banking Software

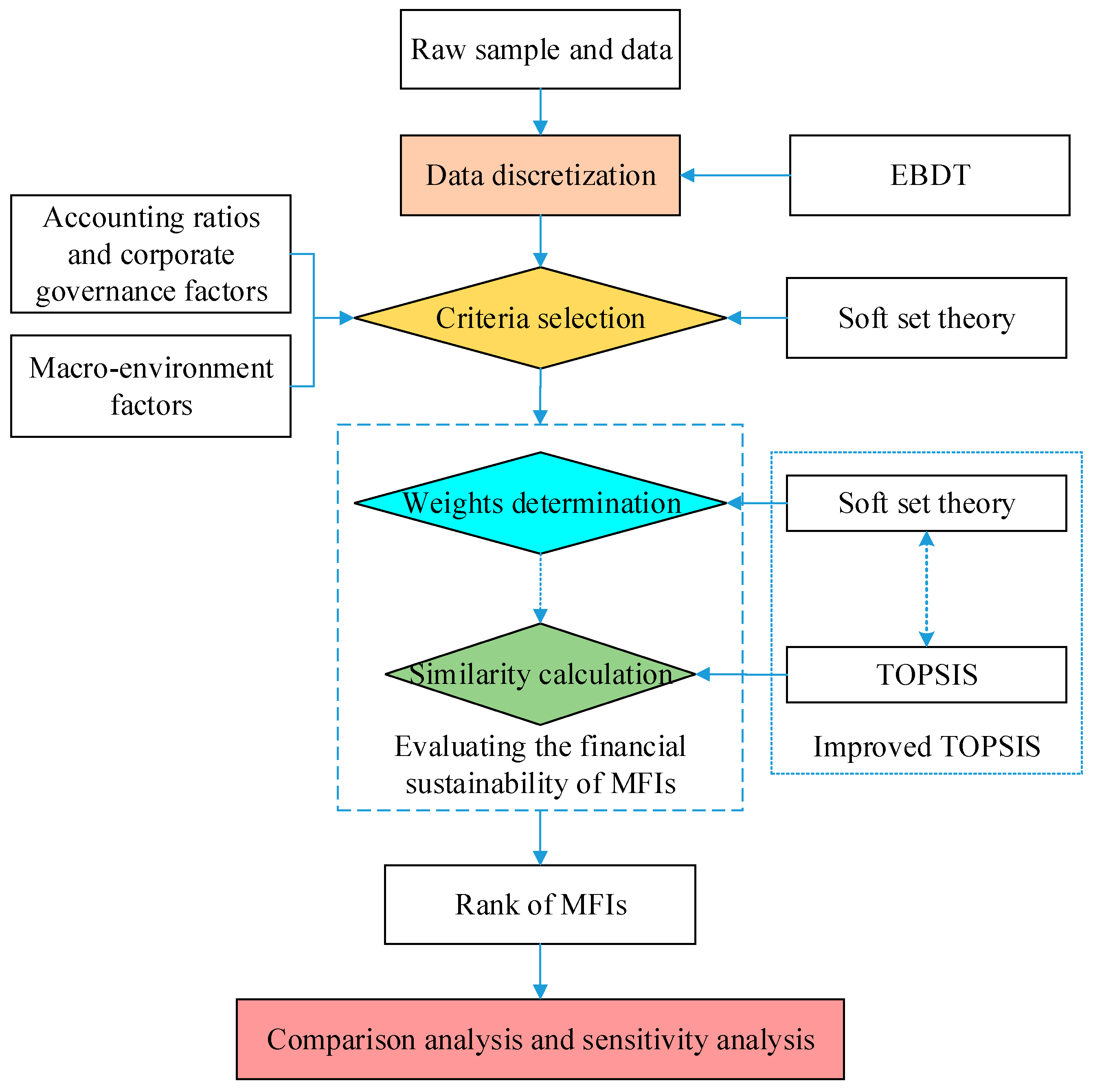

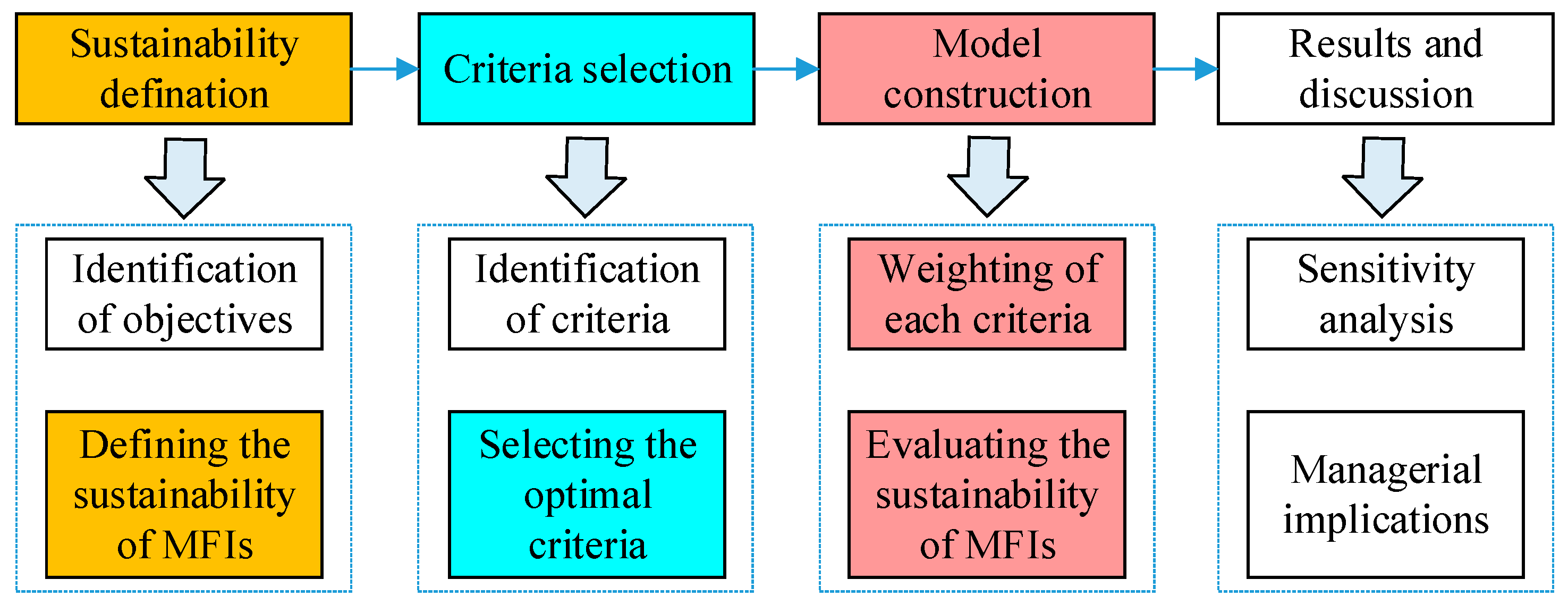

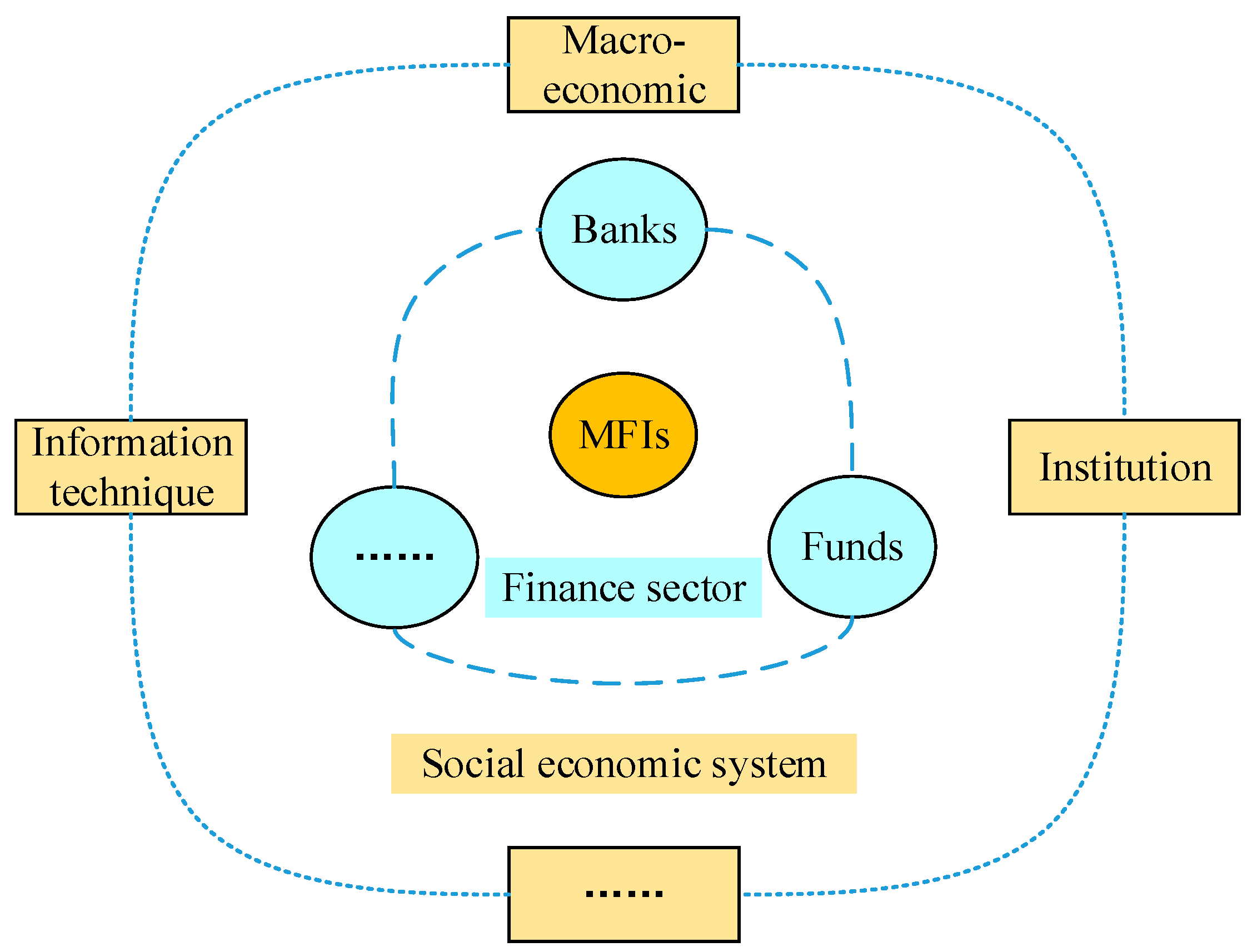

Sustainability Free Full Text Evaluating The Sustainability Of Microfinance Institutions Considering Macro Environmental Factors A Cross Country Study Html

Sustainability Free Full Text Evaluating The Sustainability Of Microfinance Institutions Considering Macro Environmental Factors A Cross Country Study Html

How Micro Finance Works Through United Prosperity Finance The Unit Entrepreneur

How Micro Finance Works Through United Prosperity Finance The Unit Entrepreneur

Pin On Mfis Microfinance Institutions

Pin On Mfis Microfinance Institutions

The Impact Of Microcredit In The Philippines Innovations For Poverty Action

The Impact Of Microcredit In The Philippines Innovations For Poverty Action

Bangalore Bengaluru Banking Software Mlm Business Mlm Companies

Bangalore Bengaluru Banking Software Mlm Business Mlm Companies

Digitalisation What S At Stake For Microfinance Advans Point Of View Convergences

Sustainability Free Full Text Evaluating The Sustainability Of Microfinance Institutions Considering Macro Environmental Factors A Cross Country Study Html

Sustainability Free Full Text Evaluating The Sustainability Of Microfinance Institutions Considering Macro Environmental Factors A Cross Country Study Html

Signal Loans Lending And Credit Management App For Micro Finance Business Business Finance Banking Software Finance

Signal Loans Lending And Credit Management App For Micro Finance Business Business Finance Banking Software Finance

Sustainability Free Full Text Evaluating The Sustainability Of Microfinance Institutions Considering Macro Environmental Factors A Cross Country Study Html

Sustainability Free Full Text Evaluating The Sustainability Of Microfinance Institutions Considering Macro Environmental Factors A Cross Country Study Html

Using Mobile Banking For New Microfinance Business Models

Using Mobile Banking For New Microfinance Business Models