Independent Contractor Vs Self Employed Canada

A person who is an independent contractor is considered to be self-employed. Tax Advantages for Self-Employed Contractors.

What Does A Pay Stub Look Like For An Independent Contractor Quora

OA Connor Homes vs Minister of National Revenue and.

Independent contractor vs self employed canada. You can view this publication in. On the other hand A self-employed worker might qualify as an independent contractor or they might be a merchant meaning they dont work according to a contract but rather sells goods or services. RC4110 Employee or Self-employed.

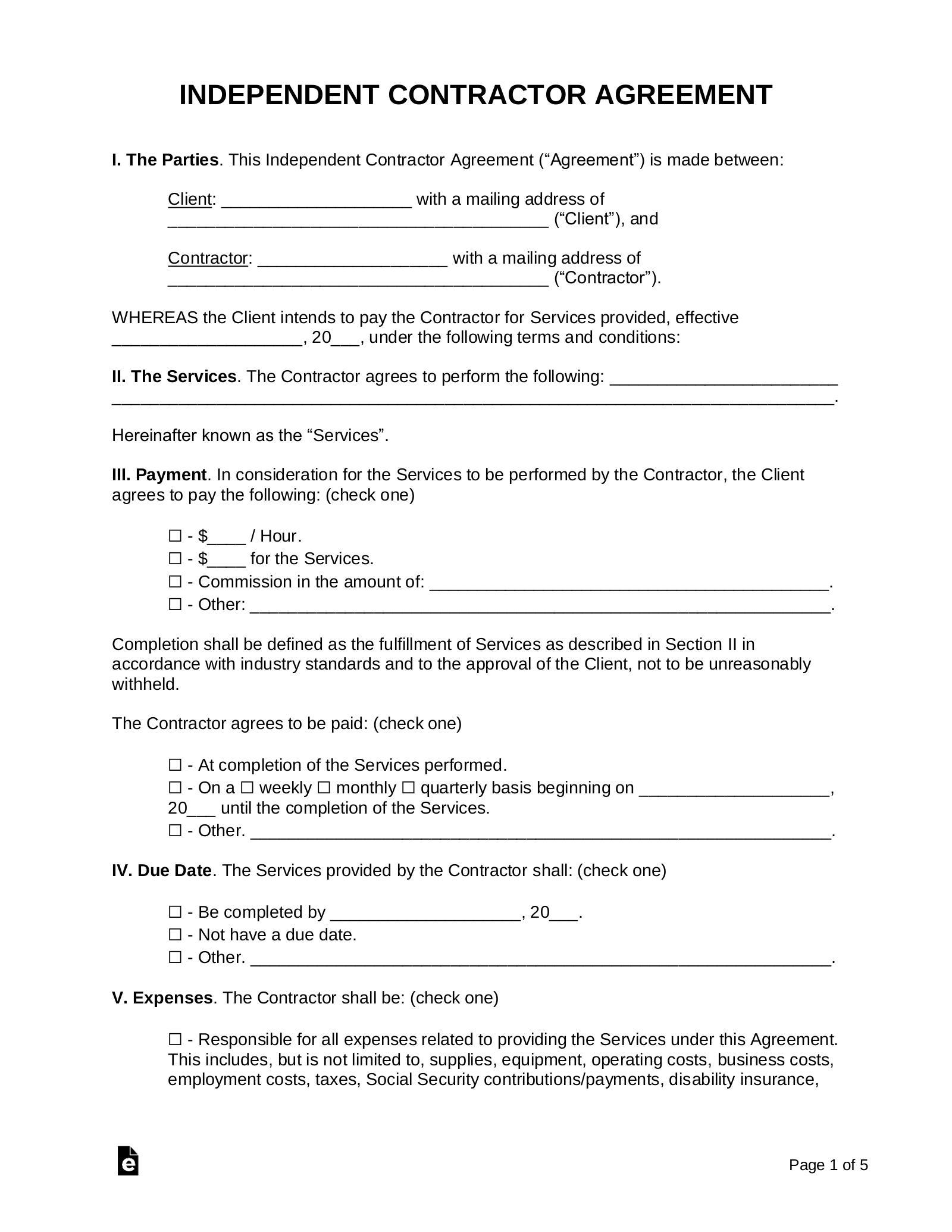

A contract FOR services sets up self-employment. These tests might seem very. The Canada Revenue Agency CRA has its own rules regarding whether a person is in a business relationship independent contractor or in an employee-employer relationship.

If you are a recently self-employed Canadian or you are thinking about starting your own businessadding extra income with a side gig you may be curious about what the tax requirements and implications would be. Filing your taxes with the Canada Revenue Agency when youre a salaried employee is pretty basic. Tax Court of Canada Woodland Insurance vs Minister of National Revenue February 2005 - this is an Employment Insurance and Canada Pension Plan case where the Court ruled that Woodland Insurance was liable for EI and CPP premiums because the worker was an employee not self-employed.

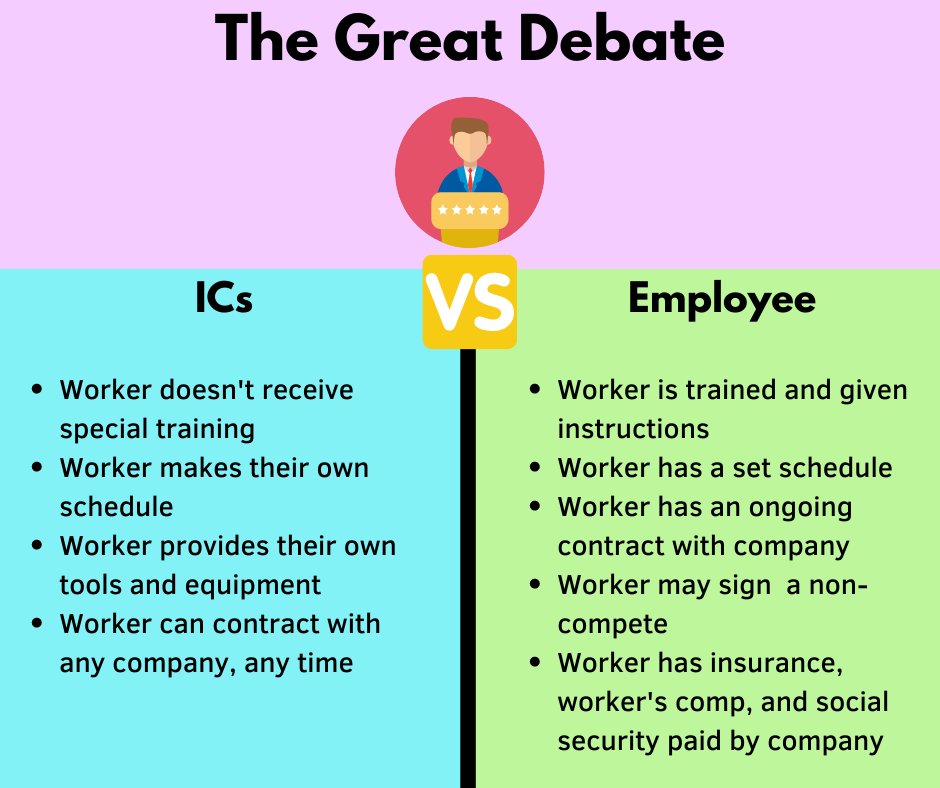

An independent contractor is usually a skilled or creative person. Many people mistake one for the other simply because either being self-employed or an independent contractor means not being an employee. A contract OF service sets up an employer-employee relationship.

This kind of person can be an IT professional photographer or even a rideshare driver. Contractors purchase tools and equipment. Unless this was negotiated into a contract.

The Employment Standards Act the Act applies to employees regardless of whether they are employed on a part-time full-time temporary or permanent basis. Employers Love to Hire Independent Contractors. In todays world many people are realizing it may be more advantageous to offer their services as an independent contractor running their own small business rather than working as an employee.

Employee or self-employed worker. Contractors can hire a subcontractor to do the work or help do the work and pay the costs for doing so. Federal Court of Appeal 1392644 Ontario Inc.

That is in business for him or herself. For the most part though this is why independent contractors charge a higher rate than employees are paid. It is important to decide whether a worker is an employee or a self-employed individualEmployment status directly affects a persons entitlement to employment insurance EI benefits under the Employment Insurance ActIt can also have an impact on how a worker is treated under other legislation such as the Canada Pension Plan and the Income Tax Act.

Français fr Gouvernement du Canada. The biggest tax advantage for an independent contractor is the potential for tax deductions that arent available to employees. This guide will help you understand how to determine a workers employment status.

Skip to main content. Self-employed contractors supply their own tools and equipment required for a job like a wrench or hammer or a truck. Menu Main Menu.

However there are differences between the two as far as contractual conditions and the way in which they. Independent Contractor Status Upheld. As an independent contractor youre your own boss and you get the freedom to choose your clients working hours and conditions and certain tax advantages.

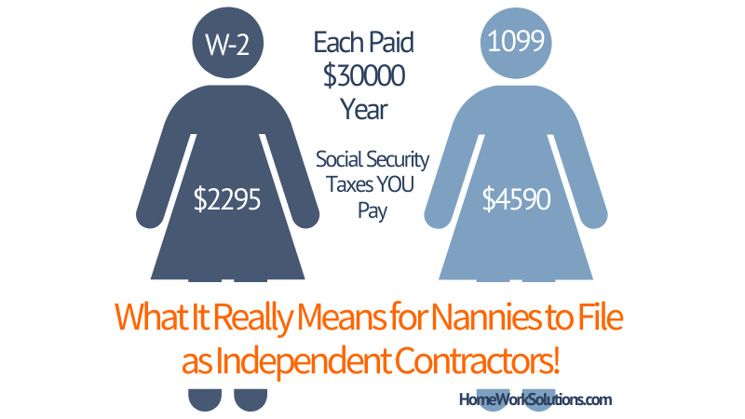

The Act does not apply to independent contractors. Since independent contractors are not employees the contractor is responsible for paying employment taxes income taxes social security and insurance. Common Provisions in Self-Employment Contracts.

A self-employed person can generally deduct all reasonable business expenses. Jobs and the workplace. The payer has no say in who they hire.

Skip to About government Language selection. They both file income taxes using Schedule C unless a different business type is chosen and both pay self. They both keep track of business income and expenses.

However an independent contractor isnt an employee. Self-employed workers are usually hired by a company to. Both independent contractors and sole proprietors are self-employed business owners.

Basically the difference between an employer-employee relationship and self-employment lies in one small wording change. Many individuals choose to categorize themselves as an independent contractor self-employed rather than an employee because of the various tax advantages. Aside from the extra info youll include on your tax return you might also be required to register for a GSTHST account and become a GSTHST Registrant.

A self-employed person is an independent contractor who works for someone else and provides services to an employer.

Independent Contractors Vs Employees A Guide For Pet Sitters And Dog Walkers Time To Pet

Independent Contractors Vs Employees A Guide For Pet Sitters And Dog Walkers Time To Pet

Avoiding Independent Contractor Risks In Canada Velocity Global

Avoiding Independent Contractor Risks In Canada Velocity Global

Free Salon Independent Contractor Agreement Template Pdf Word Eforms Free Fillable Forms Independent Contractor Salons Contractors

Free Salon Independent Contractor Agreement Template Pdf Word Eforms Free Fillable Forms Independent Contractor Salons Contractors

How Does A Nanny File Taxes As An Independent Contractor

How Does A Nanny File Taxes As An Independent Contractor

Free Independent Contractor Agreement Templates Pdf Word Eforms

Free Independent Contractor Agreement Templates Pdf Word Eforms

How To File Taxes As An Independent Contractors H R Block

How To File Taxes As An Independent Contractors H R Block

Pin By The Whimsical Word On Girl Boss Taxes Independent Contractor Self Employment Contractors

Pin By The Whimsical Word On Girl Boss Taxes Independent Contractor Self Employment Contractors

Self Employed Vs Independent Contractor What S The Difference

Self Employed Vs Independent Contractor What S The Difference

An Independent Contractor S Guide To Taxes Smartasset

An Independent Contractor S Guide To Taxes Smartasset

Employment Coach Carter County Schools Employment 37643 Employment P60 Employee Folders For New Employees Uk E New Employee Carter County Tv Schedule

Employment Coach Carter County Schools Employment 37643 Employment P60 Employee Folders For New Employees Uk E New Employee Carter County Tv Schedule

Self Employed Vs Independent Contractor What S The Difference

Self Employed Vs Independent Contractor What S The Difference

What Can Independent Contractors Deduct

Form C S Is An Abridged 3 Page Income Tax Returns Form For Eligible Small Companies To Report Their Income To Singapore Business Business Infographic Tax Forms

Form C S Is An Abridged 3 Page Income Tax Returns Form For Eligible Small Companies To Report Their Income To Singapore Business Business Infographic Tax Forms

Join A Real Self Employed Independent Contract Work Home That Is Not In Sales Affiliate Marketing Mlm Virtual Call Center Independent Contractor Solutions

Join A Real Self Employed Independent Contract Work Home That Is Not In Sales Affiliate Marketing Mlm Virtual Call Center Independent Contractor Solutions

Self Employed Vs Independent Contractor What S The Difference

Self Employed Vs Independent Contractor What S The Difference

1099 Self Employment Is Now A Better Tax Choice Than A W 2 Salary

1099 Self Employment Is Now A Better Tax Choice Than A W 2 Salary

Advantages Of Being Self Employed Independent Contractor Infographic Medicaldevices Consultants Sel Medical Sales Medical Sales Rep Pharmaceutical Sales

Advantages Of Being Self Employed Independent Contractor Infographic Medicaldevices Consultants Sel Medical Sales Medical Sales Rep Pharmaceutical Sales