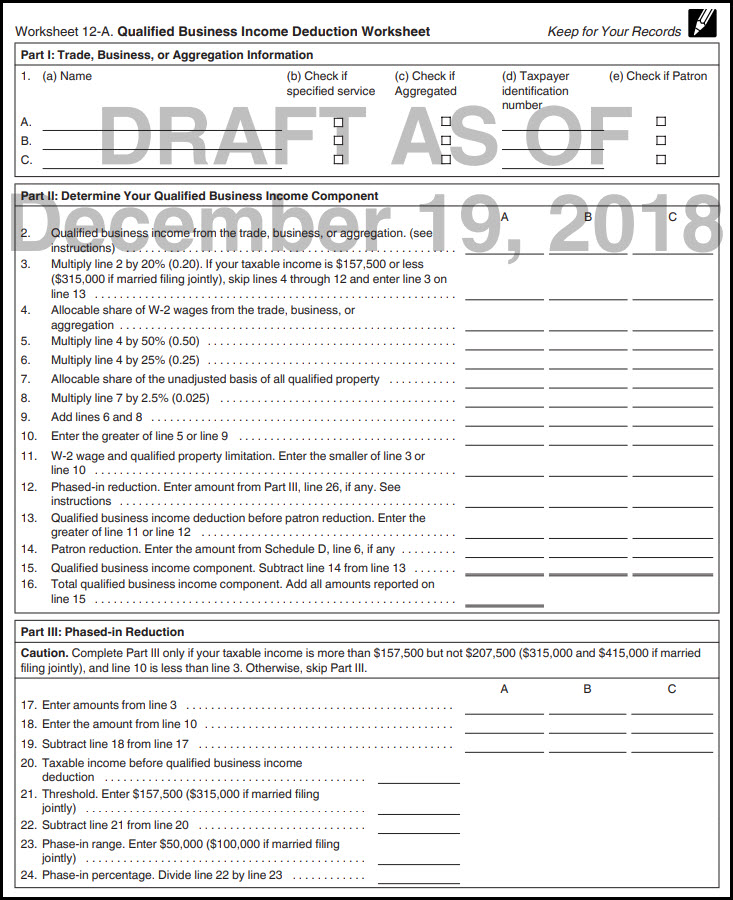

Qualified Business Income Deduction Worksheet 2019

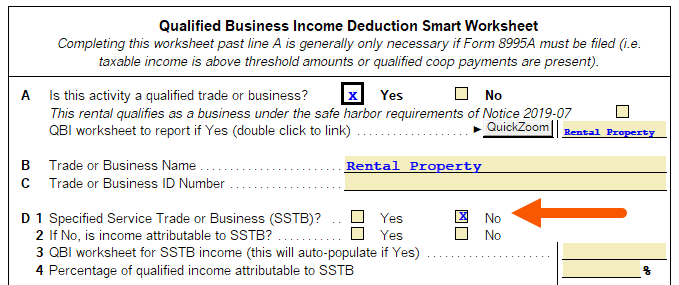

Qualified business income deduction - are the QBI worksheets functional that support ln 9 of 2018 1040. You may mark more than one unit of Screen QBI in the Income Deductions folder as a qualifying activity however UltraTax CS will no longer calculate the qualified business income Section.

Https Www Irs Gov Pub Irs Utl 2019ntf 01 Pdf

Any income from either 1 Qualified trade or business or 2 Specified service trade or business Income from qualified trade or business Income from specified service trade or business Multiply qualified business income QBI by 02 to arrive at the taxpayers allowed QBID.

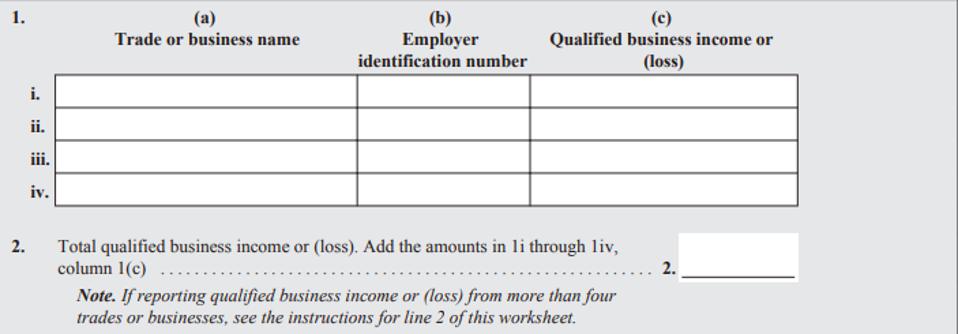

Qualified business income deduction worksheet 2019. The form 8995 is used to figure your qualified business income QBI deduction. 321400 if married filing jointly skip lines 4 through 12 and enter the amount from. Qualified Business Income Deduction.

Many owners of sole proprietorships partnerships S corporations and some trusts and estates may be eligible for a qualified business income QBI deduction also called Section 199A for tax years beginning after December 31 2017. The deduction allows them to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust REIT dividends and qualified publicly traded partnership PTP income. Use Form 8995 to figure your qualified business income QBI deduction.

Income earned by a C corporation or by providing services as an employee isnt eligible for the deduction. Form K1 from a Public Traded Partnership. Use the Publication 535 worksheet if your taxable income before the QBI deduction is higher than that threshold.

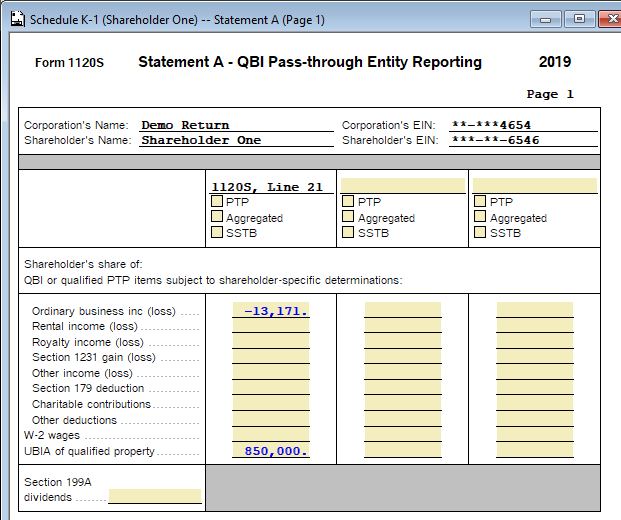

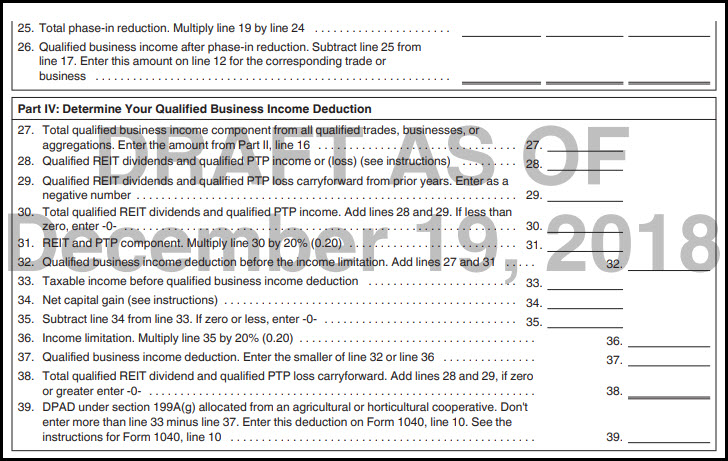

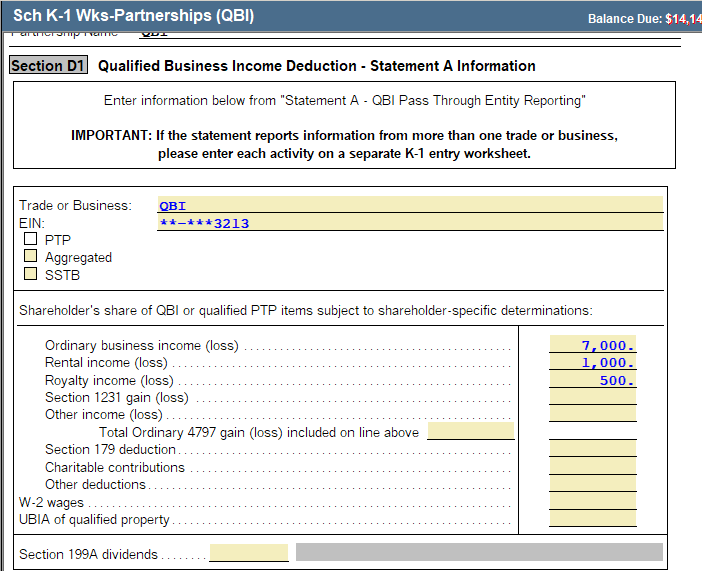

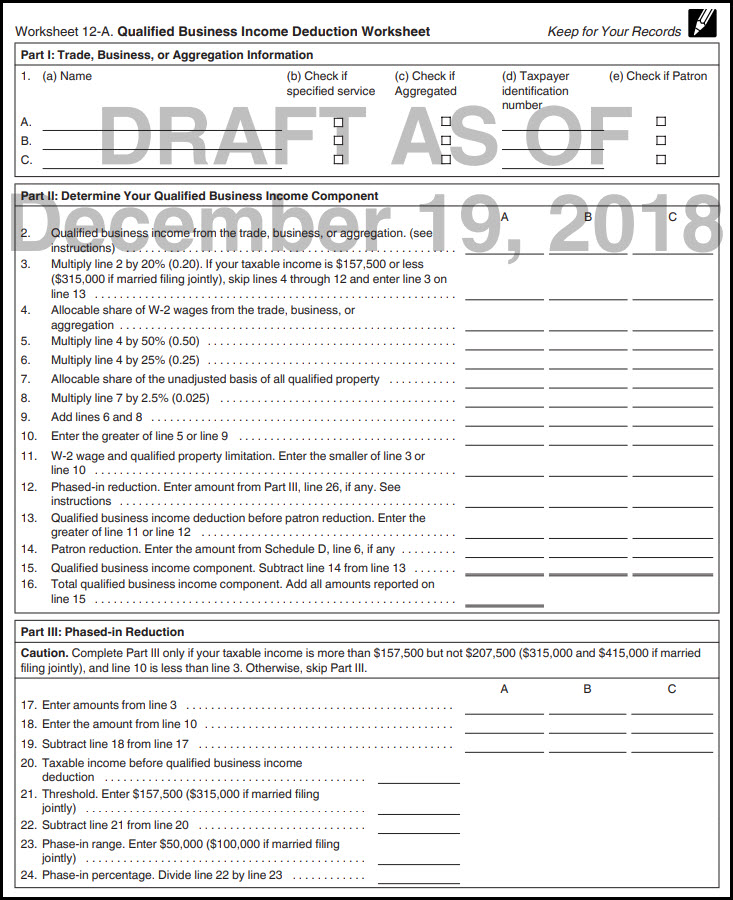

The actual calculation of the deduction was done in 2018 on one of two worksheets depending on the taxpayers income. CALCULATE W-2 LIMIT STEP 2. The Section 199A Information Worksheet includes columns for multiple activities.

Subtract 14 from 13 Total QBI component. If your taxable income is 160700 or less 160725 if married filing separately. Chapter 12 covers the qualified business income QBI deduction including guidance worksheets and instructions in arriving at the new 20 percent deduction.

Provides individuals with a new tax deduction for qualified business income. After deductions are made her taxable income is 20000. Learn if your business qualifies for the QBI deduction of up to 20.

The IRS estimates that almost 237 million taxpayers may be eligible to claim the deduction. Roughly 97 of your clients have taxable income under the threshold. However beginning in 2019 this deduction is calculated on two tax forms.

78 rows Qualified business income component. Because the income is below the 315000 limit the qualified business income deduction is 8000 40000 in qualified business income x 20. Starting with 2019 returns filed in 2020 the IRS will require business owners who claim the QBI deduction to attach Form 8995 to their returns.

Pages 26 This preview shows page 18 - 22 out of 26 pages. Business income 1099 income. Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20 of their net QBI from a trade or business including income from a pass-through entity but not from a C corporation plus 20 of qualified real estate investment trust REIT dividends and qualified.

The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust REIT dividends and qualified. Multiply line 2 by 20 020. So their deduction is equal to 20 of domestic qualified business income from a pass-through entitysubject to the overall limit based on taxable income.

2 also earned 40000 in qualified business income but she files single. Section 199A provides a deduction of up to 20 percent for an individuals domestic qualified business income from their taxable income. The Qualified Business Income QBI Deduction is a tax deduction for pass-through entities.

Purpose of Form. School Santa Rosa Junior College. An amount in box 5 of a form 1099-DIV.

This form can be triggered by the following. Course Title ACCOUNTING TAXATION. No QBI Deduction Allowed QBI Deduction Allowed STEP 1.

25 Wages Assets Lesser of QBI or Defined Taxable Income and WageAsset Calculation for Specified Service Business If in Phaseout Range. TT did not link SE income to QBI ded summary and qbi worksheet I got on a call with support and even though I didnt have any Schedule F income in 2018 I. Phaseout Deduction Calculation for Non-Service Business Above Phaseout 20 of QBI or Defined Taxable Income if lower 50 of Wages 25 of Wages 25 of Assets Greater of 50 Wages vs.

9 9 qualified business income deduction before the. The qualified business income deduction QBI is a tax deduction that allows eligible self-employed and small-business owners to deduct up to 20 of their qualified business income. The IRS released Publication 535 on Jan.

Form 8995 - Qualified Business Income Deduction Simplified Computation or Form 8995-A - Qualified Business Income Deduction. 9 9 Qualified business income deduction before the income limitation.

Income Tax Deduction Worksheet Promotiontablecovers

Https Www Irs Gov Pub Newsroom Tcja Training Provision 11011 Qbid Pdf

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

Https Exactax Com Documents Workshops 2018 20exactax 20workshop Pdf

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

How To Use The New Qualified Business Income Deduction Worksheet For 2018 Youtube

How To Use The New Qualified Business Income Deduction Worksheet For 2018 Youtube

Overview Of The Qualified Business Income Qbi De Intuit Accountants Community

Overview Of The Qualified Business Income Qbi De Intuit Accountants Community

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Taxes From A To Z 2019 Q Is For Qualified Business Income

Taxes From A To Z 2019 Q Is For Qualified Business Income

Https Www Irs Gov Pub Irs Utl 2019ntf 01 Pdf

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community