How To File 1099 Form In Quickbooks Online

In the next screen QuickBooks Online will give you two pricing options. Click to securely e-file with the IRS.

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

On the last step of your 1099 preparation select Ill file myself.

How to file 1099 form in quickbooks online. Intuit Online Payroll Full Service Contact us to correct your 1099-NEC forms we filed for you. Choose a filing method click Print 1099s ensure the dates are correct and click Ok - Ensure all the vendors are selected for printing the 1099-MISC and 1096 forms click Print 1099 and start by printing one blank test sheet for the 1099 and 1096 forms. Save money and avoid hassle of purchasing forms stamps and mailing.

Select a form you wanted to use in printing your 1096 form. Print or email copies to your contractors. Create and file 1099s using QuickBooks Online.

To start with you can use this article and go to how you prepare your 1099 form. From the main dashboard click the Workers tab on the left-hand side. In this video we will review the 1099 wizard that QuickBooks Online Plus provides for processing 1099 forms for your independent contractorsIf you enjoyed t.

However any updates or corrections can be made in a printed copy and sent in by mail to the IRS. At this time QuickBooks Online only allows you to file your 1099 once. Click the filter menu funnel icon in the top-left of your Contractor list and choose the Tax year youd like to prepare.

The customer service told me to edit company info every time I start to prepare 1099 for a separete company. Allow Intuit efile and delivery the 1099s to your contractors for you using the early bird pricing or you can print and mail out the forms yourself. How to Prepare 1099 Tax Forms with QuickBooks Desktop.

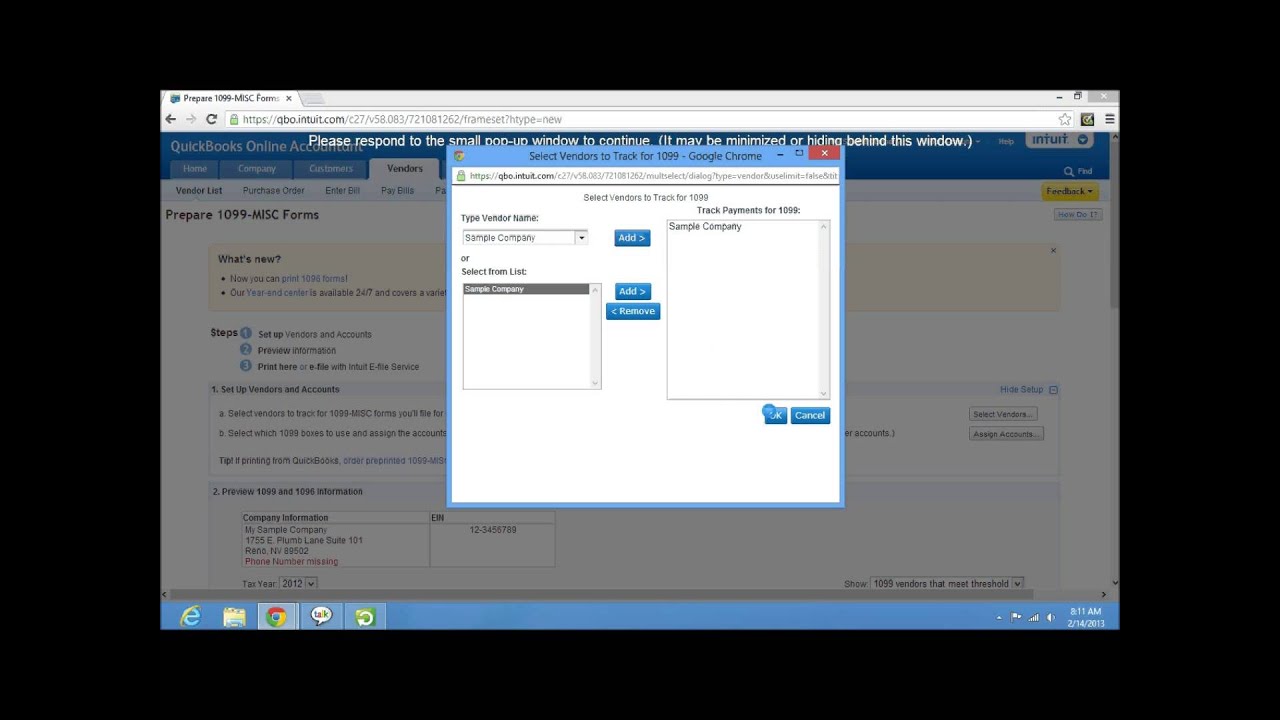

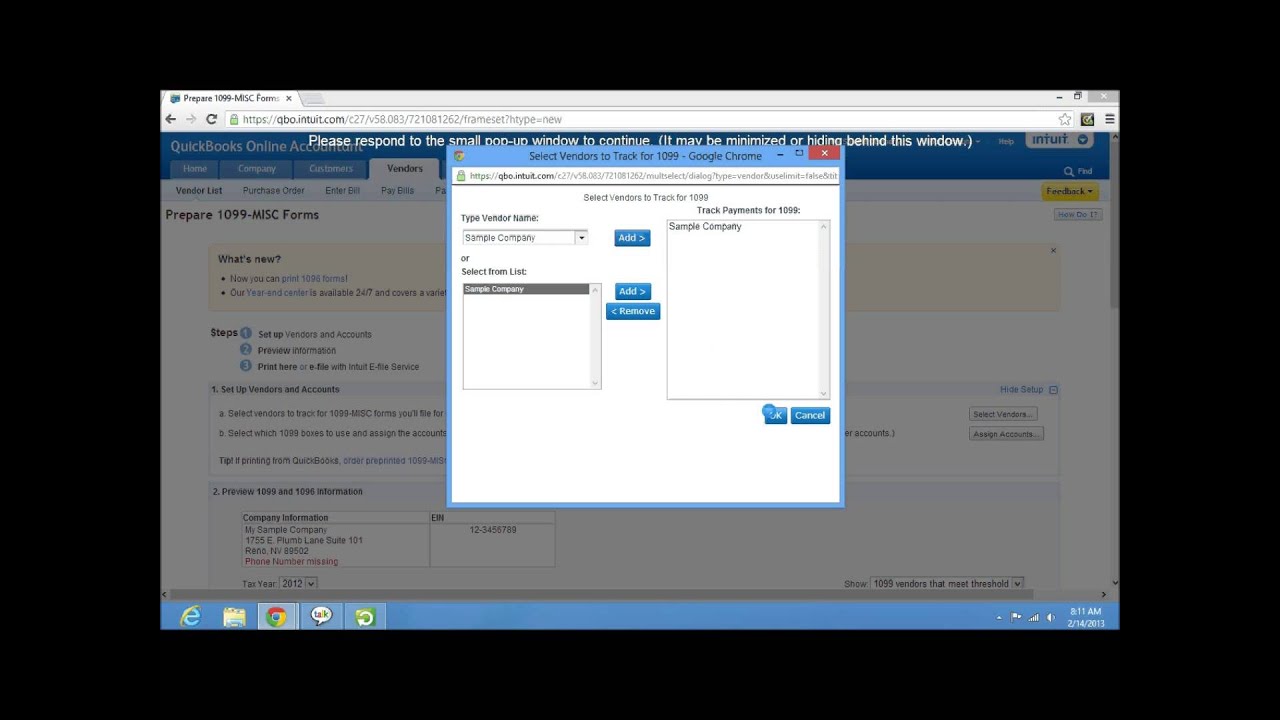

Check off Track Payments for 1099 on the bottom right. However after I did so and finished all the steps and the page goes to intuit 1099 e-file. Heres how to file the amended form.

In addition to paying employees you can also pay contractors in QuickBooks Online. For instructions on correcting your 1099s refer to this Tax 1099 article Different types of 1099 corrections after forms have been submitted. Easily enter 1099-MISC information.

The test sheet can then be held up to the light with the forms to see if the boxes match. Verify your 1099 Forms then select Continue. Enter your billing info then select Approve.

Click on Get started and select 1099-NEC or 1099-MISC depending upon the type of your contractors. Click at the button Get Started at the subsequent display screen. Click on the E-file for me button or the Ill file myself button.

1099and click on the supplied choice. Complete the alignment instructions. A contractor will typically send you a bill and can be paid as such.

Once done heres how you can start printing it. From QuickBooks Online navigate to the Expenses tab and the Vendors section. Once this is checked off the Vendor will also.

After preparing your 1099s select the E-File for me option. Click on PrintE-File 1099 Forms. If you use QuickBooks Online you can import your 1099 data.

After including a supplier pass to Tax. How to prepare and print 1099 forms from QuickBooks Online. Either follow the on-screen instructions or press Back until youre on Step 4 depending on where you left off.

Choose the distributors the use of check-boxes for 1099-eligible distributors and click on Continue button. The procedure to create 1099s in QuickBooks Desktop involves the following steps. Order 1099-NEC IRS forms online at IRS Online Ordering for Information Returns and Employer Returns or over the phone at 800-829-3676.

Edit the Vendor Card over in the Expenses Vendors list. Review your 1099 Forms and make sure that the information brought over from QuickBooks Online is correct. Start QuickBooks and go to Vendors.

QuickBooks printable 1099 kits contain 1099 tax form and four FREE 1096 forms with envelopes - designed to work seamlessly with QuickBooks software. I tried to file 1099s for several different companies via one Quickbooks Online Accountant account. To set up a 1099 employee in QuickBooks Online follow the below steps.

Select all or select only the 1099 forms you want to submit. Contractors will also have to receive Form 1099-MISC though if they are paid a minimum of 600. You can also fill in their address email and EIN numbers in this window.

Save time by filing electronically even on deadline day. Select Contractors from the sub-menu and then click Add your first contractor Enter the name and the email of the contractor in the Name and Email.

How To Prepare And E File 1099s In Quickbooks Desktop In 2020 Quickbooks Filing Preparation

How To Prepare And E File 1099s In Quickbooks Desktop In 2020 Quickbooks Filing Preparation

Quickbooks Online Training Quickbooks Online Quickbooks How To Use Quickbooks

Quickbooks Online Training Quickbooks Online Quickbooks How To Use Quickbooks

Qb 941 Printing Error Tax Forms Quickbooks Quickbooks Payroll

Qb 941 Printing Error Tax Forms Quickbooks Quickbooks Payroll

How To Set Up 1099 Tracking In Quickbooks Quickbooks Online Or Xero Accountex Report Quickbooks Online Quickbooks Sole Proprietor

How To Set Up 1099 Tracking In Quickbooks Quickbooks Online Or Xero Accountex Report Quickbooks Online Quickbooks Sole Proprietor

How To Prepare Quickbooks 1099 Misc Forms Crop Insurance Quickbooks Preparation

How To Prepare Quickbooks 1099 Misc Forms Crop Insurance Quickbooks Preparation

1099 Form 2016 News Irs Forms 1099 Tax Form Tax Forms

1099 Form 2016 News Irs Forms 1099 Tax Form Tax Forms

Track Payments To 1099 Contractors Quickbooks Online Accounting Software Quickbooks

Track Payments To 1099 Contractors Quickbooks Online Accounting Software Quickbooks

Quickbooks 1099 W2 Mate Adds Ability To Email Quickbooks 1099 Forms Tax Forms Irs Forms 1099 Tax Form

Quickbooks 1099 W2 Mate Adds Ability To Email Quickbooks 1099 Forms Tax Forms Irs Forms 1099 Tax Form

Here You Find Full Detail About Quickbooks 1099 Forms Quickbooks Quickbooks Online Bookkeeping Software

Here You Find Full Detail About Quickbooks 1099 Forms Quickbooks Quickbooks Online Bookkeeping Software

1099 Forms Free Download 1099 Forms Free Driverlayer Search Engine Irs Forms 1099 Tax Form Tax Forms

1099 Forms Free Download 1099 Forms Free Driverlayer Search Engine Irs Forms 1099 Tax Form Tax Forms

Learn How To Prepare Form In Quickbooks 1099 Wizard For More Information Dial Our Quickbooks Support Phone Num Quickbooks Mobile Credit Card Quickbooks Online

Learn How To Prepare Form In Quickbooks 1099 Wizard For More Information Dial Our Quickbooks Support Phone Num Quickbooks Mobile Credit Card Quickbooks Online

1099 W 9 Wtf How To Track File The Correct Forms For Independent Contractors Creative Entrepreneurs Things To Come Quickbooks Online

1099 W 9 Wtf How To Track File The Correct Forms For Independent Contractors Creative Entrepreneurs Things To Come Quickbooks Online

Quickbooks Tutorial How To Print 1099 Form In Quickbooks Online Quickbooks Quickbooks Online Quickbooks Tutorial

Quickbooks Tutorial How To Print 1099 Form In Quickbooks Online Quickbooks Quickbooks Online Quickbooks Tutorial

Quick Answer On How To Enter A Quickbooks 1099 Wizard In 2020 Quickbooks Online Quickbooks Data Services

Quick Answer On How To Enter A Quickbooks 1099 Wizard In 2020 Quickbooks Online Quickbooks Data Services

Quickbooks Retained Earnings Quickbooks Quickbooks Online Balance Sheet

Quickbooks Retained Earnings Quickbooks Quickbooks Online Balance Sheet

Irs Form 5 B Irs Form 5 B Will Be A Thing Of The Past And Here S Why Irs Forms 1099 Tax Form Tax Forms

Irs Form 5 B Irs Form 5 B Will Be A Thing Of The Past And Here S Why Irs Forms 1099 Tax Form Tax Forms

Quickbooks Online Reports Only User View Quickbooks Online Quickbooks Online

Quickbooks Online Reports Only User View Quickbooks Online Quickbooks Online

E File 1099 Misc Quickbooks Quickbooks Online Data Services

E File 1099 Misc Quickbooks Quickbooks Online Data Services

Try These Steps With Quickbooks 1099 Wizard To File 1099 Taxes Quickbooks Quickbooks Online Irs Website

Try These Steps With Quickbooks 1099 Wizard To File 1099 Taxes Quickbooks Quickbooks Online Irs Website