How To Find 1099-div

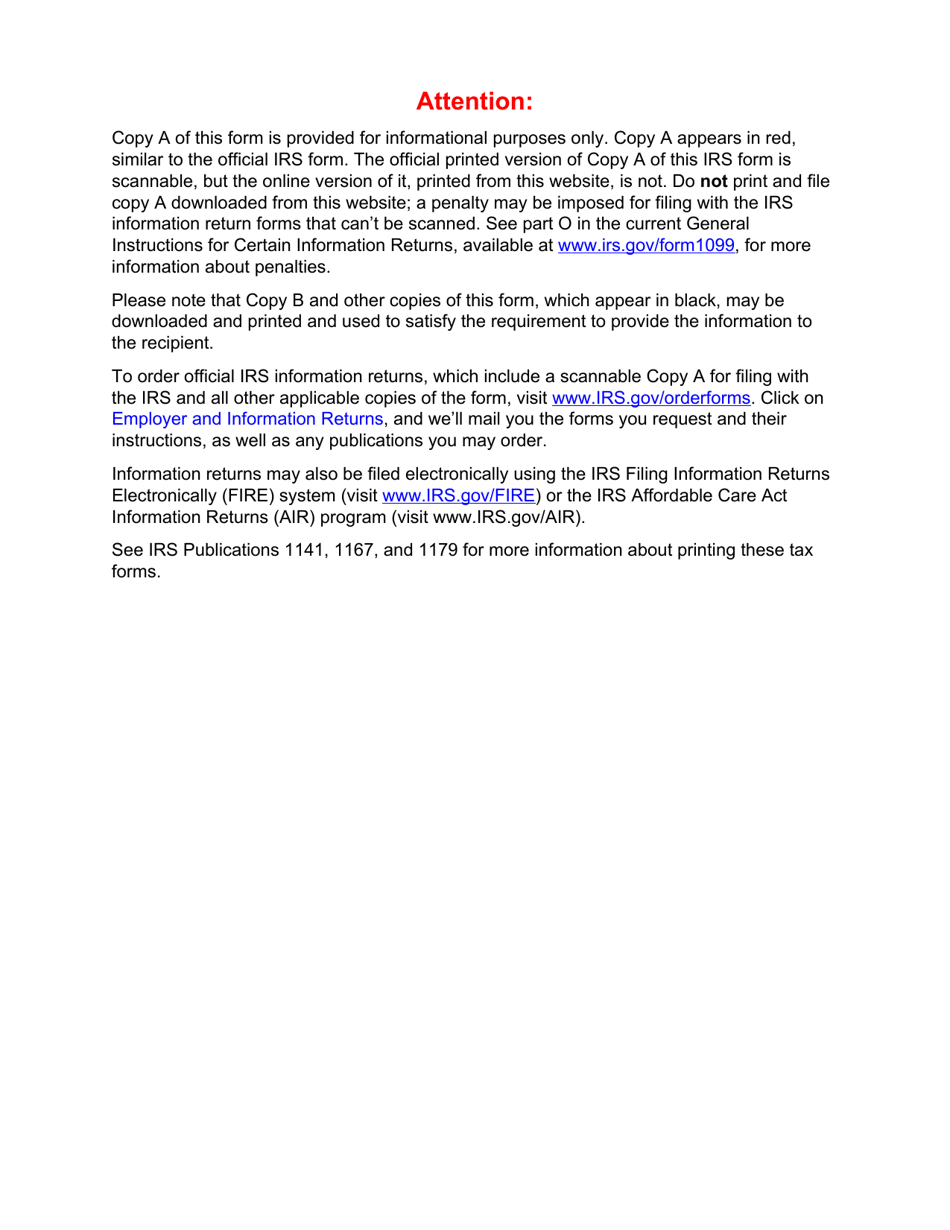

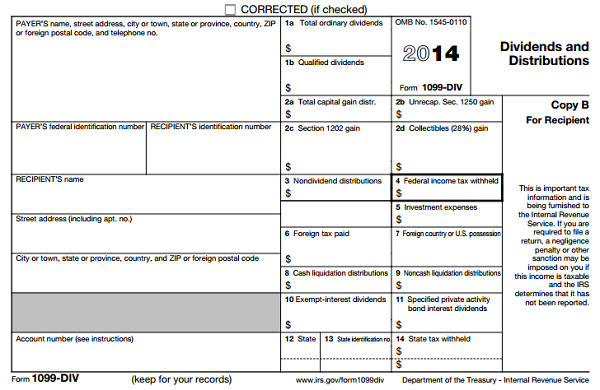

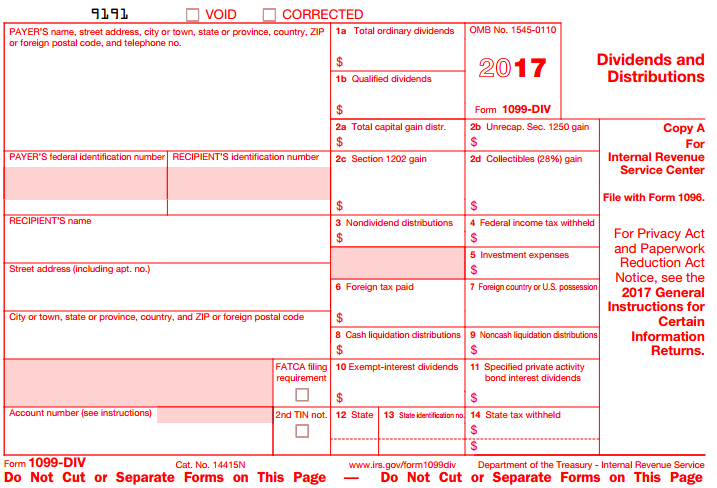

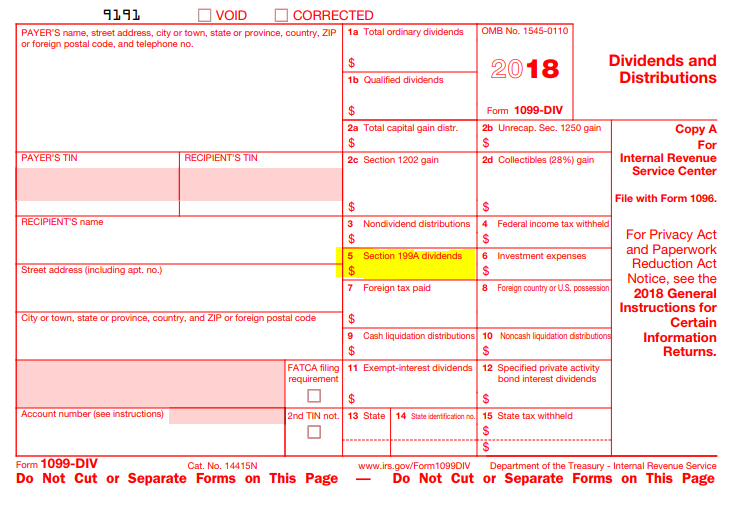

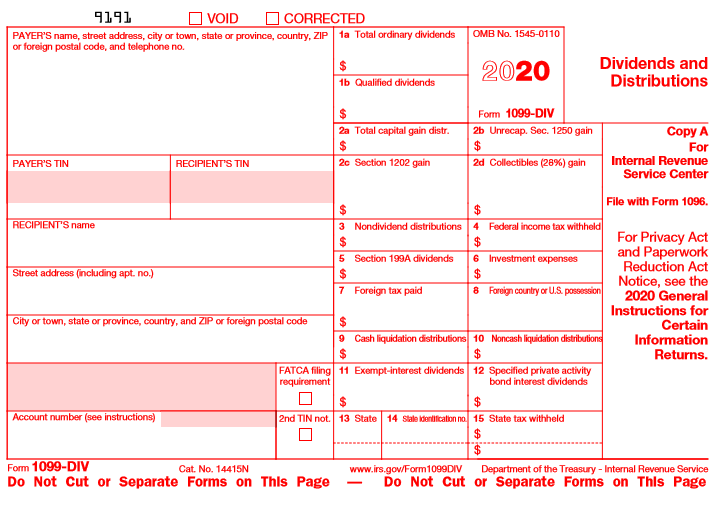

1099-DIV reporting boxes Box 1a of your 1099-DIV will report the total amount of ordinary dividends you receive. Contact the payer or institution and ask a representative if your Form 1099 has been sent if you are expecting a Form 1099 and have not received it by January 31.

What Is A C Corporation What You Need To Know About C Corps Gusto

What Is A C Corporation What You Need To Know About C Corps Gusto

You should use this method if.

How to find 1099-div. Because the underlying bonds that result in these dividends represent a wide range of US. Form 1099-DIV is a record that financial institutions send to investors the IRS to report dividends and distributions. Your income excluding net capital gain and qualified dividend income is taxed at or below the 24 income tax bracket and.

An alternative to asking an issuer for a Form 1099 is to get a transcript of your account from the IRS. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS. Where can I find the state listed for 1099-DIV andor 1099-INT.

Heres how it works how to use it. If you are looking for 1099s from earlier years you can contact the IRS and order a wage and income transcript. If your mutual fund investment makes a capital gain distribution to you it will be reported in box 2a.

A Form 1099-DIV is a great window into your taxable investments. Click the button I earned interest exempt dividends in more than one state and then in the first State box use the drop down to select Multiple States and put the entire amount from box 11 in the box next to that selection. And where to find your total distributions if you dont get the form.

Enter any qualified dividends from box 1b on Form 1099-DIV on line 3a of Form 1040 Form 1040-SR or Form 1040-NR. These include stocks mutual funds and. See sections 852b7 and 857b9 for RICs and REITs respectively.

But if the amount is less than 10 for. They provide shareowner communications and services to Verizons registered shareowners. Ordinary dividends of 10 or more from US.

If a dividend paid in January is subject to backup withholding withhold when the dividend is actually paid. It should show all Forms 1099 issued under your Social Security number. Employee plan participants can find them in the Tax Forms and Documents section of.

The transcript should include all of the income that you had as long as it was reported to the IRS. If it is not listed right on the 1099DIV which it often is not then you would need to contact your broker or financial institution for more information about the funds investments. It might be listed in your year-end reports or a prospectus online.

This value represents dividends received from ETFs like MUB which hold a broad range of US. Form 1099-DIV is a form sent to investors who have received distributions from any type of investment during a calendar year. Each Form 1099-DIV should be.

And foreign corporations capital gains distributions mutual fund dividends federal and foreign tax withheld and non-taxable distributions. Box 1b reports the portion of box 1a that is considered to be qualified dividends. Youll need at least 10 in earnings Youll get a 1099-DIV each year you receive a dividend distribution capital gains distribution or foreign taxes paid for your taxable investments.

Verizons stock transfer agent and registrar is Computershare. Contact the IRS at 800-829-1040 for assistance if you have not received the form by February 15. Box 1a has the total of any dividends on stocks you get as well as.

Verizon investors can conduct transactions calculate their cost basis and find answers to frequently asked questions. Step 3 Obtain the necessary 1099 information through an alternative method. Report the dividends on Form 1099-DIV for the year preceding the January they are actually paid.

In the Dividends and Distributions section of your Form 1099 you may have a value in Box 11. You can also access your tax forms digitally. Investors can receive multiple 1099-DIVs.

Depending on your activity and portfolio you may get your form earlier. Municipal bonds that pay federal tax-exempt dividends. Computershare makes gathering your tax information and filing a little easier.

By learning how to read the major boxes of your 1099-DIV you can gain valuable insights about your investments and their tax efficiency. Form 1099-DIV exists so that taxpayers and the IRS know the income generated by financial assets in dividend paying accounts. All 1099-DIV and 1099-B forms are mailed out by mid-February at the latest.

If you have an amount entered in other boxes of your Form 1099-DIV refer to the Instructions for Recipient of Form 1099-DIV that are attached to your form and the Instructions for Schedule D to see where to report them. Where to find your dividend income For the most part you can expect to find your dividend information in the following boxes. Their services include the administration of a.

Multiply the amount in Box 1a of your Form 1099-DIV by the Foreign Source Income Percentage in the tables that follow. If your only capital gains and losses are from capital gain.

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

Irs Form 1099 Div Download Fillable Pdf Or Fill Online Dividends And Distributions 2020 Templateroller

Irs Form 1099 Div Download Fillable Pdf Or Fill Online Dividends And Distributions 2020 Templateroller

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

1099 Div Income Tax Forms 2020 Set And 1096 Kit For 10 Vendors 4 Part Complete Laser Forms With Self Seal Envelopes In Value Pack 1099 Div Income 2020 Office Products Amazon Com

1099 Div Income Tax Forms 2020 Set And 1096 Kit For 10 Vendors 4 Part Complete Laser Forms With Self Seal Envelopes In Value Pack 1099 Div Income 2020 Office Products Amazon Com

How To Read Your Brokerage 1099 Tax Form Youtube

How To Read Your Brokerage 1099 Tax Form Youtube

Like Dividends How To Read Your 1099 Div Nasdaq

Like Dividends How To Read Your 1099 Div Nasdaq

Breaking Down Form 1099 Div Novel Investor

Breaking Down Form 1099 Div Novel Investor

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg) Form 1099 B Proceeds From Broker And Barter Exchange Definition

Form 1099 B Proceeds From Broker And Barter Exchange Definition

A Quick Guide To Your 1099 Div Tax Form Business Markets And Stocks News Madison Com

A Quick Guide To Your 1099 Div Tax Form Business Markets And Stocks News Madison Com

How To Read Your 1099 Robinhood

How To Read Your 1099 Robinhood

1099 Div 2017 Public Documents 1099 Pro Wiki

1099 Div 2017 Public Documents 1099 Pro Wiki

Missing An Irs Form 1099 Don T Ask For It

Missing An Irs Form 1099 Don T Ask For It

Schwab Moneywise Calculators Tools Understanding Form 1099

Schwab Moneywise Calculators Tools Understanding Form 1099

1099 Div 2018 Public Documents 1099 Pro Wiki

1099 Div 2018 Public Documents 1099 Pro Wiki

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

1099 Div 2020 Public Documents 1099 Pro Wiki

1099 Div 2020 Public Documents 1099 Pro Wiki

Amazon Com Laser 1099 Div Tax Form Copy C 100 Forms 2 Forms Per Sheet Office Products

Amazon Com Laser 1099 Div Tax Form Copy C 100 Forms 2 Forms Per Sheet Office Products