How To Get 1099 Int From Us Bank

You report it as if the bank had sent you a 1099-INT. HSBC eStatement customers will not receive Form 1099INT in the mail unless specifically requested through a secure BankMail within Personal Internet Banking.

1099 Int Form Fillable Printable Download Free 2020 Instructions

1099 Int Form Fillable Printable Download Free 2020 Instructions

For business accounts call 1-800-225-5935.

How to get 1099 int from us bank. Check your account statements. Check the organizations website That may be where to find 1099-INT that you can request andor downloadable statements. If youd like to receive separate Form 1099 documents in the future you can call us at 1-800-TO-WELLS 1-800-869-3557 to make your request.

An alternative to asking an issuer for a Form 1099 is to get a transcript of your account from the IRS. Specified private activity bond interest 10. Select the Go Paperless link green leaf to select which documents you want electronically.

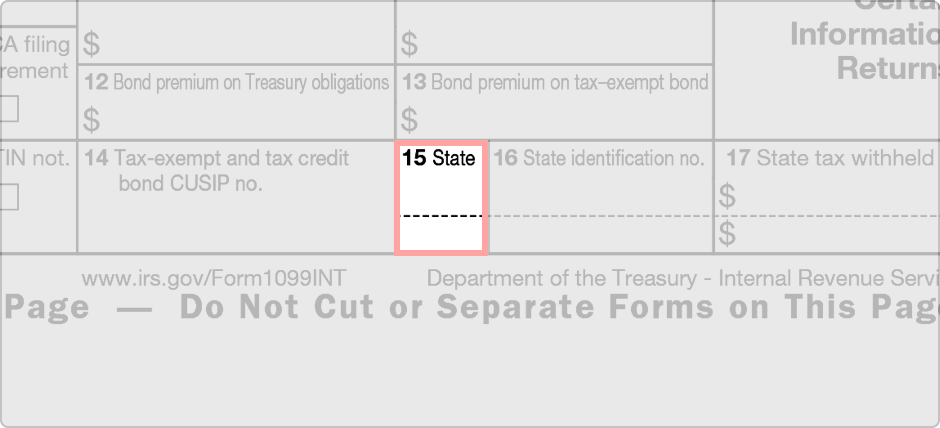

Any amount of income that is more than 49 cents is reportable and taxable. Bond premium on tax-exempt bond 14. Open your return or continue if its not already open.

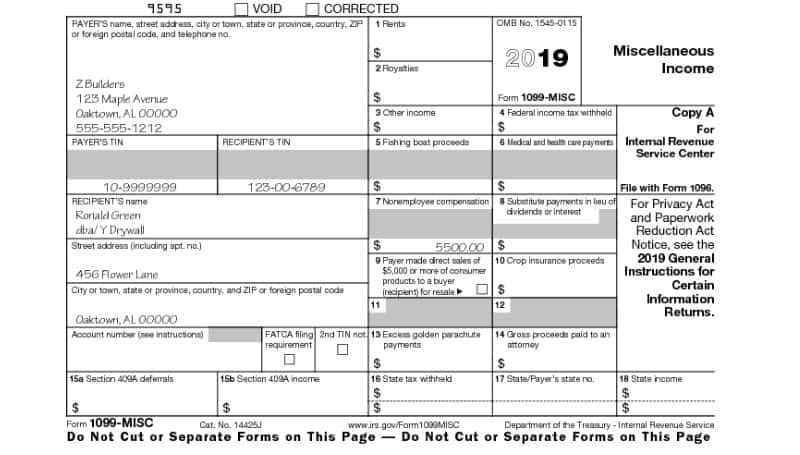

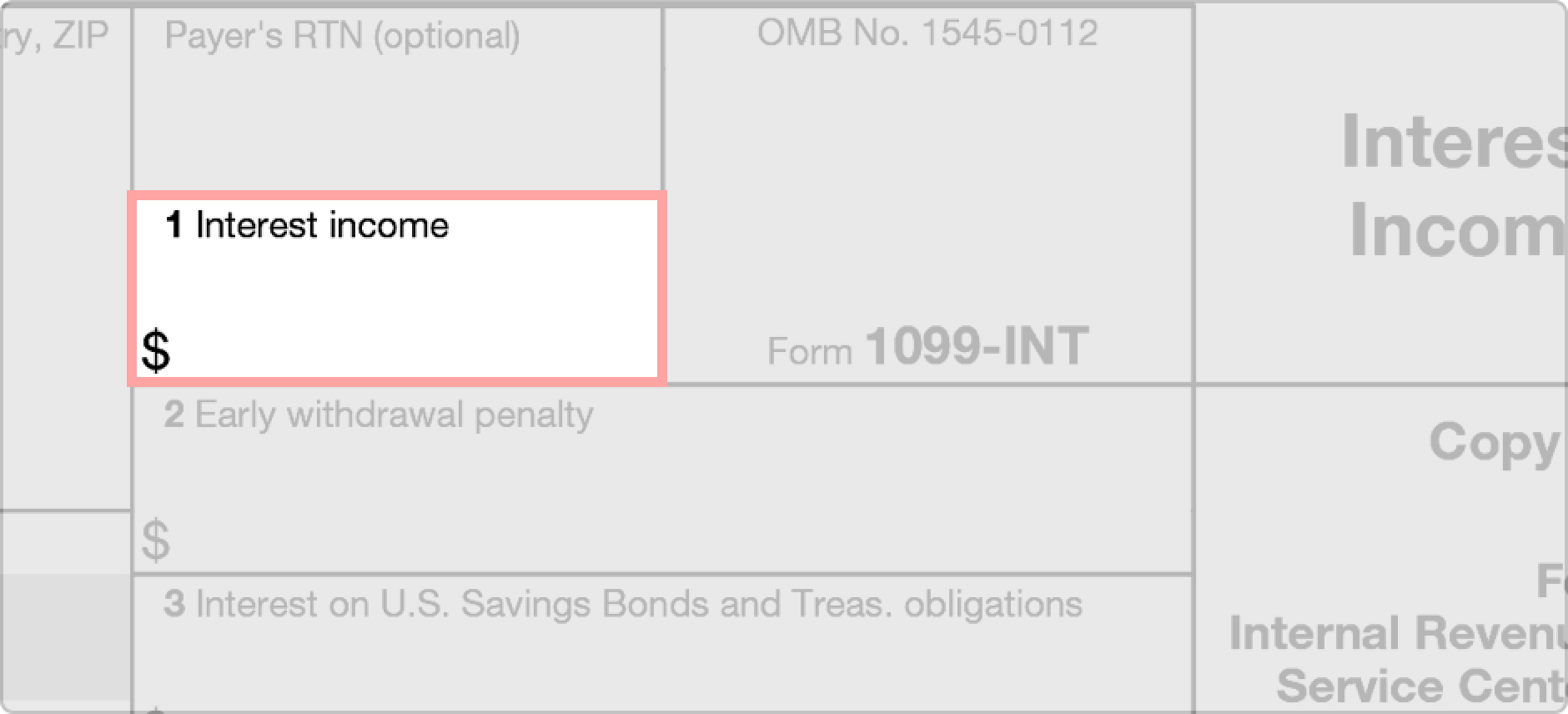

A 1099-INT tax form is a record that someone a bank or other entity paid you interest. Interest paid that must be reported on a 1099-INT will include interest on bank deposits accumulated dividends paid by a life insurance company indebtedness including bonds debentures notes. Contact the banking institutions corporate office or a local branch operating in your area and ask to have the 1099-INT form sent to your mailing address.

State tax withheld 2021. Market discount 11. 1099-INT forms are only sent out if the interest earned is at least 10.

Why is the interest on my Form 1098 more this year than it was last year. In the upper right menu select and search for 1099-INTor 1099INTlower-case also works. Keep an eye out for W2s from your employer.

Tax-exempt interest 9. Checking savings money market CDs or for any interest earned from the redemption of US. Under Account or Service select an account number.

Were getting your 1099 and 1098 tax forms ready. Late January to early February. On the right side of the page youll see To receive paper tax documents for your banking accounts email us Selectemail usand fill out the email form.

1 Form 1099INT is a statement reporting to the IRS interest income you received on checking savings and investment accounts. If you did not receive a 1099-INT form from your financial institution there are a few steps you can perform to obtain the form. Although you didnt get a 1099-INT report the interest in the 1099-INT section.

To get your interest earnings amounts do one of these. Just put the bank name as the payer and put the interest in Box 1. Select the Jump tolink in the search results.

Under My Accounts select My Documents and then select Paperless Preferences. From the My Accounts tab My Documents then select Tax Documents. 1099 INT documents are issued by US.

Bond premium 12. You should have received your 1099 and. Middleman certain portfolio interest interest on an obligation issued by an international organization and paid by that.

Double-check to make sure your mailing address is up to date. Call the organization that holds your money. If you earned more than 10 in interest from a bank brokerage or.

From whom you withheld and did not refund any federal income tax under the backup withholding rules regardless of the amount of the payment. Tax-exempt and tax credit bond CUSIP no. Bond premium on Treasury obligations 13.

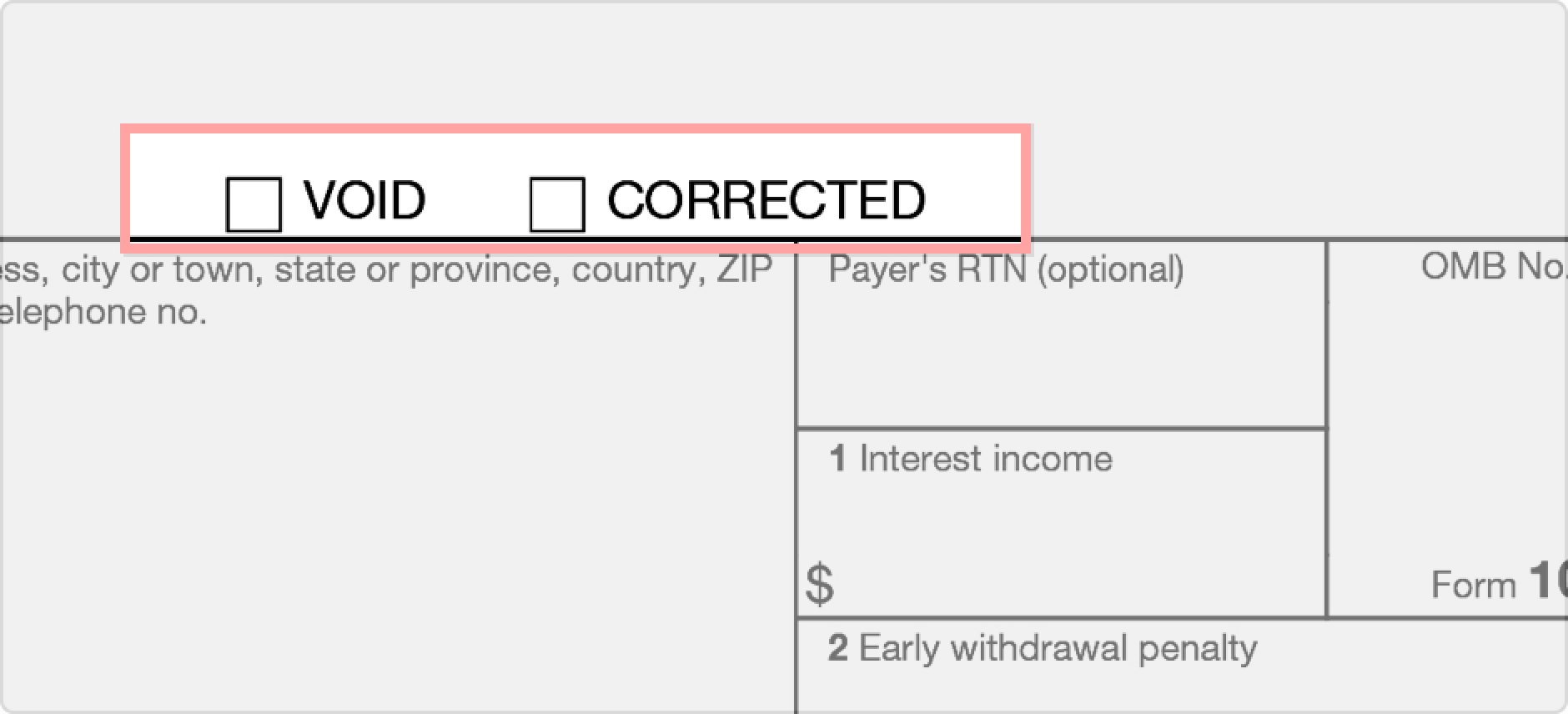

If youre enrolled in Online Banking and you meet the IRS guidelines you can find your 1099-INT form by signing in to Online Banking selecting your deposit account and then selecting the Statements Documents. You are not required to file Form 1099-INT for interest on an obligation issued by an individual interest on amounts from sources outside the United States paid outside the United States by a non-US. File Form 1099-INT for each person.

For whom you withheld and paid any foreign tax on interest. It should show all Forms 1099 issued under your Social Security number. If the amount is less than 10 the bank does not have to send you a 1099-INT but you are required to report the income.

Provide the bank with any account or identity information. Bank to the primary signer of the account s for each Social Security numberTaxpayer ID number that had 10 or more in interest income from deposit accounts ie. To whom you paid amounts reportable in boxes 1 3 and 8 of at least 10.

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

1099 Int Form Fillable Printable Download Free 2020 Instructions

1099 Int Form Fillable Printable Download Free 2020 Instructions

How To Read Your 1099 Robinhood

How To Read Your 1099 Robinhood

1099 Int Mag Mailer Peel Apart 2 Part W 2taxforms Com

1099 Int Mag Mailer Peel Apart 2 Part W 2taxforms Com

Https Www Irs Gov Pub Irs Pdf I1099int Pdf

Solved Turbotax Is Forcing Me To Give Bank Fein On Less T

Solved Turbotax Is Forcing Me To Give Bank Fein On Less T

Irs 1099 Int 2020 2021 Fill Out Tax Template Online Us Legal Forms

Irs 1099 Int 2020 2021 Fill Out Tax Template Online Us Legal Forms

Form 1099 Int What To Know Credit Karma Tax

Form 1099 Int What To Know Credit Karma Tax

Form 1099 Int Software 79 Print 289 Efile 1099 Int Software

Form 1099 Int Software 79 Print 289 Efile 1099 Int Software

Amazon Com 2020 1099 Int 4 Part Interest Tax Forms 25 Laser Form Sets For Interest Income Compatible With Quickbooks And Accounting Software 25 Pack Office Products

Amazon Com 2020 1099 Int 4 Part Interest Tax Forms 25 Laser Form Sets For Interest Income Compatible With Quickbooks And Accounting Software 25 Pack Office Products

What Is A 1099 Int Tax Form How Do I File It

What Is A 1099 Int Tax Form How Do I File It

1099 Int Form Fillable Printable Download Free 2020 Instructions

1099 Int Form Fillable Printable Download Free 2020 Instructions

How To File Us Tax On Nre Nro Interest Without 1099 Int Usa

How To File Us Tax On Nre Nro Interest Without 1099 Int Usa

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099