New York Corporate Tax Extension Form

Current General Corporation Tax GCT Forms 2020 General Corporation Tax GCT Documents on this page are provided in pdf format. 2020 Business Corporation Tax.

Need A School Tax Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com School Tuition Private School School Address

Need A School Tax Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com School Tuition Private School School Address

BOX 3653 NEW YORK NY 10008-3653 NYC-EXT1 RETURN NYC DEPARTMENT OF FINANCE PO.

New york corporate tax extension form. Form CT-53 Request for Six-Month Extension to File for combined franchise tax return or combined MTA surcharge return or both Form CT-54 Request for Six-Month Extension to File New York S Corporation Franchise Tax Return. Group agents must enter the special identification number assigned to the partnership ie group ID 80081XXXX in the Full Social Security number field. NEW YORK NY 10008-3923 NYC-EXT RETURN AND REMITTANCE NYC DEPARTMENT OF FINANCE PO.

Due dates for corporations If your business is organized as an S corporation the income tax return or extension is due by the 15th day of the 3rd month after the end of your tax year. Insurance corporations Article 33 including combined filers. Other states tax forms.

Other corporation tax returns Article 13 and Article 9. Select the appropriate form from the table below to determine where to send the Form 7004 Application for Automatic Extension of Time to File Certain Business Income Tax Information and Other Returns. Answer ID 565 Updated 12032019 0852 AM.

Form IT-203-GR Group Return for Nonresident Partners Note. Application for Automatic Extension of Time to File for Partnerships and Fiduciaries. Form CT-5 - Request for Six-Month Extension to File.

Form IT-203 Nonresident and Part-Year Resident Income Tax Return. You can make an extension payment using Form CT-200-V or pay electronically through NY Online Services for Businesses. For payment amount refer to the tax form for the tax that you will be filing after the extension period.

Most business tax returns can be extended by filing Form 7004. Customers can file many New York City returns using Business Tax E-servicesRegister now or log in to your account to file a return or make a payment. New York City forms.

The businesses operating as Corporation or S-Corporation in New York need to file Form CT-5 with the state to obtain a 6-month extension of time to file their business income tax return with the state. The following returns can be filed using e-Services. Form IT-205 Fiduciary Income Tax Return.

Business Taxpayer Answer Center. I permanently moved into or out of New York City. The full amount of tax is due on the original due date of.

Corporation tax forms current year Corporation tax returns. Finance forms and instructions are available on line at NYCgovfinance. Extensions 204EZ 4SEZ 202S CRA 2S 245 112 RAX.

To apply for a New York C-Corporation tax extension use New York Form CT-5 Request for Six-Month Extension to File. Description of Form IT-370-PF. NYC-EXT1 - Application for Additional Extension.

S corporations Article. File online with e-Services. NYC-EXT - Application for Automatic Extension of Time to File Business Income Tax Returns.

You must file Form CT-5 and pay your estimated New York tax balance by the original deadline of your return April 15 in order for your extension to be approved. In addition to my regular New York State income tax form is there another. I permanently moved into or out of New York City.

Form IT-204 Partnership Return. File Form 7004 based on the appropriate tax form shown below. File online with e-Services.

General business corporations Article 9-A including combined filers. The extension request is made by filing Request for Six-Month Extension to File New York S Corporation Franchise Tax Return Form CT-54. Application for Automatic Extension of Time to File by the original due date of the return.

Form CT-56 Request for Three-Month Extension to File Form CT-186 for utility corporation franchise tax return MTA surcharge return or both Form CT-59. If filed before the due date will allow a partnership or fiduciary an extension of time to file Form IT-204 Partnership Return or. In addition to my regular New York State income tax form is there another form I should file.

7 rows Instructions for Form CT-54 Request for Six-Month Extension to File New. 2016 PRINT OR TYPE Corporation Tax Unincorporated Business Tax UBT NYC-2 NYC-2A NYC-2S n Business C Corporations only n General-Subchapter S Corporations and Qualified Subchapter S. In fact youre required to pay your properly estimated tax liability in order to obtain a New York tax extension.

NYC-EXT - Application for Automatic Extension of Time to File Business Income Tax Returns File online with e-Services. Form IT-201 Resident Income Tax Return. You must pay the estimated franchise tax on or before the due date of.

BOX 5564 BINGHAMTON NY 13902-5564 Business Tax Form - New Mailing Addresses Business Tax Forms Unincorporated Declaration of Estimated Tax General Corporation Tax. NYC-2 - Business Corporation Tax Return. If you cannot meet the filing deadline for a NY S Corporation return you should request a six-month extension of time by filing Form CT-54 Request for Six-Month Extension to File on or before the due date of the return.

NYC-ATT-S-CORP - Calculation of Federal Taxable Income For S Corporations. For franchisebusiness taxes MTA surcharge or both. Documents on this page are provided in pdf format.

Https Www1 Nyc Gov Assets Finance Downloads Pdf 19pdf Business Tax Forms Nyc 245 2019 Pdf

Fill Free Fillable Forms For New York State

Fill Free Fillable Forms For New York State

Fill Free Fillable Forms For New York State

Fill Free Fillable Forms For New York State

Nyc Solar Property Tax Abatement Pta4 Explained 2021

Daycare Business Income And Expense Sheet To File Your Daycare Business Taxes Page 1 Taxtime Income Tax Daycare Business Plan Home Daycare Starting A Daycare

Daycare Business Income And Expense Sheet To File Your Daycare Business Taxes Page 1 Taxtime Income Tax Daycare Business Plan Home Daycare Starting A Daycare

Fill Free Fillable Forms For New York State

Fill Free Fillable Forms For New York State

Fill Free Fillable Forms For New York State

Fill Free Fillable Forms For New York State

Fill Free Fillable Forms For New York State

Fill Free Fillable Forms For New York State

Fill Free Fillable Forms For New York State

Fill Free Fillable Forms For New York State

Fill Free Fillable Forms For New York State

Fill Free Fillable Forms For New York State

Two Week Resignation Letter Template Inspirational Respond To A Letter Requesting Additional Information Letter Templates Meet The Teacher Template Lettering

Two Week Resignation Letter Template Inspirational Respond To A Letter Requesting Additional Information Letter Templates Meet The Teacher Template Lettering

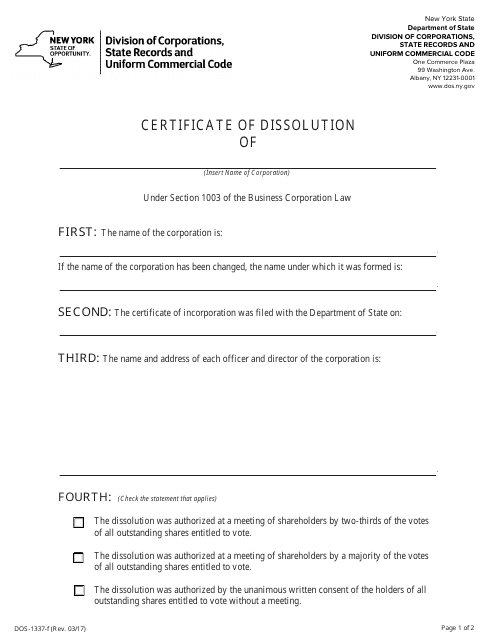

Form Dos 1337 F Download Fillable Pdf Or Fill Online Certificate Of Dissolution New York Templateroller

Form Dos 1337 F Download Fillable Pdf Or Fill Online Certificate Of Dissolution New York Templateroller

Nys Tax Warrant Statute Of Limitations How Long Does Nys Have To Collect

Nys Tax Warrant Statute Of Limitations How Long Does Nys Have To Collect

What To Know About Filing A Business Tax Extension Businessnewsdaily Com Tax Extension Tax Refund Tax Exemption

What To Know About Filing A Business Tax Extension Businessnewsdaily Com Tax Extension Tax Refund Tax Exemption

Missouri Income Tax Withholding Form 14 Seven Doubts You Should Clarify About Missouri Incom Tax Forms Income Tax Income Tax Return

Missouri Income Tax Withholding Form 14 Seven Doubts You Should Clarify About Missouri Incom Tax Forms Income Tax Income Tax Return

Fill Free Fillable Forms For New York State

Fill Free Fillable Forms For New York State

Find Irs Form 1040 And Instructions Irs Forms Irs Tax Extension

Find Irs Form 1040 And Instructions Irs Forms Irs Tax Extension

Form Nyc 210 Fill Out And Sign Printable Pdf Template Signnow

Form Nyc 210 Fill Out And Sign Printable Pdf Template Signnow

Fill Free Fillable Forms For New York State

Fill Free Fillable Forms For New York State