Qualified Business Income After Deduction Worksheet Instructions

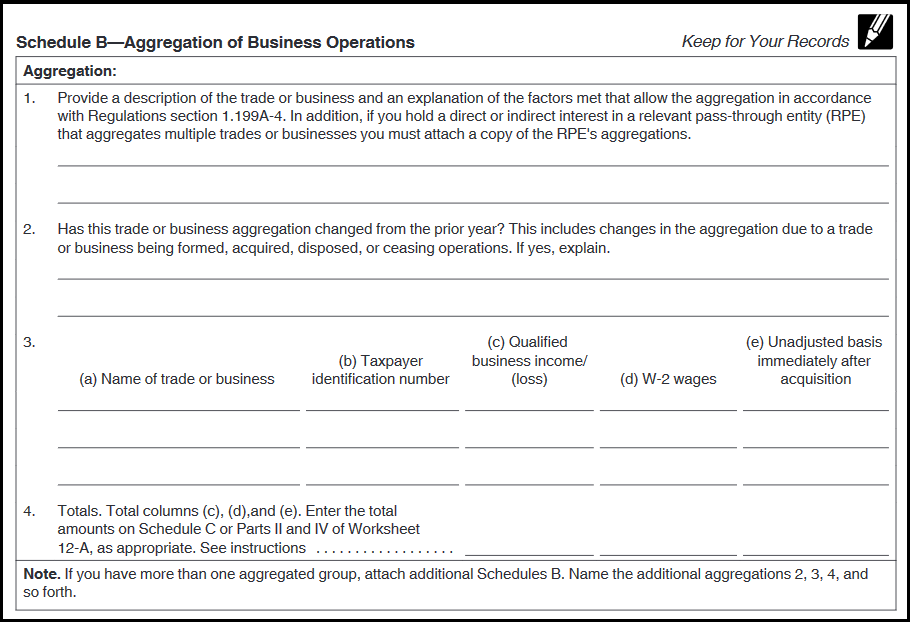

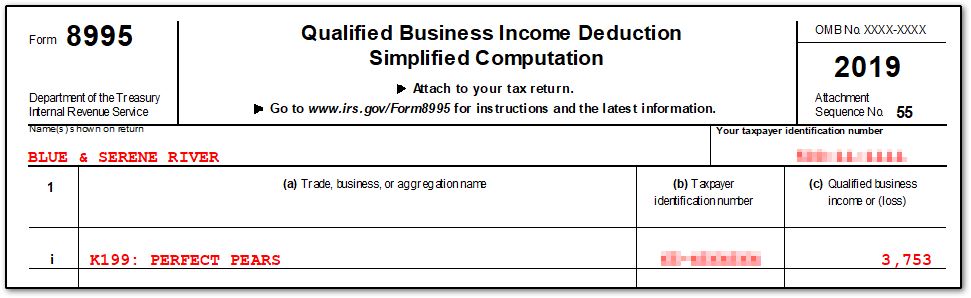

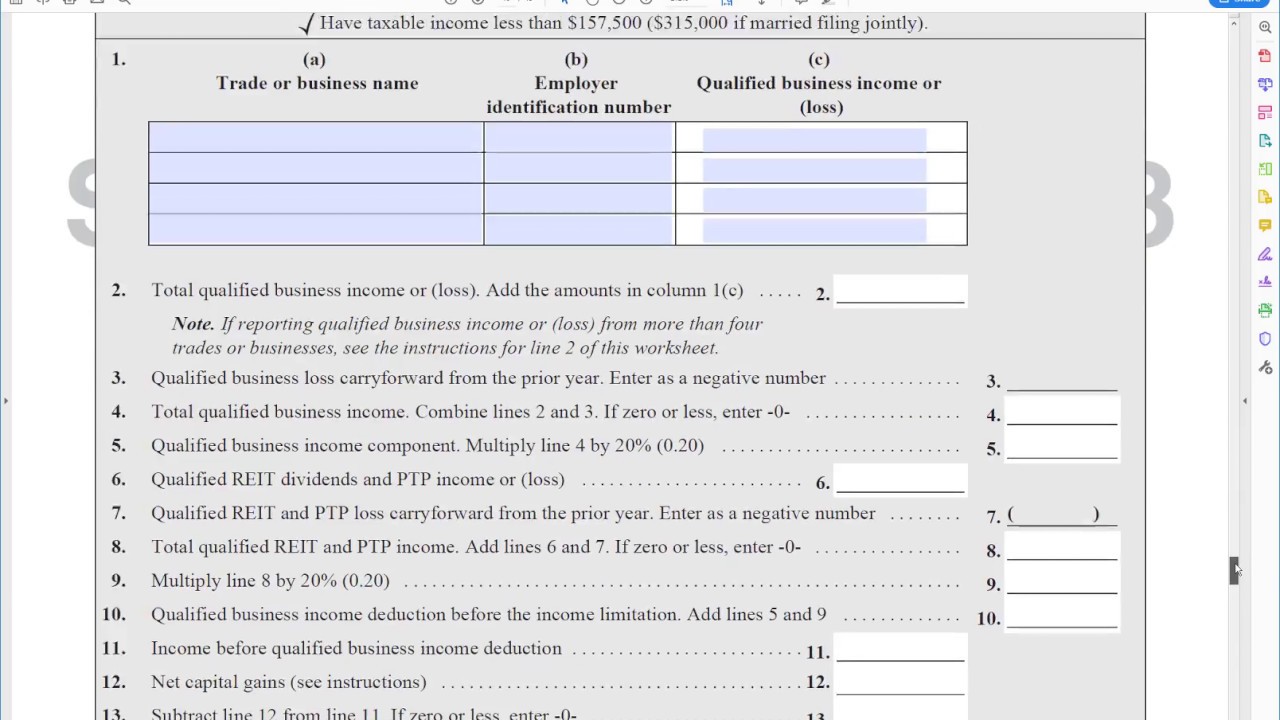

Create a new copy for that business eg give it the name of that business. Use Form 8995-A to figure your qualified business income QBI deduction.

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

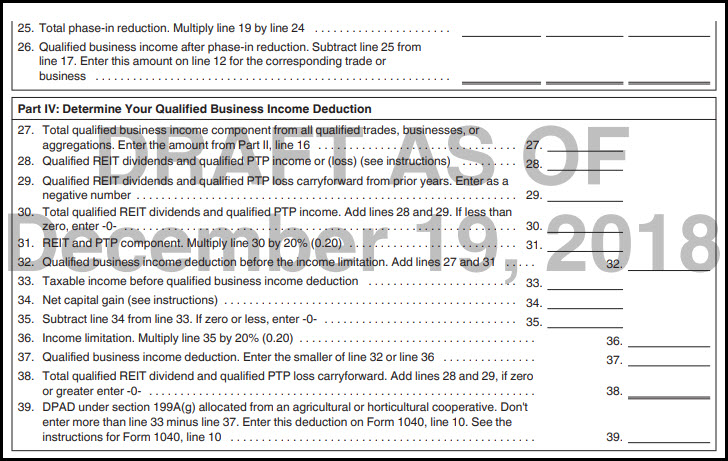

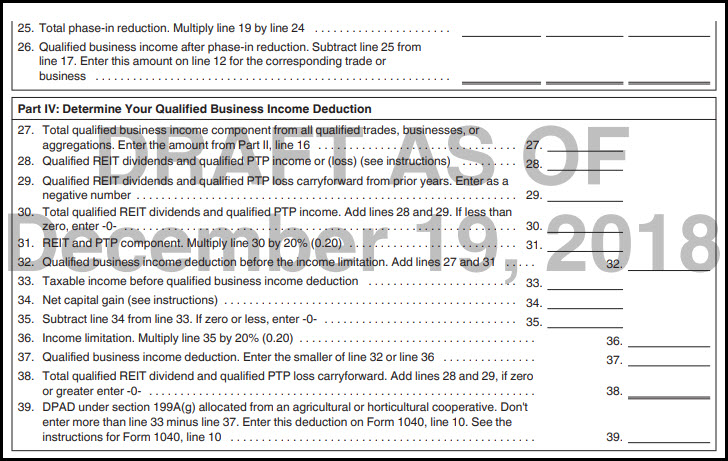

Qualified business income after phase-in reduction.

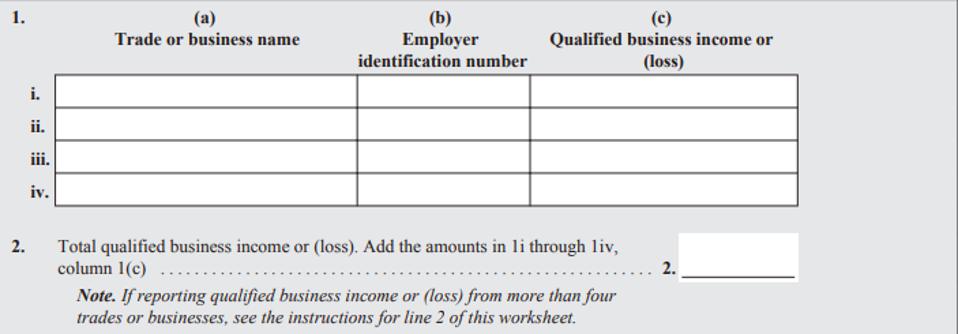

Qualified business income after deduction worksheet instructions. Many owners of sole proprietorships partnerships S corporations and some trusts and estates may be eligible for a qualified business income QBI deduction also called Section 199A for tax years beginning after December 31 2017. Subtract line 25 from line 17. The form 8995 is used to figure your qualified business income QBI deduction.

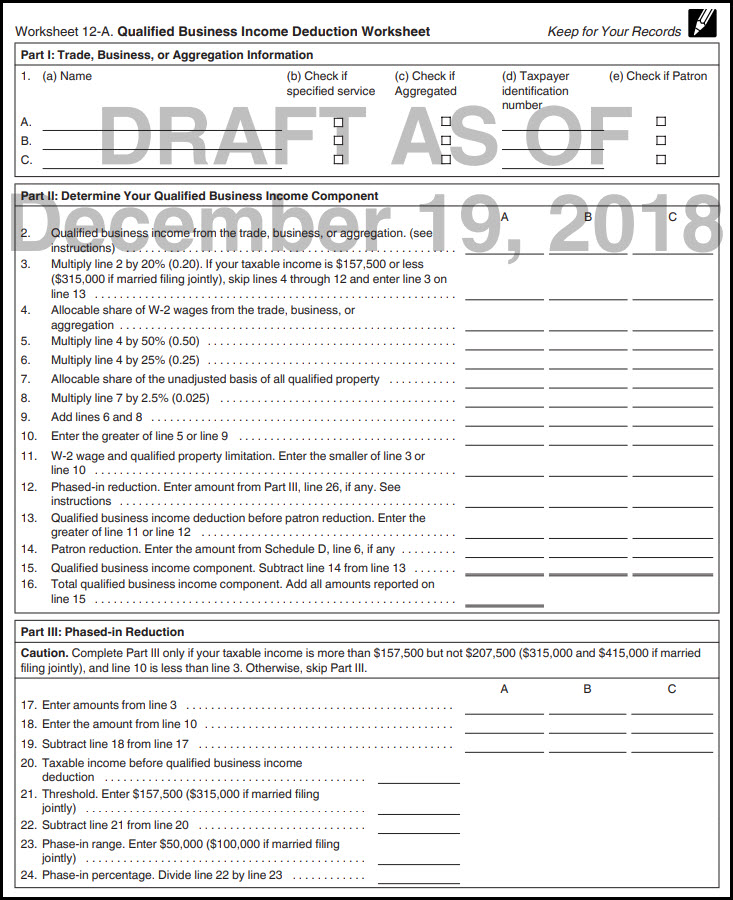

40000 business profit 2826 one half of Social SecurityMedicare tax 37174. When the taxpayer has qualified business income QBI Taxable income before QBID is more than 157500 315000 if married filing jointly. General Instructions Purpose of Form Use Form 8995-A to figure your qualified business income QBI deduction.

In Forms mode find the schedule for each businesssource of QBI eg Schedule C or Schedule E and then find the Qualified Business Income Deduction Smart Worksheet for that form eg for Schedule C it is after Part V for Schedule E it is after Line 22 Deductible rental real estate loss. Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20 of their net QBI from a trade or business including income from a pass-through entity but not from a C corporation plus 20 of qualified real estate investment trust REIT dividends. Learn if your business qualifies for the QBI deduction of up to 20.

The Qualified Business Income QBI Deduction is a tax deduction for pass-through entities. The Qualified Business Income Component Worksheet and Qualified Income Deduction Worksheet Located in the QBID folder in Form View this worksheet prints under the following conditions. Determine Your Qualified Business Income Deduction 27.

The qualified business income deduction QBI is a tax deduction that allows eligible self-employed and small-business owners to deduct up to 20 of their qualified business income. You enter 1 in the Activity qualifies as trade or business for section 199A deduction field in Screen C-2 F-2 Rent-2 K1QBI or K1TQBI and. 50 percent of your share of W-2 wages paid by the business or.

The Worksheet will compare your family taxable income with your business profit. Use Form 8995 to figure your qualified business income QBI deduction. It will multiply the lower of these two numbers by 20 and put the result on Form 1040 line 9.

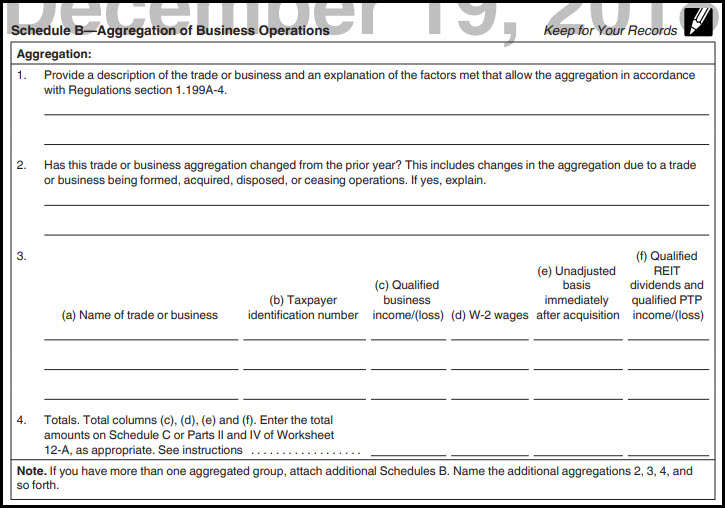

It will be highlighted for Question A in the Qualified Business Income Deduction Smart Worksheet. Form K1 from a Public Traded Partnership. Include the following schedules their specific instructions are shown later as appropriate.

Business income 1099 income. Enter the amount from Part II line 16. If your business is an SSTB with income in the phase-out range youll calculate your deduction by taking 20 percent of your qualified business income and applying the limitation of.

See QBI Loss Tracking Worksheet later. Check the Specified service trade or business SSTB box if applicable. Schedule C Form 1040 Line 31 Net Profit or Loss Schedule F Form 1040 Line 34 Net Profit or Loss Schedule K-1 Form 1065 Box 20 Code Z Qualified Business Income.

Total qualified business income component from all qualified trades businesses or aggregations. This is your Qualified Business Income Deduction finally. Schedule A Form 8995-A Specified Service Trades or Businesses Schedule B.

Enter this amount on line 12 for the corresponding trade or business. Scroll down to the Qualified Business Income Deduction section. Some taxpayers may need to use the standard deduction worksheet in the.

For most individual taxpayers Qualified Business Income will consist of the income or loss that is reported on any of the following tax schedules. Subtract the appropriate deduction and if the taxpayer qualifies the qualified business deduction from the taxpayers adjusted gross income AGI to figure their taxable income. Double click in the highlighted Question A box and you will get a pop-up asking you to link to a QBI component worksheet.

Complete Form 8995 or Form 8995-A to claim the tax deduction The qualified business income deduction QBI deduction allows some individuals to deduct up to 20 of their business income REIT dividends or PTP income on their individual income tax returns. Include the following schedules their specific instructions are shown later as appropriate. 25 percent of those wages plus 25 percent of your share of qualified property.

Included in your qualified business income deduction calculation for the year allowed. For more information relating to SSTBs click here. Enter the income and expenses on screen 18 following your normal workflow.

An amount in box 5 of a form 1099-DIV. The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate. UltraTax1041 calculates the qualified business income deduction and generates the Qualified Business Income Deduction worksheets when the following conditions are met.

This form can be triggered by the following.

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Lacerte Complex Worksheet Section 199a Qualified Intuit Accountants Community

Lacerte Complex Worksheet Section 199a Qualified Intuit Accountants Community

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

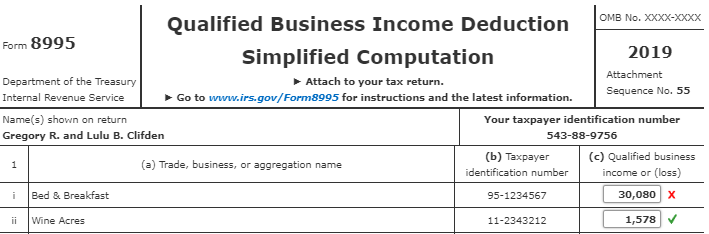

Solved I Am Having Trouble Calculating Qbi For The Bed An Chegg Com

Solved I Am Having Trouble Calculating Qbi For The Bed An Chegg Com

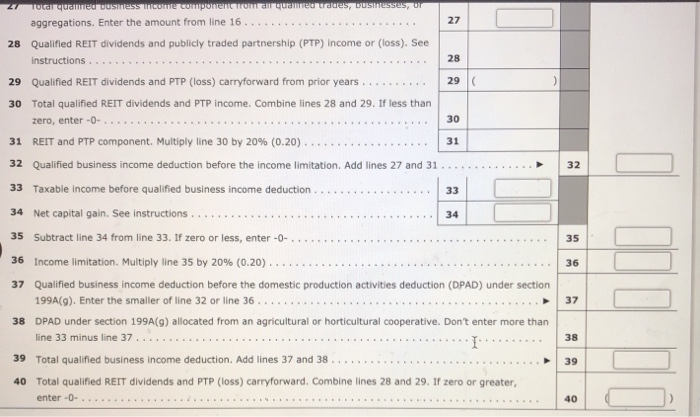

Solved I Need Help Completing The Form 8995 A For This Pr Chegg Com

Solved I Need Help Completing The Form 8995 A For This Pr Chegg Com

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Https Www Irs Gov Pub Newsroom Tcja Training Provision 11011 Qbid Pdf

Income Tax Deduction Worksheet Promotiontablecovers

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Taxes From A To Z 2019 Q Is For Qualified Business Income

Taxes From A To Z 2019 Q Is For Qualified Business Income

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

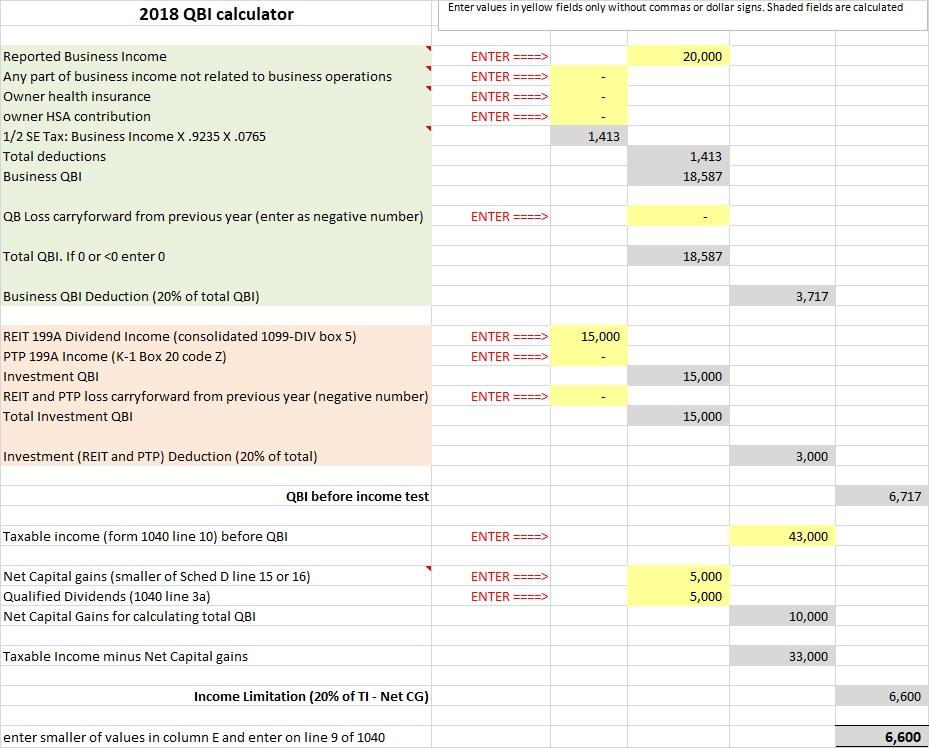

How To Use The New Qualified Business Income Deduction Worksheet For 2018 Youtube

How To Use The New Qualified Business Income Deduction Worksheet For 2018 Youtube