What Is The Deadline To Send Out 1099 Forms

Please refer to this IRS document for more information especially the table starting on page 24. Scheduling your forms gives you time between when we emailUSPS your forms to vendors and when we send the forms to the IRS.

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

The later a return is the more your business will owe the IRS.

What is the deadline to send out 1099 forms. Businesses must send Form 1099-MISC to recipients by February 1 2021 and file it with the IRS by March 1 March 31 if filing electronically. Heres what you need to know for 2021. The penalties for missing the Form 1099-NEC deadline get more expensive the longer employers wait to file.

Next 1099 forms must be filed with the IRS. 1 You must also give 1099-NEC forms to non-employees you paid 600 to in 2020. Both W-3 and 1096 summation forms are also due to the appropriate government agency by February 1 2021 unless you file online.

Contractors should reach out as soon as possible if any corrections are required. Businesses that file electronically need to go through IRS FIRE system. According to the IRS rules creditors have to send you form 1099-C - Cancellation of Debt by January 31 2017 for tax year 2016.

If businesses are using Forms 1099-MISC to report amounts in box 8 Substitute Payments in Lieu of Dividends or Interest or box 10 Gross Proceeds Paid to An Attorney there is an exception to the normal due date. The deadline for filing electronically is also January 31st. These reports must be given to recipients by February 1 2021 1.

Thats right a consolidated 1099 form should be postmarked by February 16 2021 according to the Internal Revenue Service IRS. However since January 31 2021 is a Sunday the 2020 tax year deadline is moved to Monday February 1 2021. Reporting payments to contract workers on Form 1099-MISC box 7.

The filing due date for other Forms 1099 1096 is March 1st 2021 if filing by paper and March 31st 2021 if filed electronically. The deadline for filing Form 1099-NEC with the IRS and sending recipient copies for the 2020 tax year is Feb 01 2021. The May 17 tax deadline applies to taxes payments contributions and the 2017 tax refund.

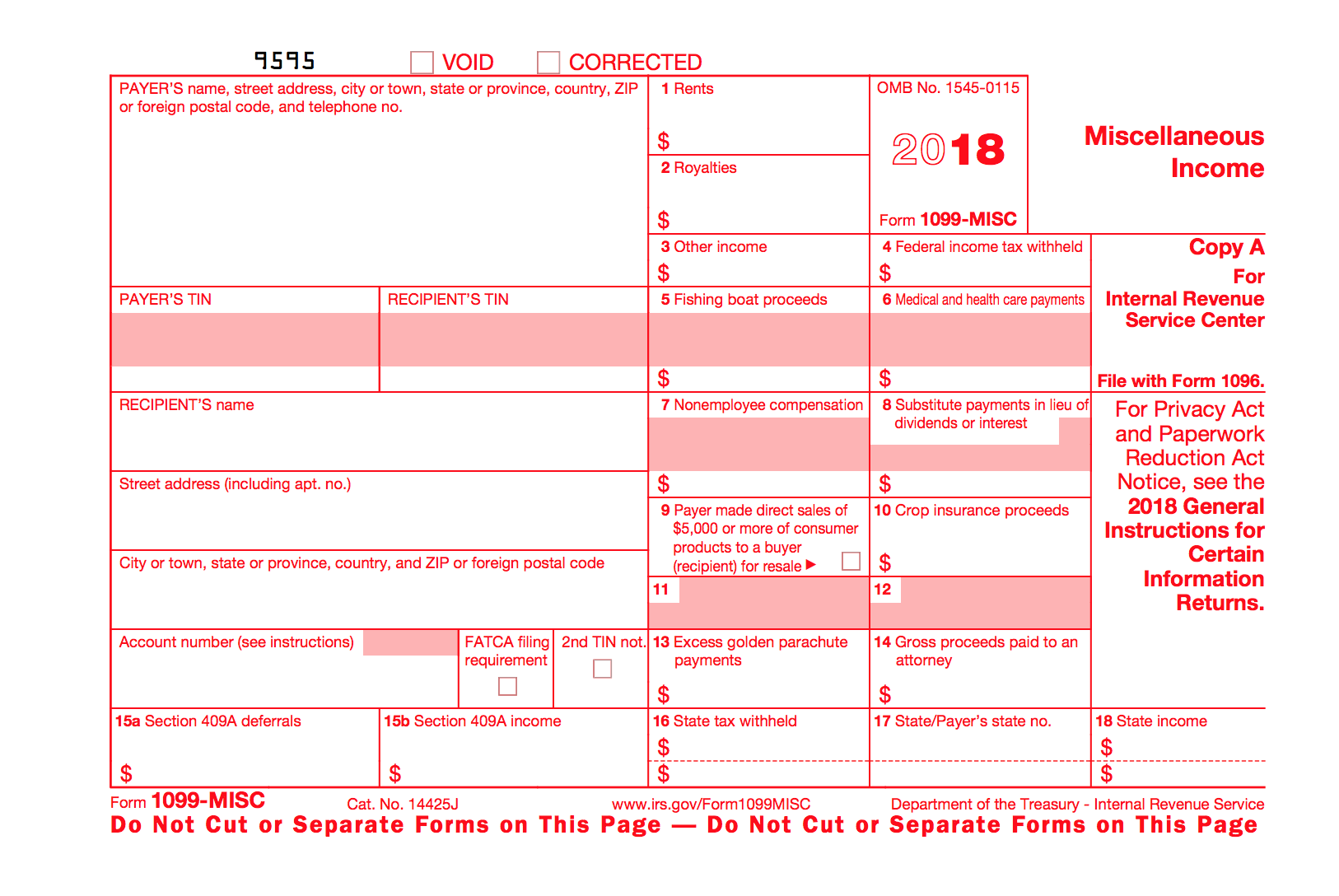

You can make those changes in Tax1099 before the. The due date for furnishing statements to recipients for Forms 1099-B 1099-S and 1099-MISC if amounts are reported in box 8 or 14 is February 15 2018. Specific Instructions for Form 1099-MISC File Form 1099-MISC Miscellaneous Income for each.

File Form 1099-MISC by March 1 2021 if you file on paper or March 31 2021 if you file electronically. Creditors also have to file forms 1099-C together with form 1096 by February 28 2017. Send 1099 form to the recipient by February 1 2021.

Businesses must send Form 1099-MISC to recipients by Feb. One of the most extensive year-end business owners tasks is filing and sending 1099 forms by the January 31 deadline. For the 2018 tax year employers should send the forms out by January 31st 2019.

If you plan on filing via paper mail the deadline is January 31st. The same deadline applies for completing and providing the 1099-NEC. Previously firms were required to have these forms validated and postmarked by January 31.

Section 6071c requires you to file Form 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures. Depending on how many contractors your company used in the previous year 1099s can become a time-consuming project that. The IRS will also send you a form 4852 Substitute for Form W-2 Wage and Tax Statement or Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance.

Actually thats been the case for a while nowthe 1099 mailing deadline changed starting with the 2008 tax year. Beginning with tax year 2020 Form 1099-NEC must be filed by January 31 of the following year whether you file on paper or electronically. Emphasis added I know many brokerages bundle the 1099-DIV with the 1099-B so one might assume that the deadlines are the same.

The February 1st deadline only applies to Form 1099-NEC wherein Copy A and Copy B should be furnished to the IRS and contractor respectively on the same date. 1 2021 and file it with the IRS by March 1 March 31 if filing electronically. 1099 MISC Due Date 2021.

This is useful because your vendors may have edits to make.

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Change To 1099 Form For Reporting Non Employee Compensation Ds B

1099 Misc Form Copy B Recipient Discount Tax Forms

1099 Misc Form Copy B Recipient Discount Tax Forms

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint