How To Determine A 1099 Vendor

Like Form 1099-MISC also submit a Form 1096 summary along with Form 1099-NEC. Fill out Form 1099-NEC if you have any workers you paid 600 or more to in nonemployee compensation.

1099 Payments How To Report Payments To 1099 Vendors

1099 Payments How To Report Payments To 1099 Vendors

What is a 1099 Vendor.

How to determine a 1099 vendor. Ledger Payables Reports Vendors 1099 - Misc. To determine whether you need. 1099 forms are typically due in February.

The first step in determining this is to establish the relationship between the service provider and the company. If you paid a vendor more than 10 in interest youve got to send out a 1099-INT. Type of business entity which is used to determine whether or not payments to the vendor could be reportable on a 1099-MISC.

Instead a 1099 vendor will send you a 1099 invoice after performing work for your business. See How to set up a vendor to show on the correct 1099 form 1099-NEC or 1099-Misc To navigate to the correct form go to. Starting at the upper left box record your organizations name as the PAYER.

How to Determine Who Receives a 1099. Filling out Forms 1099. Submit Copy B to the Vendor.

An invoice is an electronic or paper request for payment. 2 whether or not the personbusiness is a corporation. Or 1099 - NEC.

The company then sends the resulting 1099 form to the supplier. Weve put together some of the most common questions weve received surrounding PPP and 1099 workers to give you the. To better determine how to properly classify a worker consider these three categories Behavioral Control Financial Control and Relationship of the Parties.

1099 Rules Regulations Who must file. Once you know which contractors you paid over 600 to you will need to fill out Form 1099-NEC. Persons engaged in a trade or business must file Form 1099 MISC when certain payments are made.

You Might Need to Submit 1099. If a partnership or an individual then you need to prepare a 1099. Thus personal payments arent reportable.

Before issuing a 1099-MISC you should determine. If the provider is not a standard employee and they earned at least 600 in services during the year a 1099 form is required. If you hire a 1099 vendor to perform work at your business do not include them on your companys payroll.

A 1099 vendor is a designation listed in each of the records in the vendor master file that is part of an accounting software package. Submit Copy A to the IRS. A worker is an employee when the business has the right to direct and control the work performed by the worker even if that right is not exercised.

Generally if the vendor is a corporation you do NOT need to file a 1099. If youre a 1099 worker or a small business that employs 1099 workers seeking a Paycheck Protection Program PPP loan you likely have questions about whether or not you qualify for a PPP loan what you need to apply and how potential loan forgiveness will work. It can be submitted by mail or electronically.

As you settle payments against invoices that contain 1099 information the 1099 settled values are tracked. When you set up a vendor as a 1099 vendor the amounts are tracked in Microsoft Dynamics 365 Finance throughout the year. How to Determine Who Receives a 1099 by Chris Newton Demand Media.

If you designate a supplier as a 1099 vendor the system will print a Form 1099 for the supplier as part of the 1099 batch processing that follows the end of the calendar year. Copy A of Form 1099-MISC must be submitted to the IRS by January 31 2018. They are not an employee so they do not receive hourly or salary wages for each payroll period.

The PAYER TIN is the organizations tax identification number. A person is engaged in business if he or she operates for profit. If in doubt and there are only a few cases you are wondering about then the best approach would be to err on the side of caution and send the 1099.

The 1099-INT form is usually used by banks brokerage firms credit unions and sometimes even the companies handling your student loans. If You Paid Someone 10 Or More In Interest. On invoice lines you use the 1099 box and 1099 amount fields to track 1099 amounts.

Taxpayer identification number TIN of the vendor - which would be a social security number SSN for individuals and sole-proprietors and an. Who Gets a 1099. If business owners are using Venmo to pay vendors from time to time they need o make sure and include these payments in their books and determine if theyve paid a Vendor more than 600.

And 3 whether your payments to the personbusiness exceed the 600 reporting threshold. 1 whether the person is legally an employee or an independent contractor. Before you can fill out Form 1099-NEC andor Form 1099-MISC you need to gather some information.

Here are some guidelines to help determine if a vendor needs to be set up as a 1099 vendor. Venmo does not take care of the 1099 for you. Review IRS Guidelines to determine what type of 1099 the vendor needs.

Step 2 Verify The Vendor 1099 Settings

Step 2 Verify The Vendor 1099 Settings

Step 2 Verify The Vendor 1099 Settings

Step 2 Verify The Vendor 1099 Settings

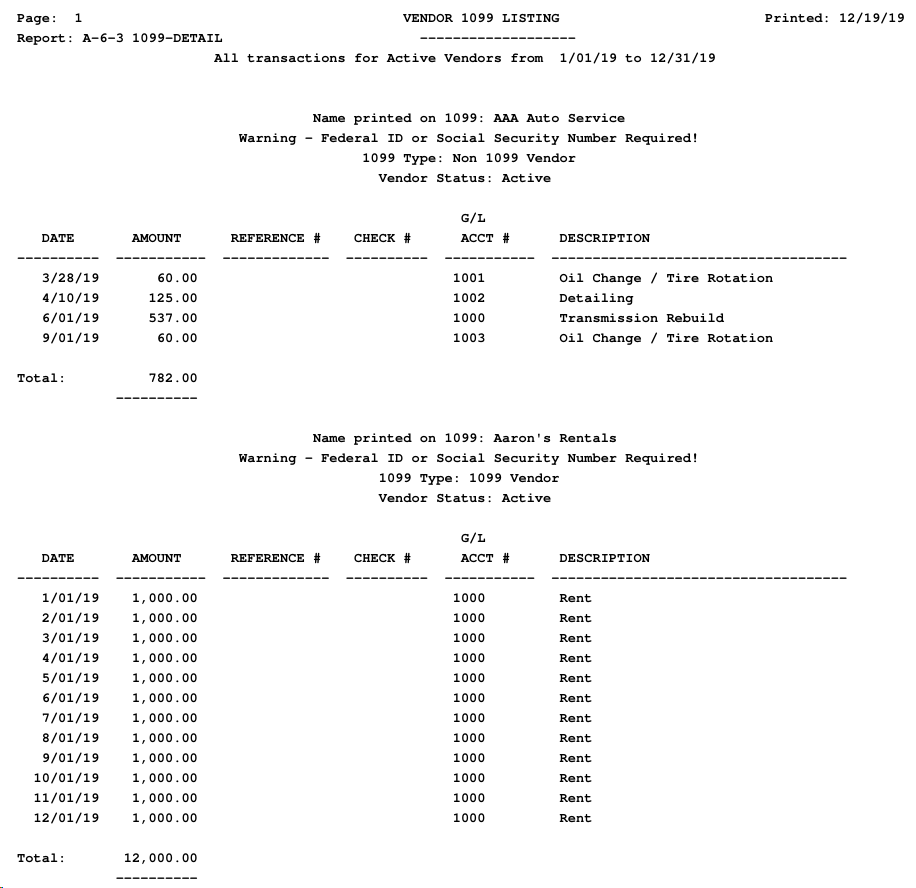

How To Run A 1099 Vendor Summary Report In Quickbooks Asap Help Center

How To Run A 1099 Vendor Summary Report In Quickbooks Asap Help Center

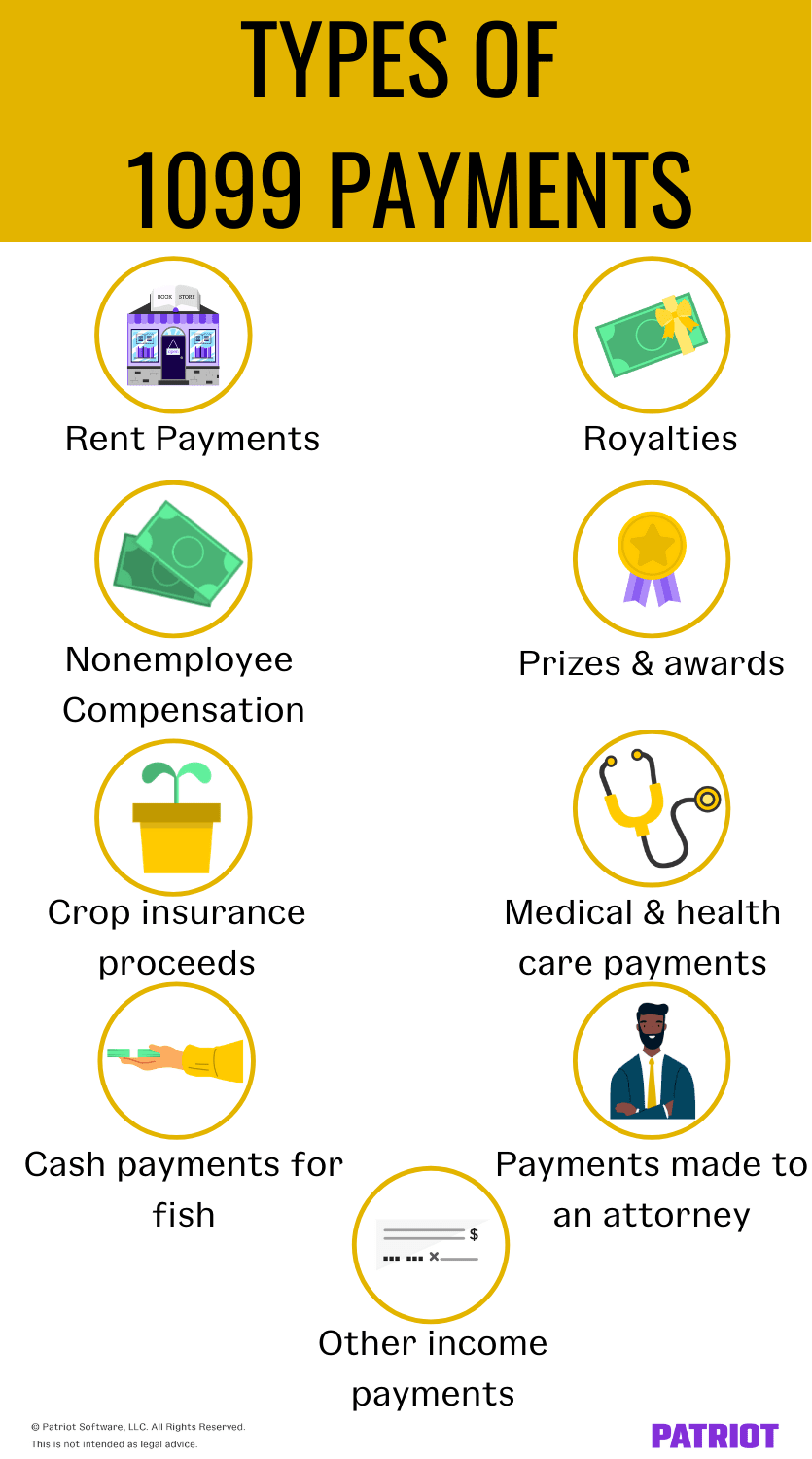

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Step 2 Verify The Vendor 1099 Settings

Step 2 Verify The Vendor 1099 Settings

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

How To Run A 1099 Vendor Summary Report In Quickbooks Asap Help Center

How To Run A 1099 Vendor Summary Report In Quickbooks Asap Help Center

Vendor Settings For 1099 Eligible Tracking In Quickbooks Desktop Asap Help Center

Vendor Settings For 1099 Eligible Tracking In Quickbooks Desktop Asap Help Center

Rules For When To Issue A 1099 Form To A Vendor The Dancing Accountant

Rules For When To Issue A 1099 Form To A Vendor The Dancing Accountant

How To Run A 1099 Vendor Summary Report In Quickbooks Asap Help Center

How To Run A 1099 Vendor Summary Report In Quickbooks Asap Help Center

Perfect For Tracking Expenditures Great For Direct Sales Consultants For Keeping Your Business Expense Business Organization Business Organization Printables

Perfect For Tracking Expenditures Great For Direct Sales Consultants For Keeping Your Business Expense Business Organization Business Organization Printables

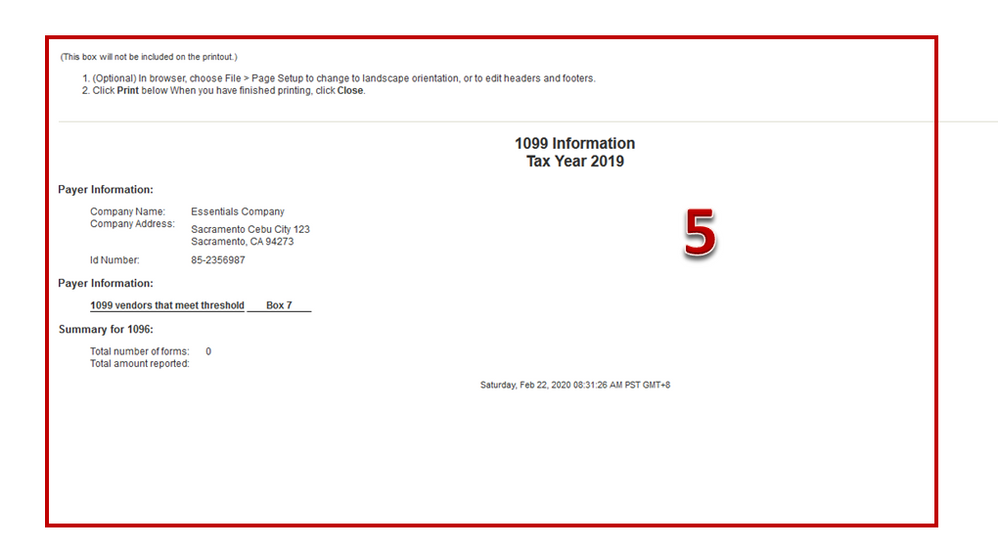

Psa L P Vendor 1099 How To Set Up A Vendor To Show On The Correct 1099 Form 1099 Nec Or 1099 Misc Parishsoft

Psa L P Vendor 1099 How To Set Up A Vendor To Show On The Correct 1099 Form 1099 Nec Or 1099 Misc Parishsoft

Wedding Vendor Contract Template Awesome Sample Vendor Contract Agreement Contracts Simple Form Contract Template Templates Reference Letter Template

Wedding Vendor Contract Template Awesome Sample Vendor Contract Agreement Contracts Simple Form Contract Template Templates Reference Letter Template