Income Tax Forms Canada Post

Use the Quebec income tax package to calculate your federal tax only. Alberta residents mail your tax return to.

Important Tax Information And Tax Forms Camp Usa Interexchange

Important Tax Information And Tax Forms Camp Usa Interexchange

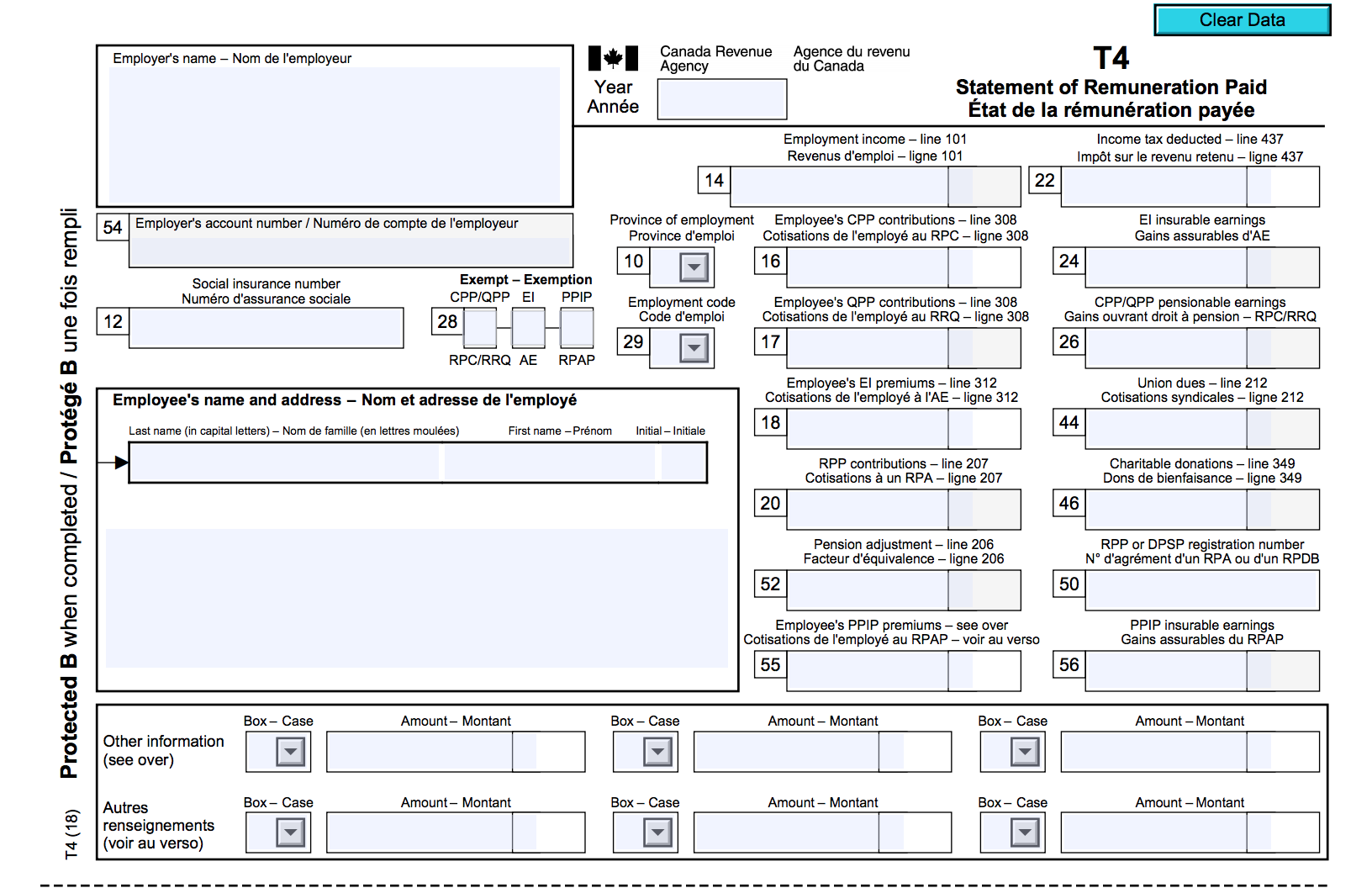

When you receive your T-5007 from WCB check your T-4 from Canada Post.

Income tax forms canada post. Get the current British Columbia General Income Tax and Benefit Package. If you cant print the forms or want to use government forms you can have them mailed to you. Schedule 5 Amounts for Spouse or Common-Law Partner and Dependants - For non-residents and deemed residents of Canada.

The post-bankruptcy tax return covers all of the tax items from the date of bankruptcy to December 31. 6 2018 CNW - Starting in January 2018 those who filed tax and benefit returns on paper last year will automatically receive the 2017 Income Tax and Benefit Guide and forms book in. Each package includes the guide the return and related schedules and the provincial information and forms.

You are filing a return for a person who died in 2020. They also have forms for prior tax years. You will also need to file a provincial income tax return for Quebec.

The Income tax package includes. View CRA page on where to mail your tax return. Post Office Box 14001.

Schedule 2 Federal Amounts Transferred From Your Spouse or Common-Law Partner - Non-Residents. The forms come with a step-by-step guide that will tell you exactly what you need to do and how to fill them out. T1 General 2020 Income Tax and Benefit Return for Non-Residents and Deemed Residents of Canada.

Download your states tax forms and instructions for free. Use the income tax package for the province or territory where the person resided at their time of death. Paper forms and return envelopes are still stocked at Canada Post outlets and Service Canada offices during tax time starting in February and through April.

TD1 Personal Tax Credits Return. For example if your amount owing to the CRA is 4500 you would make one payment of 3000 and another payment of 1500. Start a free trial now to save yourself time and money.

There may be delays because of COVID-19. Complete a TD1BC so your employer or pension administrator can calculate the taxes to deduct from your pay. This form shows the income you earned for the year and the taxes withheld from those earnings.

T88 - Mining Exploration Tax. Taxpayers who didnt file a paper return last year can download forms from the CRA and Revenu Québec for printing. For the 2020 tax year prior to filing your tax return electronically with NETFILE you will be asked to enter an Access code after your name date of birth and social insurance number.

Individuals can select the link for their place of residence as of December 31 2020 to get the forms and information needed to file a General income tax and benefit return for 2020. Employers must send you your W-2 by January 31 for the earnings from the previous calendar year of work. Order them beginning February 5 by calling us at 1-855-330-3305 be ready to give your social insurance number It can take up to 10 business days for the 2020 Income tax package to arrive by mail.

As an independent contractor youre required to complete Form T2125 Statement of Business or Professional Activities. The forms that you will need to file your tax return can be found at any Canada Post location. TD1 forms for pay received.

T2201 Disability Tax Credit Certificate. Complete these forms to apply for various personal income tax credits. If it does not wait for an amended T-4 from Canada Post before you do your income taxes.

Fill out securely sign print or email your canada authorized letter form instantly with SignNow. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Envelopes are free of charge but you must pay for postage the fee for which varies depends on how.

This is the main menu page for the T1 General income tax and benefit package for 2020. Your eight-character Access code is made up of numbers and letters and is located on the right side of your Notice of Assessment for a previous tax year. Tax packages for all years.

5000-G 5000-G-C Income Tax and Benefit Guide - All Provinces Except Non-Residents. Your tax return package will include forms for calculating your BC. An in-bankruptcy tax return covers any income from liquidated assets along with information about any of your creditors who receive a payment resulting from your companys liquidation.

Note that if the amount you owe the CRA is greater than 3000 you will need to make more than one payment to the Canada Post clerk. Schedule 6 Working Income Tax Benefit. If you choose to print and mail your federal tax return mail your return to the address based on your region of residence as specified below.

It should reflect the same amount in Box 77 of your T-4 slip. If you mailed in a paper return last year the CRA would mail you an income tax package. CRA Revenu Québec Foreign Foreign Income Foreign Investments Forms Schedules Non-Residents T2209 Tax Form.

You were a Quebec resident on December 31 2020. Available for PC iOS and Android. You can also find these forms online by going to the Canada Revenue Agencys.

The Canada Revenue Agency no longer mails out tax return packages unless requested since many more Canadians are now filing online. Most information slips must be mailed out. Canada Post Authorization Form.

Tax packages are also available for previous years. At the top of Form T2125 you enter the amount and type of income you earned such as fees and sales commission. Federal Foreign Tax Credits in Canada April 9 2021 April 9 2021.

Get Your W-2 Before Tax Time. What to do when. Order them online at canadacaget-cra-forms.

Complete a separate copy of Form T2125 for each business that you operate.

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Cra Form T2125 Everything You Need To Know Bench Accounting

Cra Form T2125 Everything You Need To Know Bench Accounting

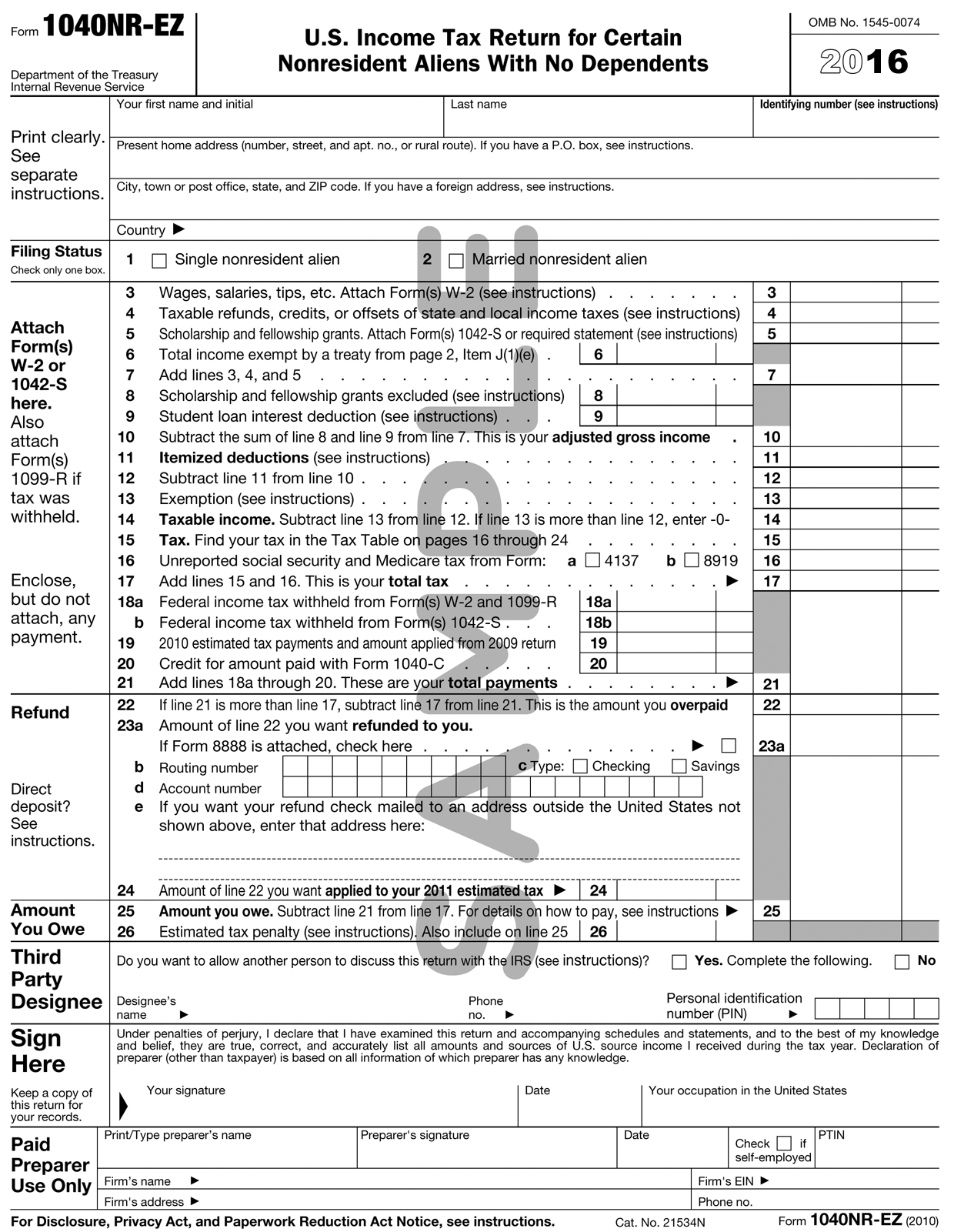

Us Tax For Nonresidents Explained What You Need To Know

5 Us Tax Documents Every International Student Should Know

Looking For The New Form 1040 Tax Forms Irs Tax Forms Income Tax

Looking For The New Form 1040 Tax Forms Irs Tax Forms Income Tax

Us Tax For Nonresidents Explained What You Need To Know

The Cra Redesigned The T1 Personal Income Tax Return Form And There Are Some Major Changes Financial Post In 2020 Income Tax Income Tax Return Tax Deadline

The Cra Redesigned The T1 Personal Income Tax Return Form And There Are Some Major Changes Financial Post In 2020 Income Tax Income Tax Return Tax Deadline

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

How Do I Get My Prior Years T4 And Or Other Tax Slips Taxwatch Canada Llp

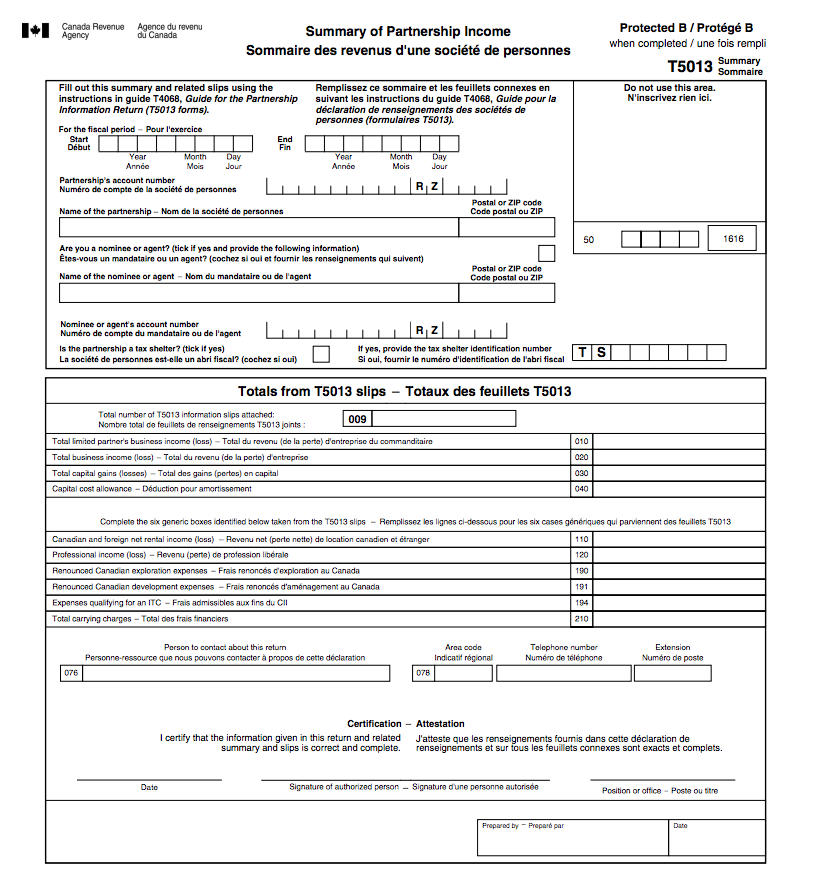

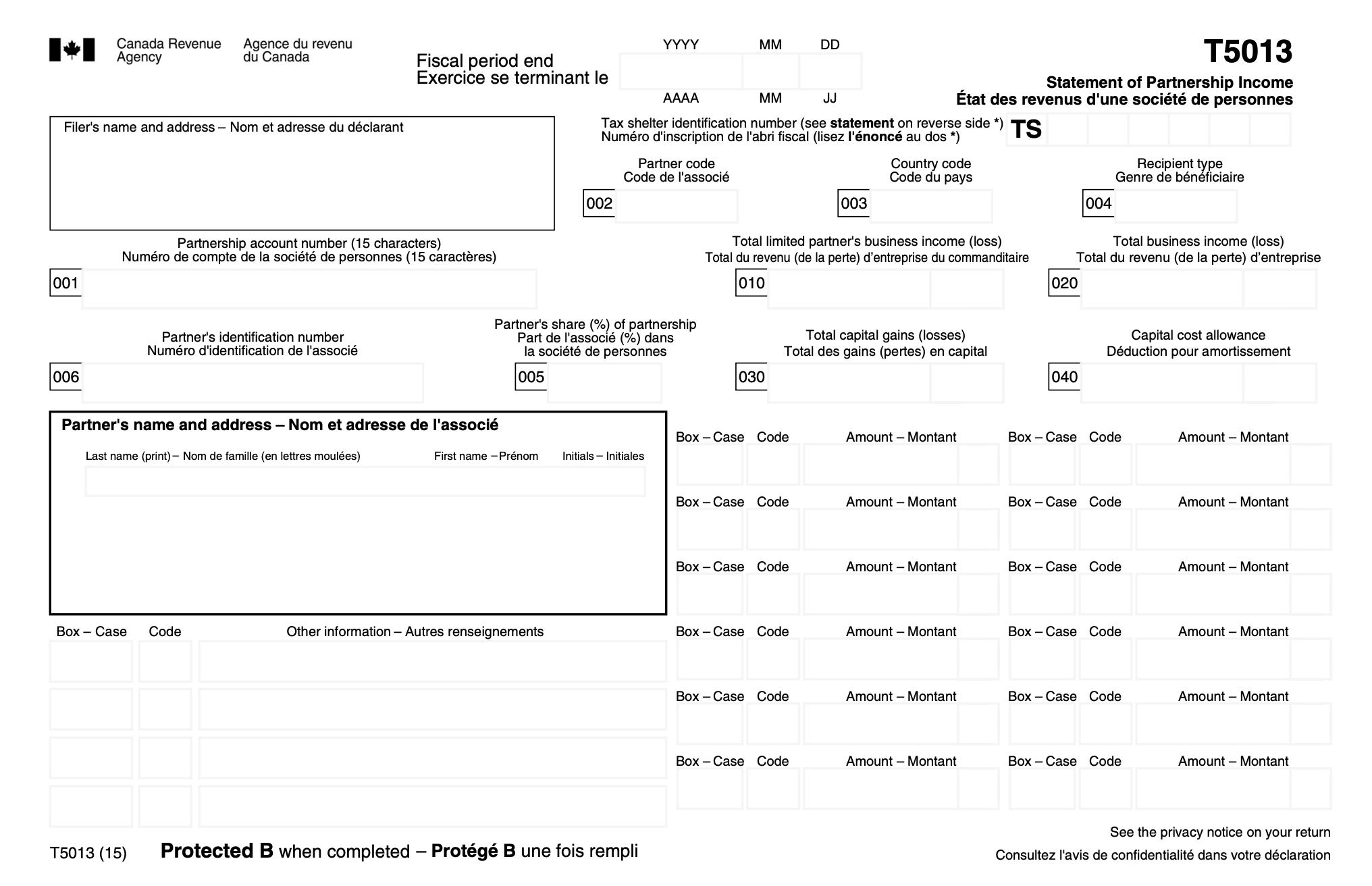

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

The Canadian Employer S Guide To The T4 Bench Accounting

The Canadian Employer S Guide To The T4 Bench Accounting