What Is W8ben Form In Upwork

Upwork is required to collect this tax and pay it. I cannot complete my profile since in the Tax Information section I do not know what to write in the field Legal name of business since I do not pay tax because I do not posses anything that is exclusivelly mine like real estate etc.

Help With Canadian W 8ben Form Upwork Community

Help With Canadian W 8ben Form Upwork Community

The US has an income tax treaty in place and FORM W-8BEN will establish your eligibility of treaty benefits.

What is w8ben form in upwork. That form is for non-US citizens Sushil. W-8BEN forms are used to certify that foreign individuals not businesses have been paid with the appropriate withholding rate. You can send a copy of the form to your non-resident alien employees but theyll need to fill it out themselves.

Go to Settings Tax Information. The form allows foreigners to claim tax treaty benefits. I am puzzled a bit with Tax Information section.

You sign electronically by submitting the form. It certifies foreign status regarding tax withholding on income. If you click on Settings under your profile picture youll be re-directed to a page where you get to provide your legal name and address which must match with your bank account details so as to avoid future payment problems.

I can see that you were already able to fill-in your tax information in the form. For record-keeping purposes Upwork requires a Form W-8BEN for all non-US. Client in order to avoid paying tax to the IRS.

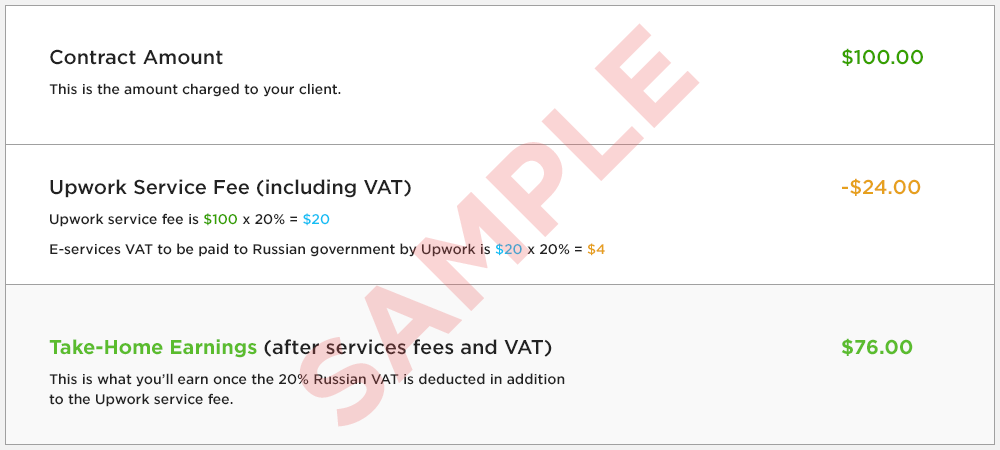

To begin with I have to point out I am not a U. Upwork charges VAT to freelancers and agencies in certain countries unless specific exemption requirements are met. Purpose of Substitute Form W-8BEN.

Once you file your Form W-8BEN the system will activate your eligibility to access funds immediately. About Form W-8 BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Individuals Give Form W-8 BEN to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding. The W-8BEN is one of the most commonly used.

Value Added Tax or VAT is a consumption tax assessed on Upworks supply of digital services. The W-8BEN is a form required by the Internal Revenue Service IRS the United States tax agency. W-8BEN does not imply that you are a taxpayer.

This form is used by a non-United States non-US person who is a beneficial owner as defined below of ADSs in order to avoid United States federal income tax backup withholding on payments made in connection with the Offer. Taxpayer and that Upwork is not required to withhold taxes from your earnings. The Form W-8BEN is a form used to confirm youre not a US.

Provide us with your. Taxpayer and that Upwork is not required to withhold taxes from your earnings. These individuals must provide a completed W-8BEN form to their US.

And therefore I have no tax return and name. Taxpayers paid on Upwork. Submit Form W-8 BEN when requested by the withholding agent or payer whether or not you are claiming a.

The Form W-8BEN is a form used to confirm youre not a US. Taxpayers paid on Upwork. Tax-free income as specified by this form includes interest dividends rents royalties and annuities.

Taxpayers paid on Upwork. All freelancers who are US persons should file a Form W-9 with Upwork all others should file a Form W-8BEN. Legal Name Your own name or your business name if youre filing as a company entity.

For record-keeping purposes Upwork requires a Form W-8BEN for all non-US. If you are a non-US person that does business in the US Form W-8BEN will establish your foreign status and allow you to claim tax exemption or reduced tax rates on US-sourced income. To provide Upwork with your Form W-9.

Form W-8BEN is a form used to confirm youre not a US. The W-8BEN form is applicable to foreign individuals and sole proprietors who earn money or income from US. W-8BEN is used by foreign individuals who acquire various types of income from US.

For record-keeping purposes Upwork requires a Form W-8BEN for all non-US. The payor also referred to as the withholding agent has the responsibility of deducting and withholding that tax from your income and paying it. Taxpayer and that Upwork is not required to withhold taxes from your earnings.

Form W8BEN US tax return and Foreign Nationals This type of non-resident tax is withheld by the source of the income or payor.

Earning In Upwork Verify Tax Info Verify Or Add W 8ben Tax Info In Upwork Theonliner4271 Youtube

Earning In Upwork Verify Tax Info Verify Or Add W 8ben Tax Info In Upwork Theonliner4271 Youtube

Freelance Web Developer Proposal Template Proposal Templates Professional Cover Letter Template Web Development

Freelance Web Developer Proposal Template Proposal Templates Professional Cover Letter Template Web Development

How To Fill Tax Form W 8ben In Upwork W 8ben Tax Information Upwork Pakistan Upwork Course Youtube

How To Fill Tax Form W 8ben In Upwork W 8ben Tax Information Upwork Pakistan Upwork Course Youtube

How To Fill W8ben Non Us Person Form Upwork Youtube

How To Fill W8ben Non Us Person Form Upwork Youtube

Upwork W 8ben Fill Out And Sign Printable Pdf Template Signnow

Upwork W 8ben Fill Out And Sign Printable Pdf Template Signnow

How To Fill Upwork W 8ben Form For Non U S Indian Taxpayers On Upwork Youtube

How To Fill Upwork W 8ben Form For Non U S Indian Taxpayers On Upwork Youtube

How To Register On Upwork Step By Step Guide With Screenshots How To Freelance

How To Register On Upwork Step By Step Guide With Screenshots How To Freelance

How To Register On Upwork Step By Step Guide With Screenshots How To Freelance

How To Register On Upwork Step By Step Guide With Screenshots How To Freelance

How To Fill Upwork W 8ben Form For Non U S Indian Taxpayers On Upwork Youtube

How To Fill Upwork W 8ben Form For Non U S Indian Taxpayers On Upwork Youtube

Getting W 8ben Tax Information While Withd Upwork Community

Getting Paid In Ukraine How To Set Up Wire Transfer

Getting Paid In Ukraine How To Set Up Wire Transfer

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

Earning In Upwork Verify Tax Info Verify Or Add W 8ben Tax Info In Upwork Theonliner4271 Youtube

Earning In Upwork Verify Tax Info Verify Or Add W 8ben Tax Info In Upwork Theonliner4271 Youtube

W 8ben Tax Information For Indian Citizens Li Upwork Community

Legal Name Of Business Upwork Community

Legal Name Of Business Upwork Community