Doordash 1099 Business Type

Typically you will receive your 1099 form before January 31 2021. Form 1099-NEC is new.

We Make Self Employment Taxes Easy Simplify Is Your Solution To Paying Self Employment Quarterly Taxes With The Fewest Tax Deadline Tax Deductions Tax Season

We Make Self Employment Taxes Easy Simplify Is Your Solution To Paying Self Employment Quarterly Taxes With The Fewest Tax Deadline Tax Deductions Tax Season

If you are a full time dasher you may have to wait for Payable to send you a 1099-K instead of a 1099-NEC.

Doordash 1099 business type. Youll receive a 1099-NEC if youve earned at least 600 through dashing in the previous year. Get cashback for gas. Need to know business code.

The most important box on this form that youll need to use is Box 7 Nonemployee Compensation. You can update your delivery preference for the 2021 tax season directly in your Payable account. A DoorDash Merchant for example would receive a 1099-K from DoorDash as DoorDash has concluded it satisfies the criteria for a TPSO.

A 1099-MISC form is used to report contractor earnings to the IRS. Doordash will send you a 1099-MISC form to report income you made working with the company. HttpsupsideapplinkY9PDJG apply for trusted gig jobs without the hassle.

This form stands for Payment Card and Third Party Network Transactions meaning that Payable will send you the 1099-K since they settle the transactions of your DoorDash. Like most other income you earn the money you make delivering food to hungry folks via mobile apps such as UberEATS Postmates and DoorDash is subject to taxes. However Im stuck in creating my account because I dont know what business type we should file as.

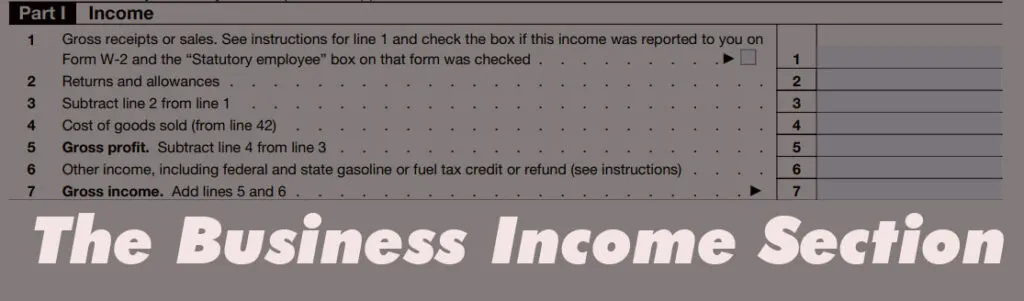

The most important box on this form that youll need to use is Box 7 Nonemployee Compensation This reports your total earnings from Doordash for last year. If Doordash was your only income for this business you would enter the earnings from your 1099 on line 1. Up to 10 cash back Best local restaurants now deliver.

The seller would also need to meet the minimum 1099-K thresholds of processing 200 transactions and 20000 in gross volume. Im a food delivery driver for DoorDash inc I pick updrop off food to people. But as you go back to filling out the form on Payable so you can get your 1099 for Instacart Doordash or any other gig companies that use them dont stress too much.

You will have to file a 1099-K instead of a 1099-NEC if you make more than 20000 in sales and have 200 or more transactions. Here are the options. Get breakfast lunch dinner and more delivered from your favorite restaurants right to your doorstep with one easy click.

If you later decide to engage in this type of activity as a business you can change to self-employment at that time. This video has been prepared for informational purposes only a. Beginning with the 2020 tax year the IRS requires DoorDash to report Dasher income on the new Form 1099-NEC instead of Form 1099-MISC.

Gig Coach Jake Consulting LLC does not provide tax legal or accounting advice. It will look like this. It will look like this.

Form 1099-NEC reports income you received directly from DoorDash ex. Lastly if you actually are in the business of delivery with several or any other vendor then include this income on the same self employment schedule since its the same type of business activity. Last year this information was reported on Form 1099-MISC box 7.

Technically according to the. Youll only get a 1099-MISC form after earning more than 600 with a company. You dont actually put any of your Doordash 1099 or from any other platforms anywhere on the form.

These items can be reported on Schedule C. Individual - Single Proprietorship - PartnerShip - LLC Single Member - LLC C Corp Tax Class - LLC - S Corp Tax Class - C Corp - S Corp - Nonprofit. What business type is DoorDash.

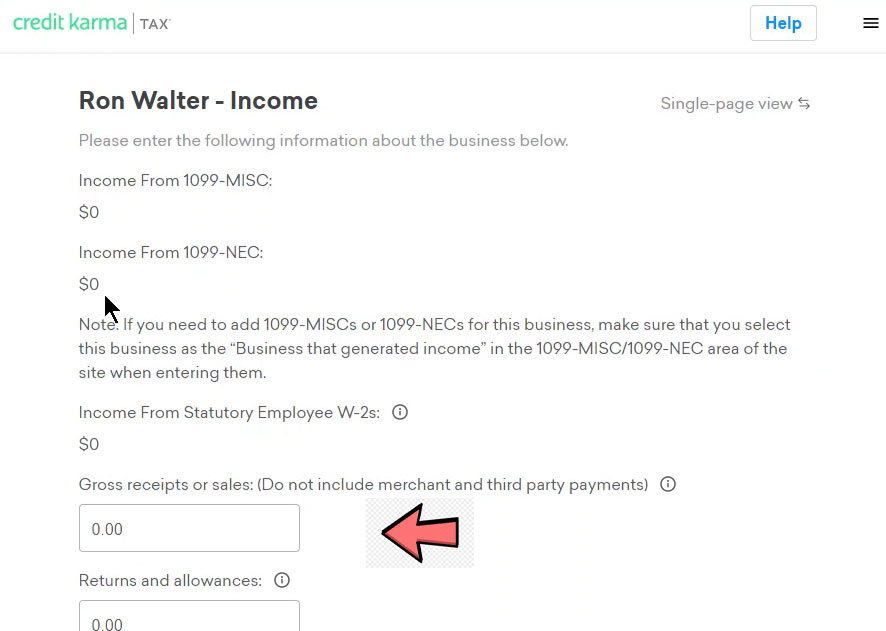

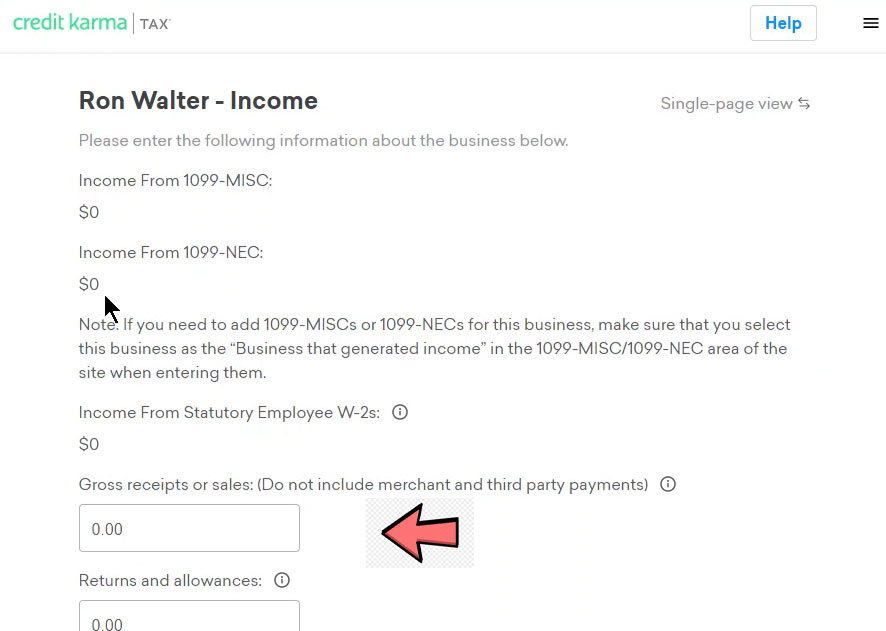

Can I change my election for delivery preference. So this is my first time filing taxes ever so I have to fill out a 1099 via payable as DoorDash has told us all. 26 March 2021 In simple terms DoorDash can be defined as an online food ordering business that was formed back in 2013 with 2021 being its eighth year since inception.

Individual or Sole Proprietor are both right answers to Business Type. Attractive pay with a side of flexibility makes on-demand food delivery an ideal way to put extra cash in your pocket. Hi this is my first time filing with a 1099 Misc.

Doordash will send you a 1099-NEC form to report income you made working with the company. Typically you will receive your 1099 form before January 31 2017. If youve received a form from Doordash that means according to their records youve earned over 600 from them.

The 1099 form is meant for the self-employed but it also can be used to report government payments interest dividends and more. If you worked multiple delivery companies you would add up all income and put it on line 1. Tax Form 1099-NEC vs 1099-K.

Incentive payments and driver referral payments. Neither do you attach your 1099 to the form.

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Doordash Taxes Schedule C Faqs For New Experienced Dashers

Doordash Taxes Schedule C Faqs For New Experienced Dashers

How To Fill Out The Schedule C

How To Fill Out The Schedule C

Business Expenses For Doordash Instacart Instacart Uber Eats Taxes

Business Expenses For Doordash Instacart Instacart Uber Eats Taxes

Learn How To Fill Out A W 9 Form Correctly And Completely

Learn How To Fill Out A W 9 Form Correctly And Completely

Business Expenses For Doordash Instacart Instacart Uber Eats Taxes

Business Expenses For Doordash Instacart Instacart Uber Eats Taxes

Doordash Taxes Schedule C Faqs For New Experienced Dashers

Doordash Taxes Schedule C Faqs For New Experienced Dashers

How To Pay Tax As An Independent Contractor Or Freelancer

How To Pay Tax As An Independent Contractor Or Freelancer

Common Mistakes On Credit Karma Free Tax Doordash Uber Eats Instacart

Common Mistakes On Credit Karma Free Tax Doordash Uber Eats Instacart

What Is Doordash Business Type Payable Email Answered Youtube

What Is Doordash Business Type Payable Email Answered Youtube

Anyone Can Type Your Income And Federal Withholdings Into Software Everyone Has A Tax Pro But Is Your Business Tax Small Business Management Financial Health

Anyone Can Type Your Income And Federal Withholdings Into Software Everyone Has A Tax Pro But Is Your Business Tax Small Business Management Financial Health

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Help With Payable Invite For 1099 Form Questions In Pic Captions Doordash

Help With Payable Invite For 1099 Form Questions In Pic Captions Doordash

Delivery Driver Log Sheet Template Good Resume Examples Resume Examples Resume

Delivery Driver Log Sheet Template Good Resume Examples Resume Examples Resume

What Is The 1099 Nec For Contractors And Freelancers

What Is The 1099 Nec For Contractors And Freelancers

There S Free And Then There S Me As Your Tax Preparer I Promise To Offer A True Concierge Tax Experience I Make I Tax Money Tax Preparation Turbotax

There S Free And Then There S Me As Your Tax Preparer I Promise To Offer A True Concierge Tax Experience I Make I Tax Money Tax Preparation Turbotax

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png) Schedule C Profit Or Loss From Business Definition

Schedule C Profit Or Loss From Business Definition