How Do You Determine If A Vendor Needs A 1099

Hi we missed sending a 1099 to a vendor do we have to send in the entire batch again or just amend the 1096 with the additional 1099. If you are in a trade or business you must prepare 1099-MISC forms to show the amounts you have paid to others during the year.

What Is A W 9 Tax Form Know Its Use Purpose Taxact Blog

What Is A W 9 Tax Form Know Its Use Purpose Taxact Blog

Go to the Workers or Payroll menu Or select Expenses and then Vendors.

How do you determine if a vendor needs a 1099. LLCs typically need a 1099-Misc unless it is taxed as an S corp or C corp. Generally if the vendor is a corporation you do NOT need to file a 1099. Persons engaged in a trade or business must file Form 1099 MISC when certain payments are made.

1099 Rules Regulations Who must file. Lastly determine if the vendor is a corporation. If you designate a supplier as a 1099 vendor the system will print a Form 1099 for the supplier as part of the 1099 batch processing that follows the end of the calendar year.

If the service providers business is incorporated you do not need to send them a 1099-NEC. Select the Contractors tab. The client also sends a copy to the IRS.

What is a 1099 Vendor. This will give you the business information needed to prepare the 1099-Misc and also indicate. A 1099 vendor is a designation listed in each of the records in the vendor master file that is part of an accounting software package.

Their email makes it way easier to send their 1099 The easiest way to get this info is to have your vendors fill out or send you a W9. Click here for a blank W9. It depends on the type of business you do and the type of vendors youre dealing with.

This form lists what theyve paid them over the course of the prior tax year. You can ask them to fill out Form W-8BEN for this purpose. Here are some guidelines to help determine if a vendor needs to be set up as a 1099 vendor.

The best way to determine this is to request a form W-9. If you have an automated system like QuickBooks or QuickBooks Online there are 1099 Summary and 1099 Detail reports. If you had designated your vendors as potential 1099 contractors when you set them up these reports would show you which vendors were paid more than 600 during the year.

Click Prepare 1099s and select Lets get started. A business does not need a 1099 if it is a C corporation. It is the onus of the business owner to determine whether a contractor or vendor is a citizen.

Typically a contractor will get Form 1099 from a client in Januarythe beginning of tax season. Each client a contractor invoices for more than 600 is required to send the contractor a Form 1099. If the provider is not a standard employee and they earned at least 600 in services during the year a 1099 form is required.

Their email makes it way easier to send their 1099 The easiest way to get this info is to have your vendors fill out or send you a W9. Click here for a blank W9. Now that you know who you need to issue 1099s to you will need some information from them.

Please tell me more so we can help you best. If You Pay A Vendor More Than 600 Or 10 In Royalties A 1099-MISC is the form any business sends anyone they pay to do a service who isnt an employee such as those loyal workers who signed a W-2 at the start of their contract and already get their taxes removed from their paychecks. 1 Operating for gain or profit A non-profit organization including 501 c3 and d organizations.

The company then sends the resulting 1099 form to the supplier which. The Accountant will know how to help. If in doubt and there are only a few cases you are wondering about then the best approach would be.

Now that you know who you need to issue 1099s to you will need some information from them. EIN or Social Security Number. Thus personal payments arent reportable.

If they are incorporated then they are exempt from receiving a 1099-MISC form unless they are a MedicalHealth provider or attorney. The IRS considers trade or business to include. If you only paid a vendor 250 in all of last year they are below the threshold and no 1099-MISC form is needed at year-end.

A 1099 is required for any worker who is not a US. If a partnership or an individual then you need to prepare a 1099. Payments to Report A Form 1099 MISC must be filed for each.

How to Determine Who Receives a 1099 The first step in determining this is to establish the relationship between the service provider and the company. A person is engaged in business if he or she operates for profit. Ensure your company name address and tax ID is correct and matches the letters from the IRS.

EIN or Social Security Number.

6 Colossal Lessons Learned From 1099 Season 5 Minute Bookkeeping

6 Colossal Lessons Learned From 1099 Season 5 Minute Bookkeeping

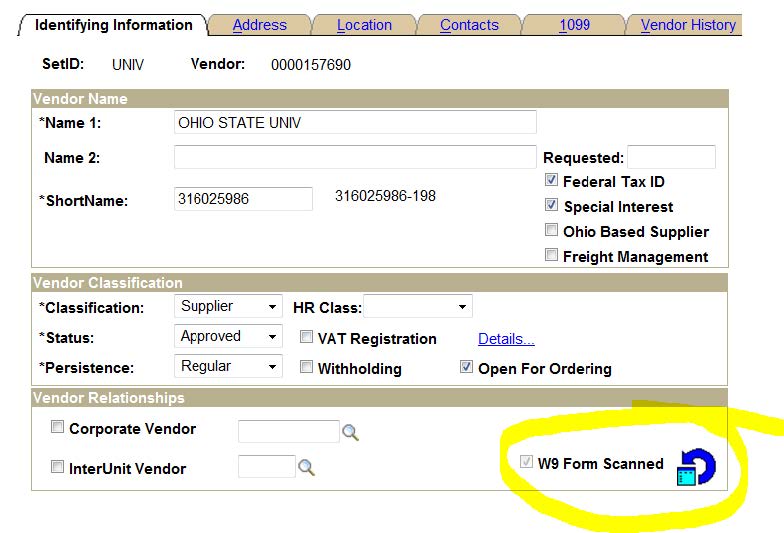

Peoplesoft 8 4 Payables Peoplebook

Peoplesoft 8 4 Payables Peoplebook

M Green Company Llp A Professional Tax And Accounting Firm In Tulare California Blog

Why Are Clients Asking For A W 9 And What The Heck Is It The Smart Keep Inc Small Business Tax Small Business Bookkeeping Small Business Finance

Why Are Clients Asking For A W 9 And What The Heck Is It The Smart Keep Inc Small Business Tax Small Business Bookkeeping Small Business Finance

2021 Irs Form 1099 Simple Instructions Pdf Download

6 Colossal Lessons Learned From 1099 Season 5 Minute Bookkeeping

6 Colossal Lessons Learned From 1099 Season 5 Minute Bookkeeping

M Green Company Llp A Professional Tax And Accounting Firm In Tulare California Blog

What Your Co Op Needs To Know About 1099 Filing

What Your Co Op Needs To Know About 1099 Filing

Getting Started In Qbonline Faq Links Quickbooks Quickbooks Online Turbotax

Getting Started In Qbonline Faq Links Quickbooks Quickbooks Online Turbotax

Frequently Asked Questions Office Of Business And Finance

Frequently Asked Questions Office Of Business And Finance

Webinar Best Practices For 1099 Compliance Including The New 1099 Nec And Updated 1099 Misc W9manager

Webinar Best Practices For 1099 Compliance Including The New 1099 Nec And Updated 1099 Misc W9manager

Who Needs To File 1099 S For Taxes Megan Naasz Entrepreneur Resources Crop Insurance Business Tips

Who Needs To File 1099 S For Taxes Megan Naasz Entrepreneur Resources Crop Insurance Business Tips

The Complete Guide To Bookkeeping For Small Business Owners Small Business Organization Small Business Finance Small Business Bookkeeping

The Complete Guide To Bookkeeping For Small Business Owners Small Business Organization Small Business Finance Small Business Bookkeeping

M Green Company Llp A Professional Tax And Accounting Firm In Tulare California Blog

The Top Seven Questions About Irs Tax Transcripts H R Block

The Top Seven Questions About Irs Tax Transcripts H R Block

1099 Rules For Landlords Money Matters All About Numbers

1099 Rules For Landlords Money Matters All About Numbers

M Green Company Llp A Professional Tax And Accounting Firm In Tulare California Blog

6 Colossal Lessons Learned From 1099 Season 5 Minute Bookkeeping

6 Colossal Lessons Learned From 1099 Season 5 Minute Bookkeeping

Am I Required By Law To Obtain Form W 9 From My Vendors

Am I Required By Law To Obtain Form W 9 From My Vendors