Itr Form For Business Owners

Eligible small business owners file this form annually to report federal income tax withheld and FICA tax Social Security and Medicare taxes on employee wages as well as calculate and report their employer Social Security and Medicare tax liability. The simplest way to file business taxes is on Schedule C E or F with your individual income tax return Form 1040.

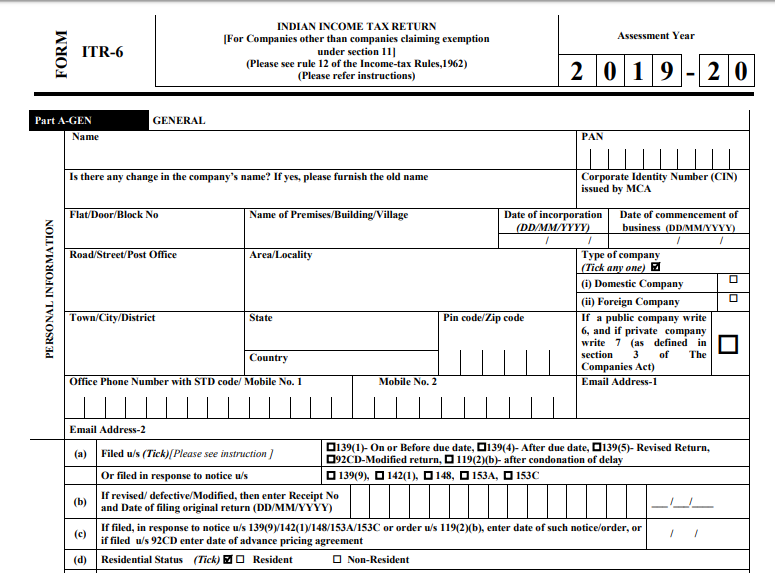

Itr 6 Itr Form 6 Meaning Due Date How To Download Paisabazaar

Itr 6 Itr Form 6 Meaning Due Date How To Download Paisabazaar

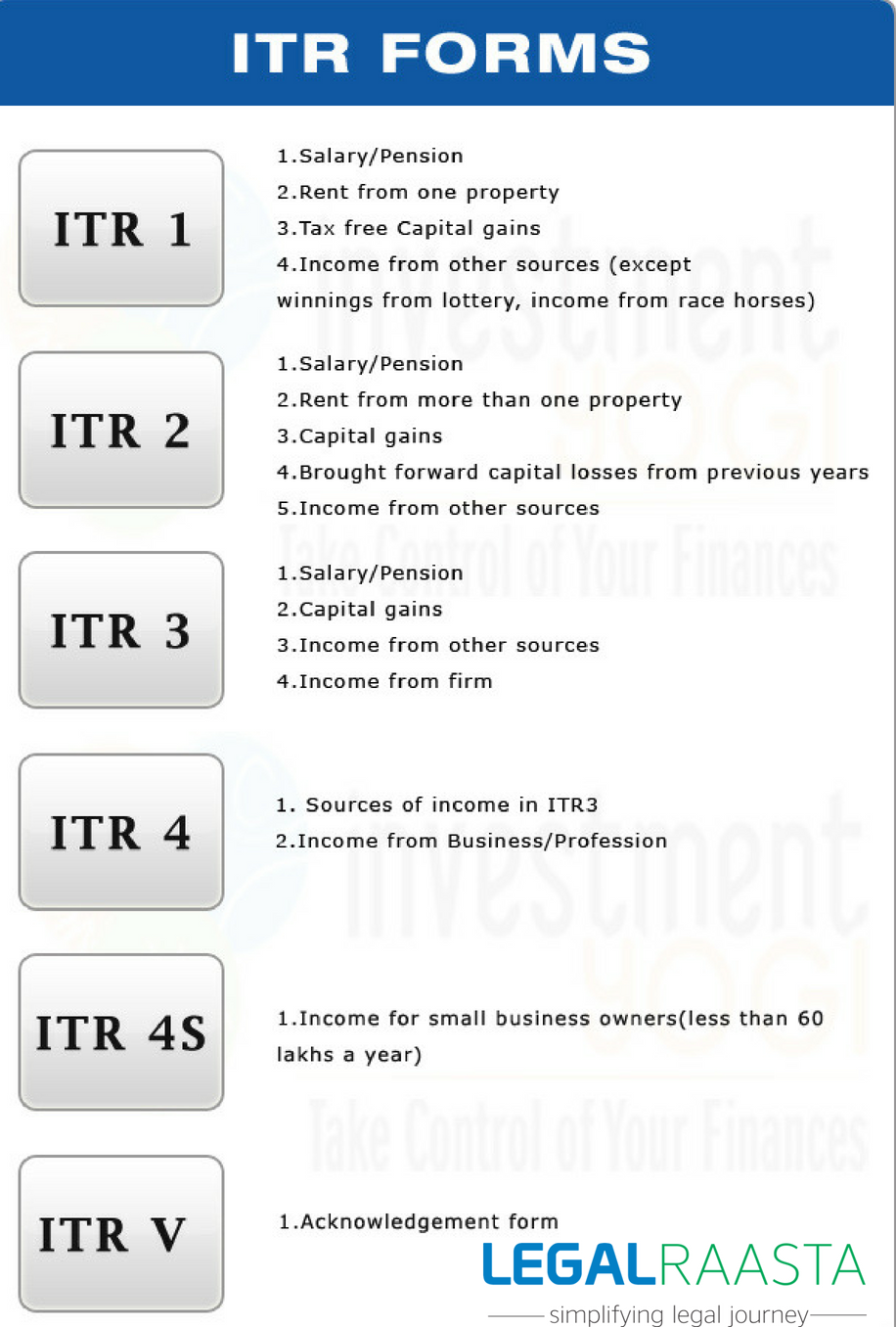

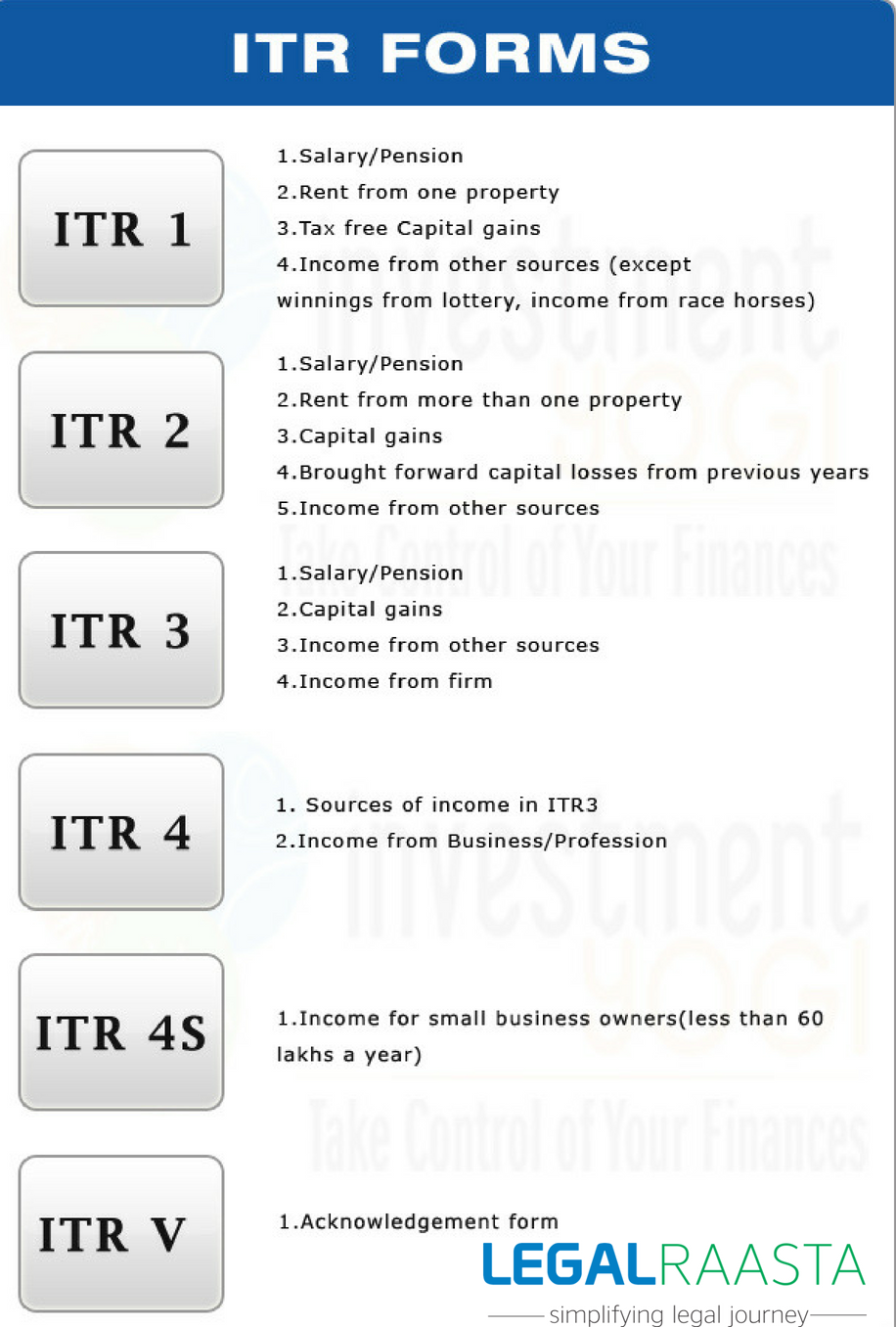

7 rows Individuals who make an income from profession and business can opt for the form.

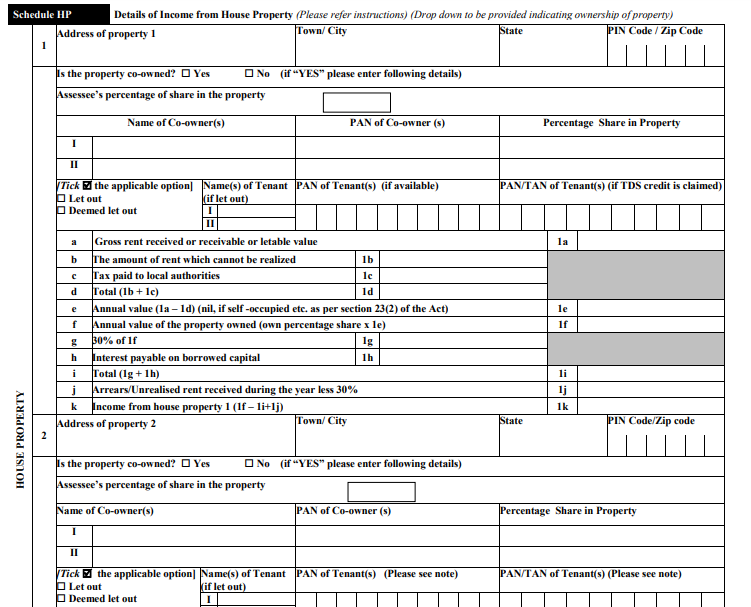

Itr form for business owners. Form 944 Employers Annual Federal Tax Return. In simple words ITR 3 needs to be filed when income is earned under the head Profit or gain of business or profession. It asks more questions and you must provide balance sheet information for the beginning and end of the tax period.

Other forms may be appropriate for your specific type of business. The ITR 4 form is for the taxpayers who have opted for the presumptive income scheme. What is ITR Form 4.

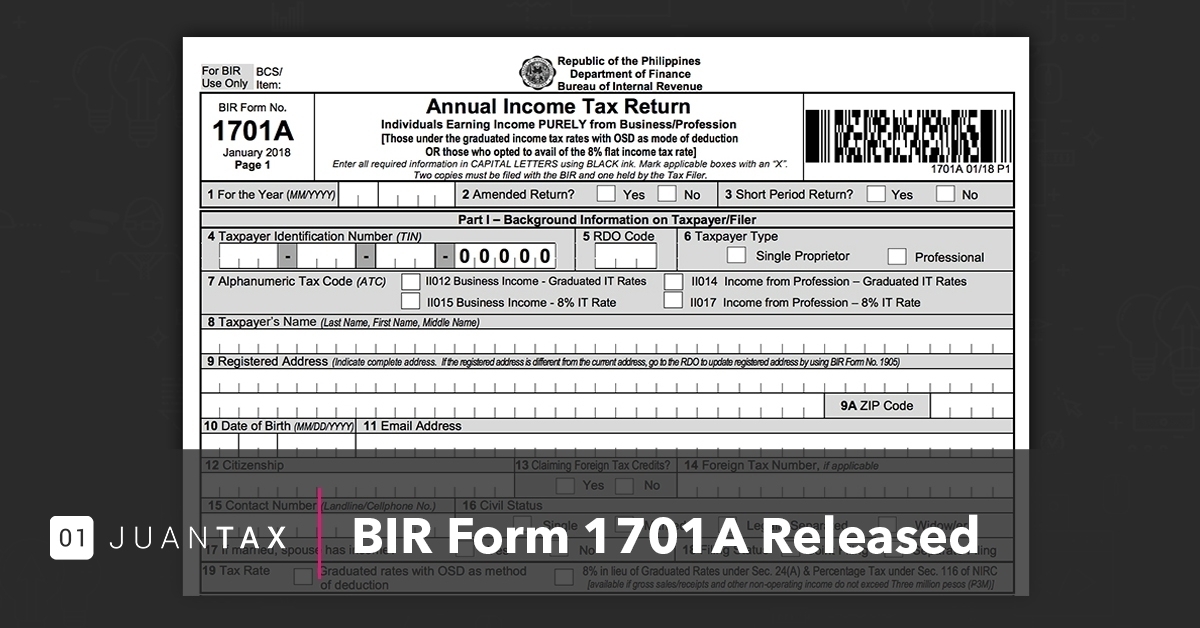

Description BIR Form No. If youve incorporated as a C corporation you will file Form 1120 for your business return. The income tax return form can only be filed when the business is having an annual turnover of less than Rs.

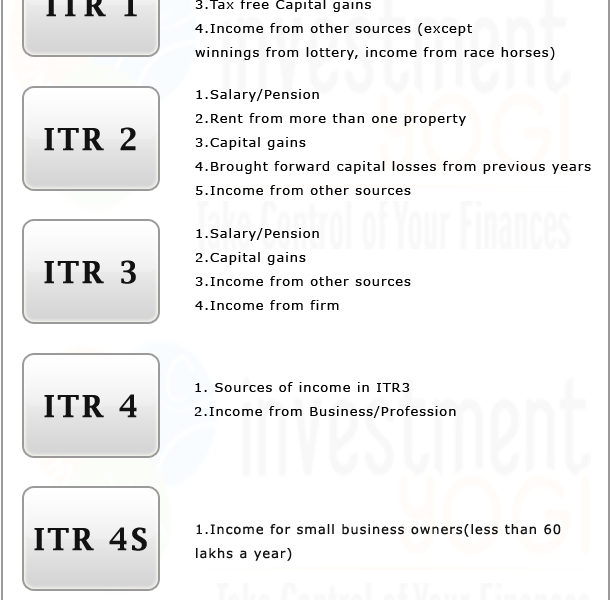

1701 shall be filed by individuals who are engaged in tradebusiness or the practice of profession including those with mixed income ie those engaged in the tradebusiness or profession who are also earning compensation income in. I will focus mainly on agency owners solopreneurs engaged in professional services and freelancers for this article. ITR-4 also called SUGAM is an income tax return form which can be filed by the businesses and professionals under presumptive taxation scheme.

Only those taxpayers can file ITR-4 whose total gross receipts total receipts from all clients including the foreign clients are less than Rs. The list should not be construed as all-inclusive. Its a simple tax return form for the business owners and professionals who dont want to get into the complexities of the income tax law.

This includes sole proprietors and single-member LLC owners. For individuals who have mixed-income or are self-employed the ITR Form that you will need to accomplish is BIR Form 1701. The Sugam or ITR 4S form is available for taxpayers who are individuals HUF members or business owners with a presumptive salary pension or business income in addition to income from a property as well as income from other sources for IT returns.

File Schedule C if you are a sole proprietor. This form needs to be filled by business enterprises only if their turnover is. As per the Section 44 AD Section 44 ADA and Section 44 AE of the Income Tax Act a tax- payers are eligible to opt for presumptive income scheme as per their business requirement or the form of business.

The ITR-4 Form is the Income Tax Return form for those taxpayers who have opted for the presumptive income scheme as per Section 44AD Section 44ADA and Section 44AE of the Income Tax Act. Its for small businesses filing their tax returns on Schedule C with their personal returns Form 1040. If the turnover is more than Rs.

Form 1120 is a little more involved than a Schedule C. This section provides links to a variety of forms that businesses will need while filing reporting and paying business taxes. How Business Owners Can Fill Income Tax Return.

For instance a doctor a lawyer or a shopkeeper. Understanding Form ITR- 4 SUGAM. Form 1120 is not filed as part of your personal income tax return.

Our panel of competent. If your business income is from rents or royalties prepare Schedule E. Online Filing of Income Tax Return Form 1 ITR Form-1 through DigitalFilings with Income Tax Expert support.

You should consult the instructions for each form for any related forms necessary to file a complete tax return. Schedule F is for farmers or fishermen. ITR 4 Form.

ITR-4 is the answer to all your tax concerns. File your Income Tax Return Online. Proficient partners thoroughly understands the business specific regulatorylegal requirements and is focused to assist business owners at every stage of their venture.

It is also filed when Tax Audit is. An income tax return ITR is a form that taxpayers file with the BIR to report their income expenses and other important information such as tax liability and any refund for excess payment of taxes. ITR-3 can be used by an individual or a HUF who has income from a profession or a business.

ITR 3 form means having income from business or Profession and from partnership firmLLP for individual or HUFs. 2 crores then ITR form 2 is filled.

Itr 7 Form Filing Income Tax Return Indiafilings

Itr 7 Form Filing Income Tax Return Indiafilings

Changes In Itr Forms As On 9th August Online Learning Legal Raasta

Changes In Itr Forms As On 9th August Online Learning Legal Raasta

10 Changes In Itr 1 Filing In 2019 Income Tax Tax Refund Dividend Income

10 Changes In Itr 1 Filing In 2019 Income Tax Tax Refund Dividend Income

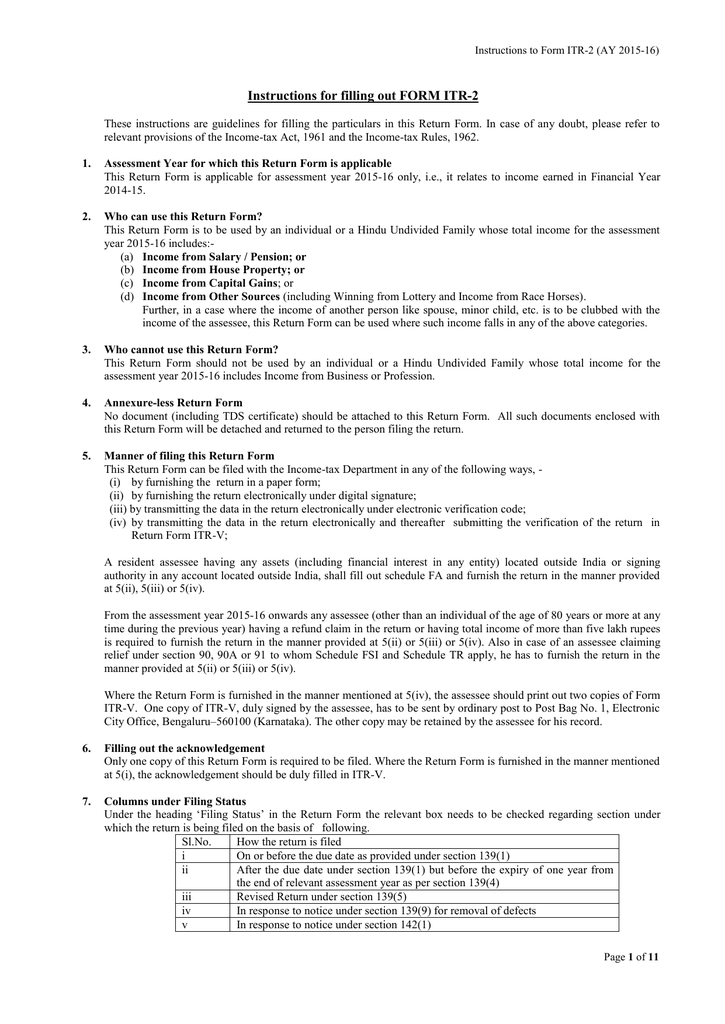

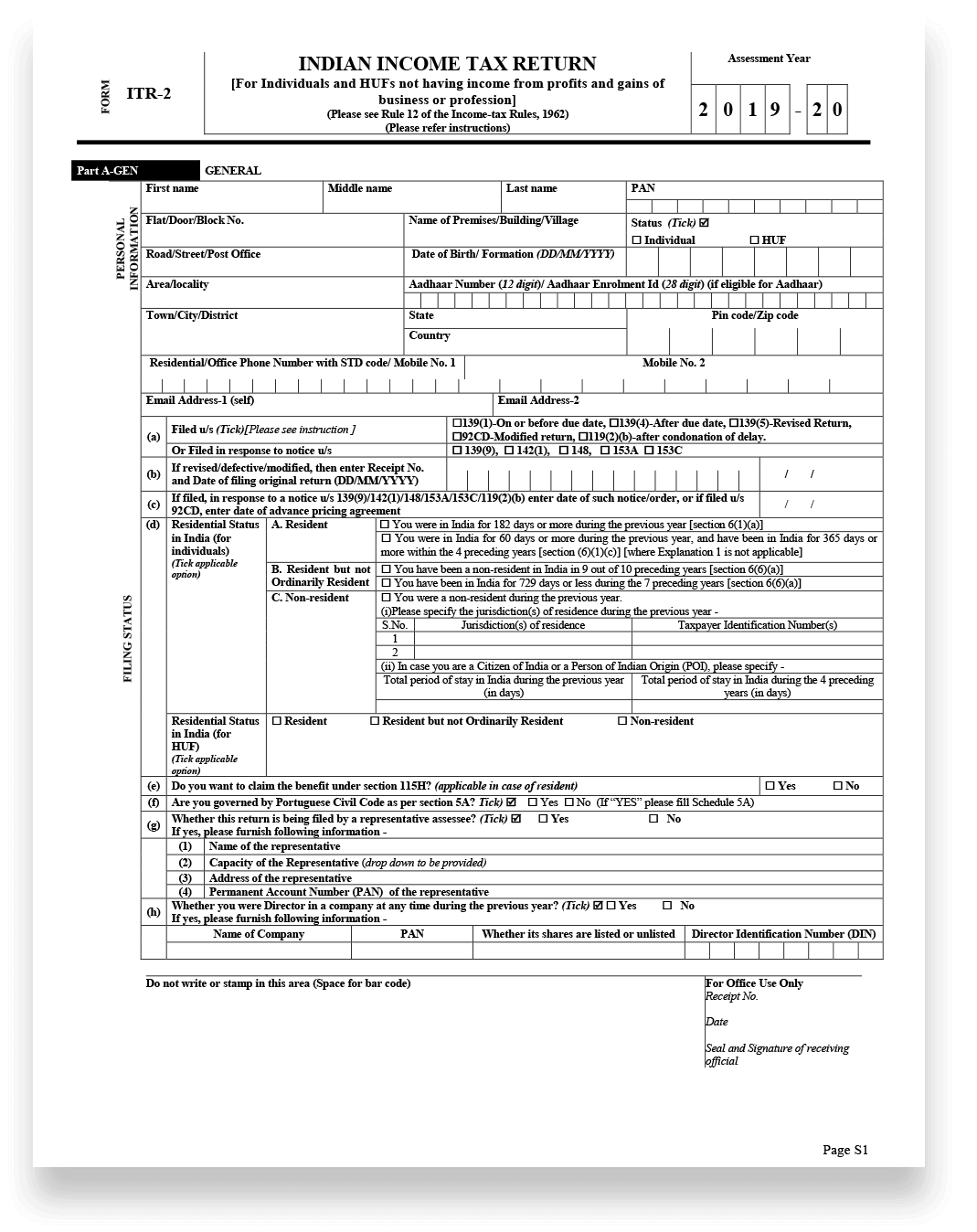

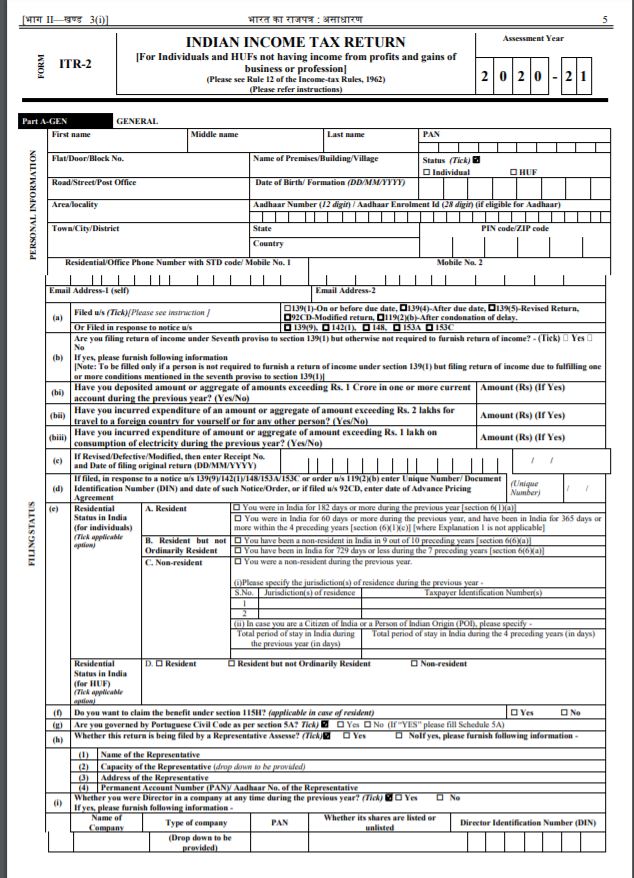

Instructions For Filling Out Form Itr 2

Instructions For Filling Out Form Itr 2

Itr 4 Sugam The Itr Form Now Available For E Filing At Income Tax Portal

Itr 4 Sugam The Itr Form Now Available For E Filing At Income Tax Portal

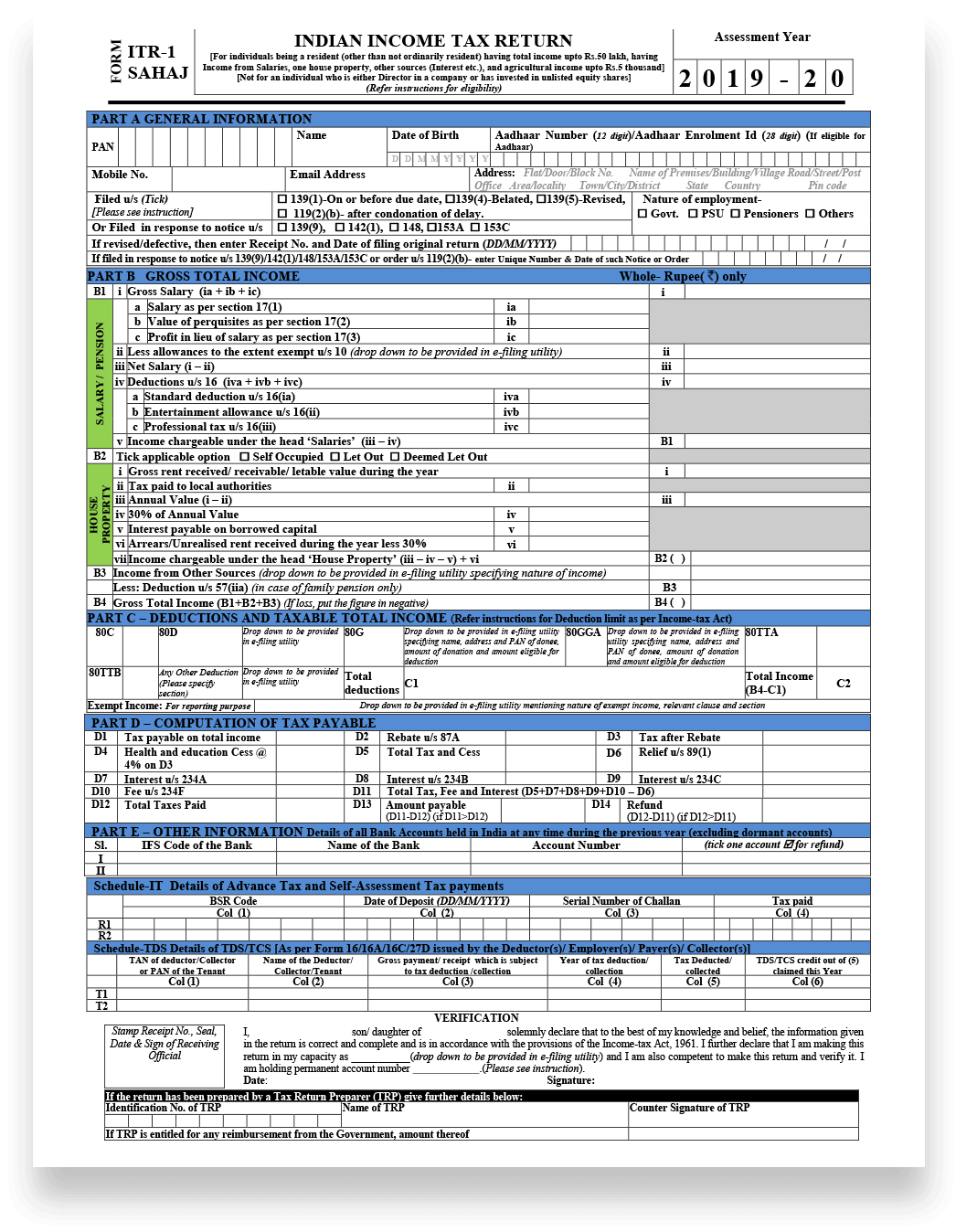

Income Tax Return Itr 1 Filing Form How Do I File My Itr 1 Form

Income Tax Return Itr 1 Filing Form How Do I File My Itr 1 Form

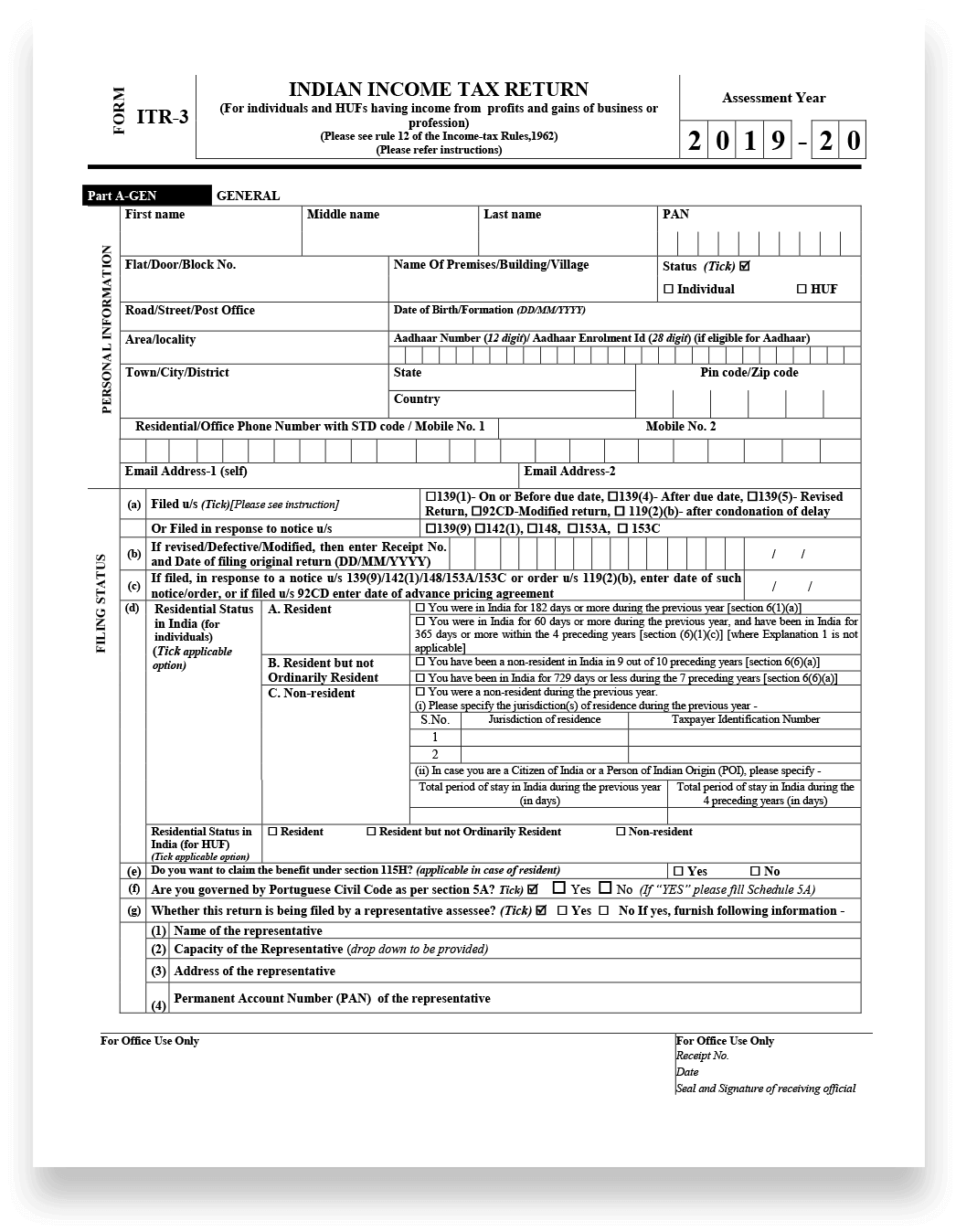

Income Tax Return Itr 3 Filing Form How Do I File My Itr 3 Form

Income Tax Return Itr 3 Filing Form How Do I File My Itr 3 Form

What Is Itr 7 Form How To File Itr 7 Form Tax2win

What Is Itr 7 Form How To File Itr 7 Form Tax2win

Itr Forms Simplified New Deadline Aug 31

Itr Forms Simplified New Deadline Aug 31

Income Tax Return Itr 2 Filing Form How Do I File My Itr 2 Form

Income Tax Return Itr 2 Filing Form How Do I File My Itr 2 Form

Online Filing Of Income Tax Return Itr Form 2 Digital Filings

Online Filing Of Income Tax Return Itr Form 2 Digital Filings

Income Tax Return Filing Itr Form 1 And 4 For Ay2020 21 Released Check Details

Income Tax Return Filing Itr Form 1 And 4 For Ay2020 21 Released Check Details

Baba Taxcorp Tax Soultion Services

Income Tax Return Fill Online Printable Fillable Blank Pdffiller

Income Tax Return Fill Online Printable Fillable Blank Pdffiller

File Itr 2 Income Tax Return Online Learn By Quicko

File Itr 2 Income Tax Return Online Learn By Quicko

Itr 6 Itr Form 6 Meaning Due Date How To Download Paisabazaar

Itr 6 Itr Form 6 Meaning Due Date How To Download Paisabazaar

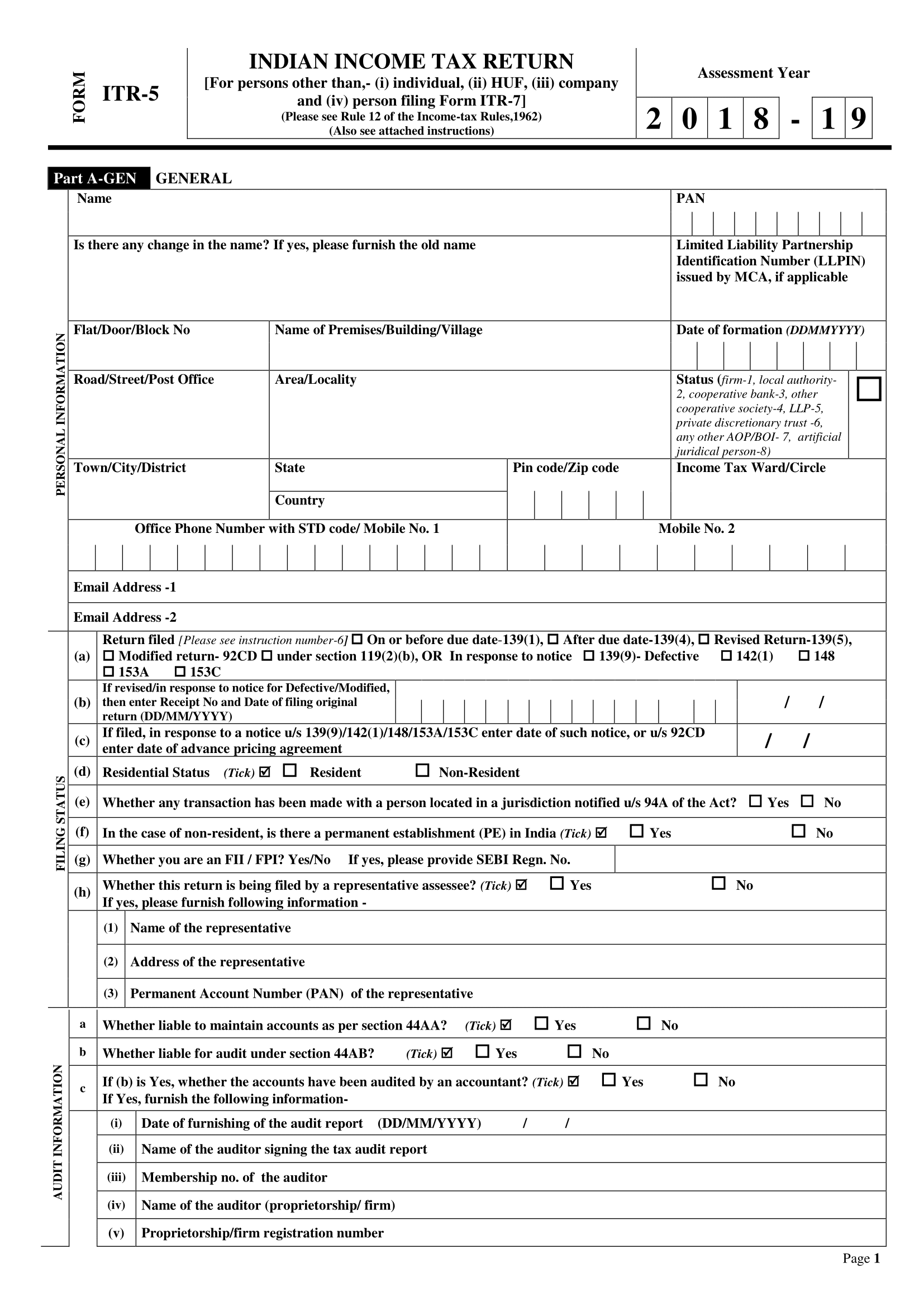

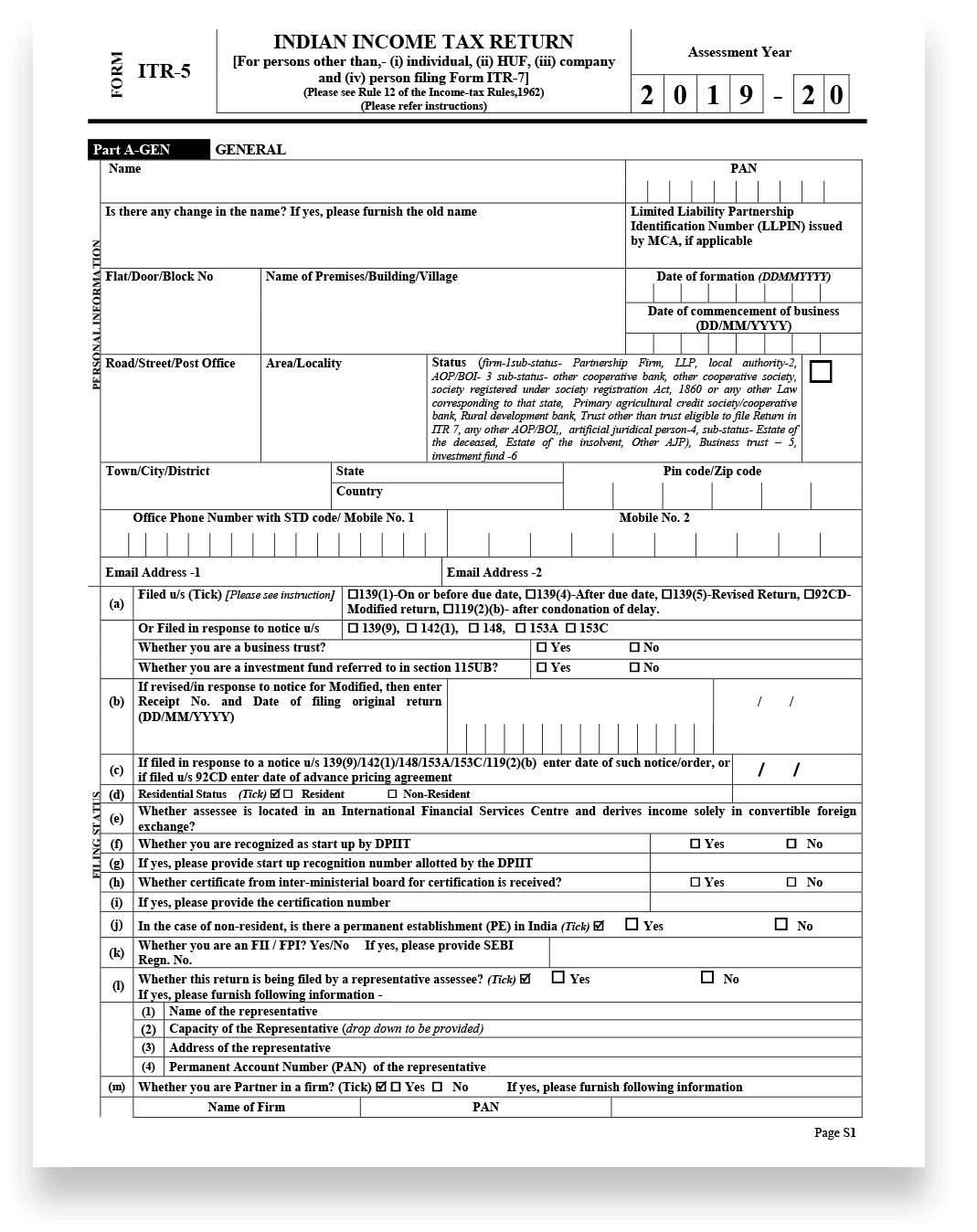

Income Tax Return Itr 5 Filing Form How Do I File My Itr 5 Form

Income Tax Return Itr 5 Filing Form How Do I File My Itr 5 Form