What Is A Payroll Register In Quickbooks

If the Payroll Register Quickbookss are straightforward to read and perceive then this makes the job of the guide keeper or the accountant simpler. Choose how youd like your columns to be viewed by by employee weekly bi.

Go to the Reports menu.

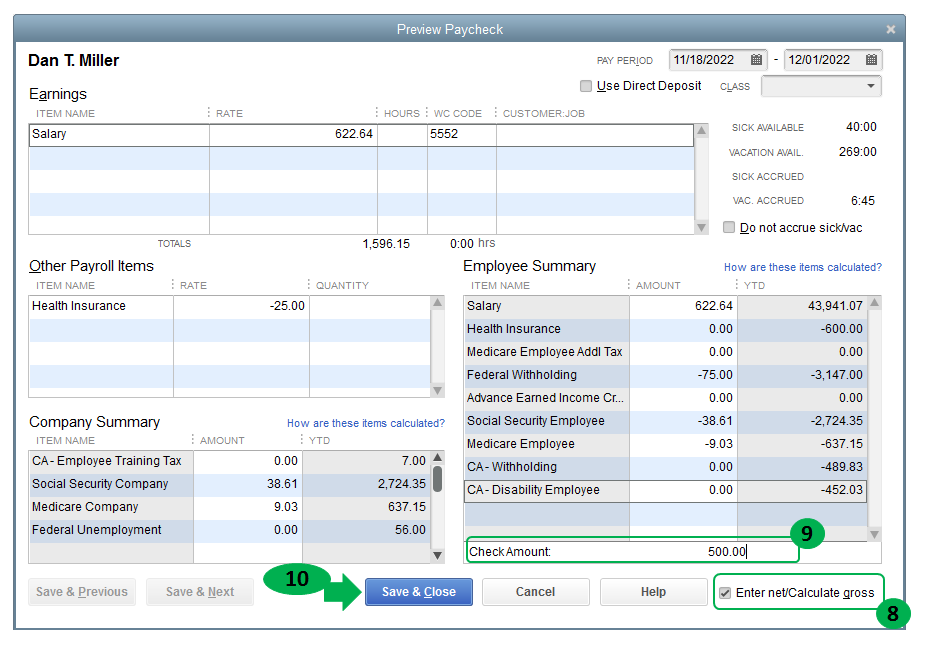

What is a payroll register in quickbooks. The payroll register report is created at the end of the payroll process. A payroll register is a spreadsheet that lists the total information from each payroll. Linked to the general ledger accounts for the various types of labor the payroll items on the paycheck function to post the labor costs to the appropriate general ledger accounts.

Also how do I use STP in QuickBooks. An improvement for payroll processors who want to set up a payroll liability payment due reminder using a calendar application. Most payroll and accounting solutions make it easy to create and run various payroll reports.

That is to extend the method potential of the paperwork. It looks like a checkbook register with one line devoted to each item. When a payroll is posted in Quickbooks it creates a paycheck which contains payroll items.

Sign in to your QuickBooks account. A payroll register is a record of all pay details for employees during a specific pay period. If you may write a letter in Word then you may make a template.

Payroll register quickbooks Receiving the Very Best Letter Templates Printable You should customize the resume along with cover letter based upon your requirements. Total gross pay the total of each type of deduction and total net pay are set out in a payroll register. Be aware the bigger type for your very first letter creates another distance between the first and second lineup.

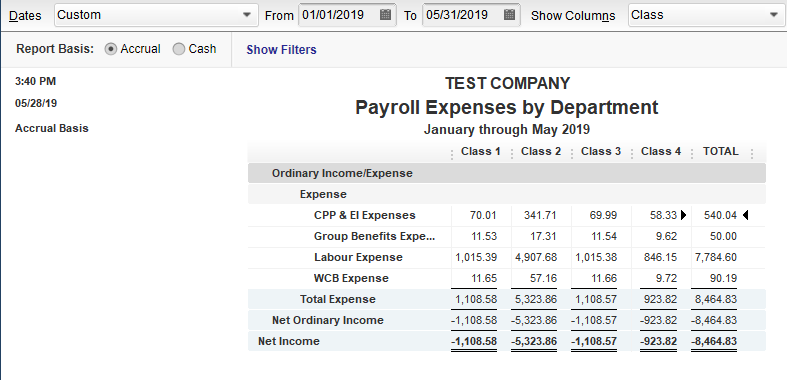

A particular company would usually observe a continuing sample of those Payroll Register Quickbookss. QuickBooks offers a collection of payroll reports that generate a wealth of information about a companys employees and expenses. The payroll register lists information about each employee for things such as gross pay net pay and deductions.

Payroll information for a pay period has been entered. Youll be able to view for example its Type any Limit imposed the Payable To name and Tax Tracking designations. Run a Payroll Tax and Wage Summary report.

If you have any troubleshooting issues check out the QuickBooks Payroll Help Centers or call QuickBooks payroll support directly. Dont forget to check out the rest of our QuickBooks Desktop Pro 101 Series to learn how to export files create a budget use direct deposit write and print payroll checks and more. A payroll register is a record of all pay details for employees during a specific pay period.

Select Reports then choose Standard then select Payroll. The hourly rate or salary you pay each employee along with any bonus or. Creating a PPP payroll report using payroll or accounting software.

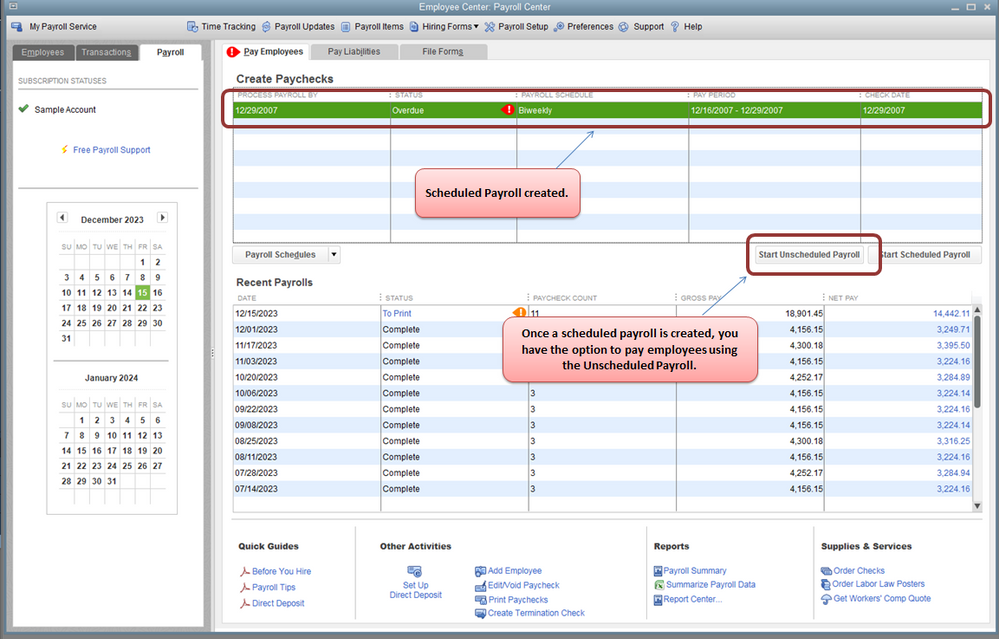

Review and create paychecks. The payroll register lists information about each employee for things such as gross pay net pay and deductions. How do I run a wage report in QuickBooks.

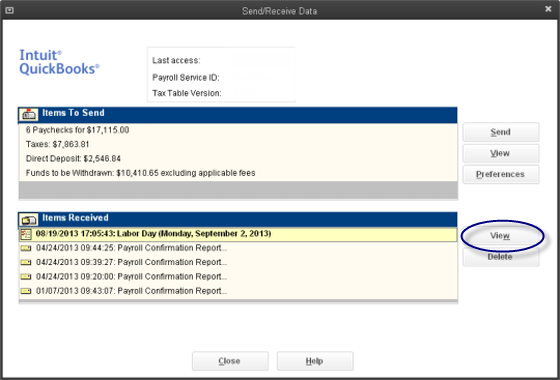

Payroll Liability Reminders. CPA Tyler McBroom breaks down the essential components that go into keeping payroll calculating payroll processing payroll for your business. The simplest way to think of your payroll register is as a checkbook register.

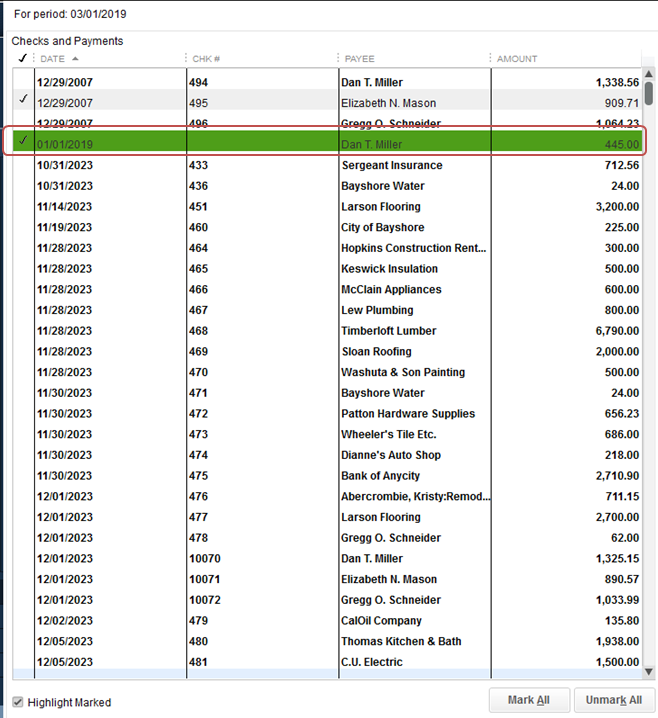

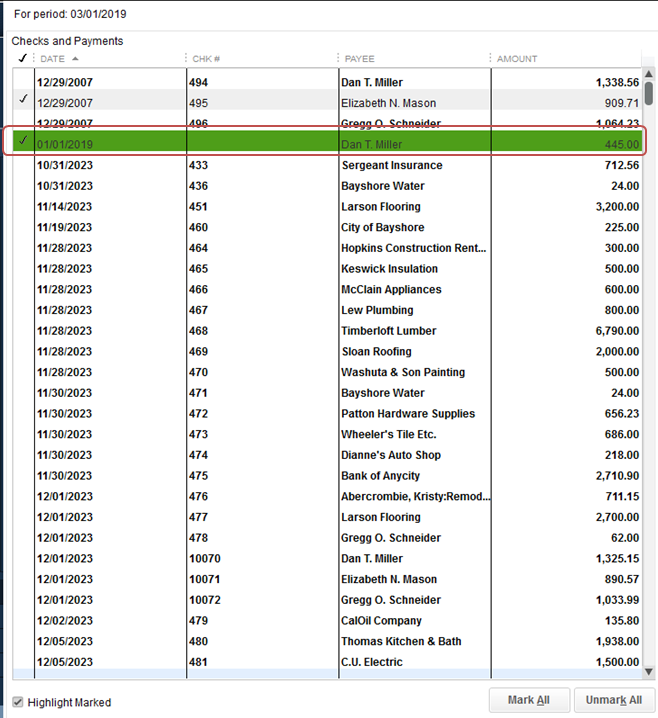

Assuming you have a designated account from which wages are drawn each pay period which you should the payroll register includes line items for all deposits withdrawals each paycheck printed tax liabilities withheld from employee checks employer contributions to Medicare and the like as well as the rolling. The window that opens contains a list of the Payroll Items you created. Employee Information Items Youll Use to Enter Data in QuickBooks Payroll.

What is the next step in the paycheck creation process-Click Help-Click Info button. Select Enable Single Touch Payroll. Find the Payroll section then Payroll Summary by Employee.

The register also lists the totals for all employees combined during the period. QuickBooks Online Payroll. Which are two ways to bring up the description of a report.

Quickbooks handles the labor distribution when it runs a payroll. In the Payroll section select Payroll. These reports can provide information about general staff or about individual employees and can.

The calculations for each individual employee for total gross pay. QuickBooks users can decide to create a calendar reminder using the calendar app installed locally or they may download a calendar file that can be imported into a calendar. How to switch on STP in QuickBooks.

Simply set a date range select the employees you want to include in your report and generate the report. Select the single employee or group of employees. Set a date range from the dropdown.

Upon hiring a new employee you need to have them complete a W-4 form which will provide you with their withholding info and other pertinent info you need in order to correctly calculate their payroll tax deductions. The payroll software provides a system to personally process employee payroll and manage taxes. Which are three steps to running payroll in Quickbooks 2017.

It shows the gross and net pay for each employee and each of the payroll. Select Employees and sign up to KeyPay our integrated payroll partner Select Payroll settings then Electronic lodgment and STP.

What If Quickbooks Payroll Taxes Are Not Computing Insightfulaccountant Com

What If Quickbooks Payroll Taxes Are Not Computing Insightfulaccountant Com

Manual Payroll In Quickbooks Desktop Us For Job Costing Youtube

Manual Payroll In Quickbooks Desktop Us For Job Costing Youtube

How To Enter Payroll Into Quickbooks Summary Youtube

How To Enter Payroll Into Quickbooks Summary Youtube

Payroll Errors Most Common Quickbooks Accounting Mistakes

Quickbooks Payroll Tip Tracking Employee Advances Or Loans Quickbooks For Contractors Blog

Quickbooks Payroll Tip Tracking Employee Advances Or Loans Quickbooks For Contractors Blog

View And Print Past Payroll Confirmation Reports

View And Print Past Payroll Confirmation Reports

Enter Adp Payroll In Quickbooks Quickbooks Tutorial