How Much Does It Cost To Register A Business Name In Indiana

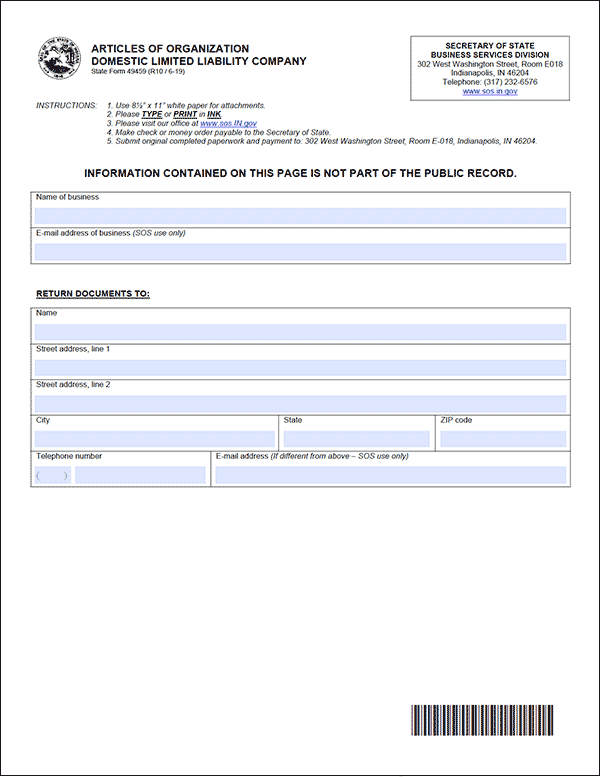

50 by mail or 31 online every 2 years. Once filed with the state this document formally creates your Indiana LLC.

How Much Does It Cost To Trademark A Business Name Legalzoom Com

How Much Does It Cost To Trademark A Business Name Legalzoom Com

95 Online 100 by Mail In Person.

How much does it cost to register a business name in indiana. To do so in Indiana you must register your assumed name with the Indiana Secretary of State. Indiana does not provide an option to register a vehicle by mail. The articles cost a minimum of 9650.

How much does a DBA cost in Indiana. 100 by mail or 95 online one-time fee Business entity report. Once filed your business name will be reserved in Indiana for 120 days.

Failure to do so may result in a civil action being filed against you. Corporations and Limited Liability Companies will be charged 20 when filing online or. You can renew the name reservation once it expires but not for consecutive 120-day periods.

In order to form an LLC in Indiana youll be required to file the Articles of Organization with the Secretary of State Business Services Division. The acceptance of a trademark filing by the Indiana Secretary of State does not establish rights to the mark. The filing cost is 1000.

How much does it cost to start an LLC in Indiana. You can file for an Indiana name reservation and any number of extensions by completing an online application via Indianas INBiz website and paying the 20 filing fee. Fees to Trademark a Business Name When filing an application to trademark your business name on a federal level through the USPTO you should count on paying between 250 and 750.

However you can mail in your Application for Certificate of Title Form 205 to title the vehicle from out of state. The filing fee to form a corporation in Indiana is between 85 and 95. Once the vehicle is titled you can then register the vehicle using the online registration process.

A name may be reserved up to 120 days. Professional business formation service recommended. If you conduct business as an individualsole proprietor association or general partnership under an assumed name many banks and lenders require you to file a Certificate of Assumed Business Name or Doing-Business-As DBA formThe document must be notarized meet recording requirements and include the correct fee in order to be recorded.

Pre-requisites outlined by the Division of Corporations must be met when filing a DBA to secure a trade name. Each year youll also be required to pay 50 or 32 with your annual report depending on whether you file via mail or online. Bear in mind that an Indiana complainant may recover treble damages or profits 3 times.

The fee for filing your Articles of Organization is 100 95 if submitted online the optional name reservation fee is 20. All applications must be filed in duplicate. The filing fee is 20 30 for filings by mail.

Appoint a registered agent choose a name for your business and file Articles of Incorporation with the Business Services Division. The cost of the initial registration of an LLC or. The filing fee for Sole Proprietorships and Partnerships to register for a Certificate of Assumed Name varies by county is generally around 25.

Also there is no self-employment tax with a corporation as income to the owner s will come from either a salary or dividends which may be beneficial. 1 Appoint a Registered Agent. The state of Indiana charges a 95 fee or 100 if filed by mail or in person fee to process and record this document.

How to Incorporate in Indiana To start a corporation in Indiana youll need to do three things. You may register online or by postal mail by filing a Certification of Assumed Business Name. The Articles of Incorporation must be filed with the Indiana Secretary of State Business Services Division.

51 rows Indiana Business Registration Fees. You can file this document online or by mail. To register to do business in Indiana visit the.

According to the USPTO website the trademark fees youll pay depend on. You may file a name reservation application with the Secretary of State online or by mail along with the required filing fee which is about 20. File state documents and fees In most cases the total cost to register your business will be less than 300 but fees vary depending on your state and business structure.

The number of trademarks you seek. New and Small Business Education Center Learn about state laws the tax-filing process and what services are available to help you as your business evolves. Indiana LLC costs.

Indiana Filing Fee. The articles cost 100 to submit the paper form or 98 to file online includes a 3 processing fee. Use Indianas one-stop resource for registering and managing your business.

How To Search Available Business Names In California Startingyourbusiness Com

How To Search Available Business Names In California Startingyourbusiness Com

How To Search Available Business Names In Michigan Startingyourbusiness Com

How To Search Available Business Names In Michigan Startingyourbusiness Com

How To Search Available Business Names In Florida Startingyourbusiness Com

How To Search Available Business Names In Florida Startingyourbusiness Com

How To Search Available Business Names In Michigan Startingyourbusiness Com

How To Search Available Business Names In Michigan Startingyourbusiness Com

File With The Secretary Of State Inbiz

File With The Secretary Of State Inbiz

Indiana Registered Agent Service We Beat Any Price Registered Agent Limited Liability Company Business Articles

Indiana Registered Agent Service We Beat Any Price Registered Agent Limited Liability Company Business Articles

How To Search Available Business Names In Texas Startingyourbusiness Com

How To Search Available Business Names In Texas Startingyourbusiness Com

Cost To Register Your Business Name Business Names Names Business

Cost To Register Your Business Name Business Names Names Business

How To Search Available Business Names In Florida Startingyourbusiness Com

How To Search Available Business Names In Florida Startingyourbusiness Com

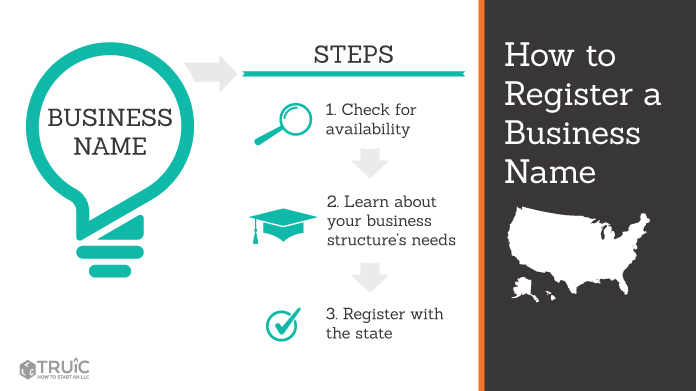

How To Register A Business Name

How To Register A Business Name

How To Search Available Business Names In California Startingyourbusiness Com

How To Search Available Business Names In California Startingyourbusiness Com

How To Search Available Business Names In Georgia Startingyourbusiness Com

How To Search Available Business Names In Georgia Startingyourbusiness Com

How To Search Available Business Names In Michigan Startingyourbusiness Com

How To Search Available Business Names In Michigan Startingyourbusiness Com

Business Name How To Name A Business

Business Name How To Name A Business

How To Search Available Business Names In Georgia Startingyourbusiness Com

How To Search Available Business Names In Georgia Startingyourbusiness Com

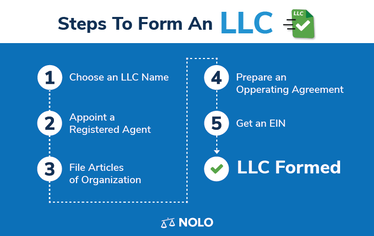

How To Form An Llc In Oklahoma Oklahoma Llc Nolo

How To Form An Llc In Oklahoma Oklahoma Llc Nolo

Llc Indiana How To Start An Llc In Indiana Truic Guides

Llc Indiana How To Start An Llc In Indiana Truic Guides

How To Search Available Business Names In California Startingyourbusiness Com

How To Search Available Business Names In California Startingyourbusiness Com

How To Search Available Business Names In Michigan Startingyourbusiness Com

How To Search Available Business Names In Michigan Startingyourbusiness Com