How To Get 1099 G Virginia

Virginia Relay call 711 or 800-828-1120. 1099-G Tax Form Published on Virginia Employment Commission httpswwwvecvirginiagov 1099-G Tax Form 1 The 1099-G tax form is commonly used to report unemployment compensation.

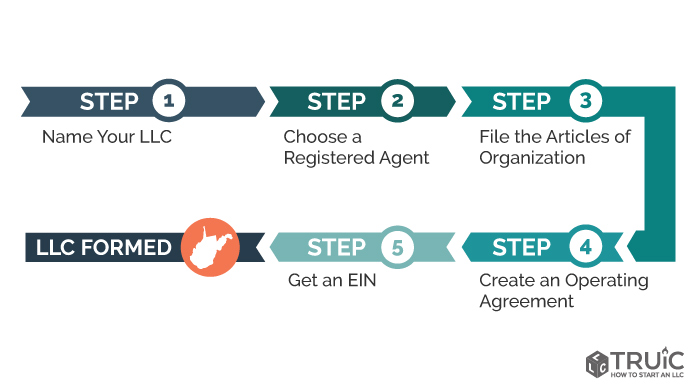

West Virginia Llc How To Form A West Virginia Llc Truic Guides

West Virginia Llc How To Form A West Virginia Llc Truic Guides

This 1099-G does not include any information on unemployment benefits received last year.

How to get 1099 g virginia. The 1099-G tax form is commonly used to report unemployment compensation. If youre owed one you should receive your 1099-G by January 31 giving you plenty of time to complete your taxes by Tax Day typically April 15. In Virginia unemployment benefits are not considered taxable income on your state return.

Instructions for the form can be found on the IRS website 2. You will be mailed a statement Form 1099-G of benefits paid to you during the year. To quickly get a copy of your 1099-G or 1099-INT simply go to our secure online portal MyTaxes at httpsmytaxeswvtaxgov and click the Retrieve Electronic 1099 link.

Request Your 1099 By Phone To request a copy of your 1099-G or 1099-INT by phone please call 304 558-3333. Request Your 1099 By Phone To request a copy of your 1099-G or 1099-INT by phone please call 304 558-3333. O Do not include tax account information in your email.

If you choose this option it could take several days to receive your form in the mail. You may obtain a duplicate 1099-G form by accessing your Claimant Self-Service account. You should have had it by January 31st.

Look up your 1099G1099INT. Open or continue your tax return in TurboTax online. To look up your 1099GINT youll need your adjusted gross income from your most recently filed Virginia income tax return Line 1 or the sum of both columns of Line 1 for a part-year return.

It is your responsibility to inform the VEC of any changes in your address and to include unemployment benefits received on your annual tax return and pay any tax due. The tax year of your return. If you dont receive your forms in time call your state or local taxing authority or unemployment office.

When there was no deposit the following week I spent every day trying to get a hold of someone but was unable to get through. Other wise waite to see if it comes in the mail. My benefit payments suddenly stopped in August 2020 after receiving benefits since May 2020 when I was put in quarantine.

To quickly get a copy of your 1099-G or 1099-INT simply go to our secure online portal MyTaxes at httpsmytaxeswvtaxgov and click the Retrieve Electronic 1099 link. Your Social Security number If you filed jointly youll also need your spouses SSN. If you received unemployment compensation from a union private voluntary fund or as a state employee you might not get a 1099-G.

If you received a 1099-G from the Virginia Employment Commission for the tax year 2020 and want to request a corrected form 1099-G be sent to you and the IRS you will need to submit your request in writing to the address listed below. This is the fastest option to get your form. If you choose this option it could take several days to receive your form in the mail.

I can not for the life of me reach a human at VEC about anything Gov2Go app locked me out saying I entered a wrong PIN which I know I didnt. Call the company up and ask for it sometimes they have a website for employees to download it. IRS could not help.

My last payment was on 81920. The Internal Revenue Service IRS requires government agencies to report certain payments made during the year because these payments or refunds may be considered taxable income for the recipients. Search for unemployment compensation and.

This is the fastest option to get your form. Federal tax purposes on Form 1099-K using the thresholds imposedfor purposes of Form 1099-MISC under IRC 6041a. Your adjusted gross income Line 1 If you filed a part-year return add together the amounts from both columns Line 1.

Instructions for the form can be found on the IRS website. To look up your Form 1099-G1099-INT online youll need the following information from your most recently filed Virginia tax return. Important Information Concerning Your 1099-G.

I got a 1099 - G statement but it didnt look like a real 1099 would there was no withholding box etc. Your original 1099-G form is mailed directly to your address of record. Therefore for Virginia tax purposes third-party settlement organizations must submit Form 1099-K information to the Department to the extent that they make payments of 600 or more in a taxable year to another person who.

VirginiaPUA and 1099 G Questions Virginia Question. There is a selection oval on your individual income tax form to opt out of receiving a paper Form 1099G each. Electronic W-2 1099 Filing Guidelines web page Web Upload Help Desk WebUploadtaxvirginiagov o Provide your name and phone numbers.

There was no warning or information of any kind provided by the VEC. The Form 1099G is a report of the income you received from the Virginia Department of Taxation. Just the amount I made.

866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays. Heres how you enter the unemployment.

Divorce In Virginia Fill Online Printable Fillable Blank Pdffiller

Divorce In Virginia Fill Online Printable Fillable Blank Pdffiller

Virginia Annulment Fill Out And Sign Printable Pdf Template Signnow

Virginia Annulment Fill Out And Sign Printable Pdf Template Signnow

Are You Interested In Attending A Free Tax Preparation Please Contact 804 775 6433 To Reserve A Time Slot Today Tax Preparation Tax Free Preparation

Are You Interested In Attending A Free Tax Preparation Please Contact 804 775 6433 To Reserve A Time Slot Today Tax Preparation Tax Free Preparation

Virginia Woolf Night And Day Day For Night Virginia Wolf Books

Virginia Woolf Night And Day Day For Night Virginia Wolf Books

State Tax Department No Longer Sending 1099s Wvpb

State Tax Department No Longer Sending 1099s Wvpb

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Https Www Tax Virginia Gov Sites Default Files Vatax Pdf 2019 763 Instructions Pdf

Https Www Tax Virginia Gov Sites Default Files Taxforms Early Release 2020 Individual Income Tax Draft 2020 763 Instructions Pdf

Https Www Tax Virginia Gov Sites Default Files Inline Files 2020 Software Provider Letter Of Intent Pdf

Prepare And Efile Your 2020 2021 Virginia Income Tax Return

Prepare And Efile Your 2020 2021 Virginia Income Tax Return

Https Www Vec Virginia Gov Printpdf 377 Mini 2013 05

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

Https Www Vec Virginia Gov Printpdf 1099

About Us Communities In Schools Of Virginia

About Us Communities In Schools Of Virginia

Irs Approved Blank W2 G Gambling Winnings Forms File This Form To Report Gambling Winnings And Any Federal Income Ta Tax Forms The Secret Book Payroll Checks

Irs Approved Blank W2 G Gambling Winnings Forms File This Form To Report Gambling Winnings And Any Federal Income Ta Tax Forms The Secret Book Payroll Checks

Faq S General Unemployment Insurance Virginia Employment Commission

Faq S General Unemployment Insurance Virginia Employment Commission