How To Lodge Company Activity Statement

Steps to Write a Business Activity Statement. T1 T2 20100 17 34170.

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

You can lodge your BAS.

How to lodge company activity statement. You are unable to lodge the Company Tax Returns using AccountRight this will allow you to Lodge your Business Activity Statement or Income Activity Statement to the ATO directly. Online services for business is here. To lodge a new activity statement select Lodge activity statement.

This video explains why the best way to prepare and lodge any activity statement or PAYG instalment notice is online. Even if you cant pay lodge on time to avoid this extra cost. Enter 341 at both T11 and 5A.

You have several options for lodging your business activity statements BAS and reporting your goods and services tax GST to us. The completion of your Business Activity Statement generally depends on your business registrations and whether you make your statement monthly or quarterly. If you are new to completing the GST section of your activity statement 1 read the first five chapters in the before you start section.

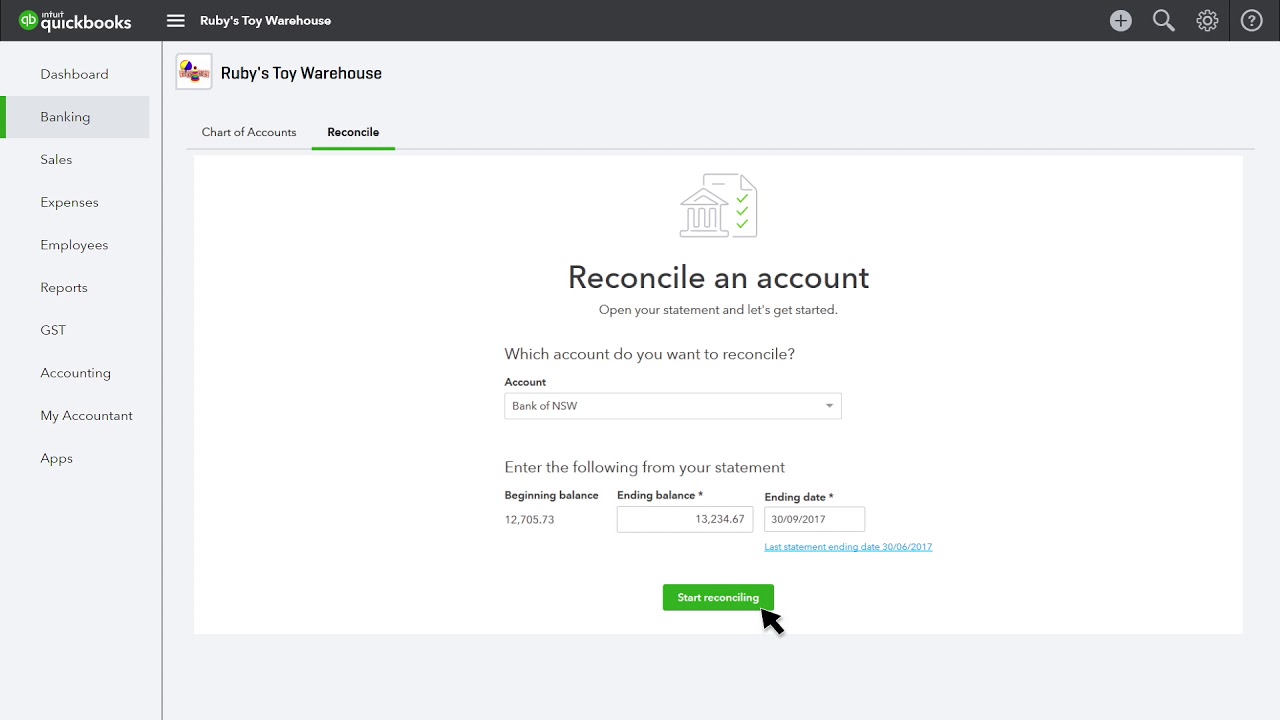

Click Prepare BASIAS in the Accounts command centre. Most businesses that lodge their own BAS choose an online option. The Business Portal and electronic superannuation.

Complete and return by the due date on your BAS along with any payment due. Lodge an activity statement Online services for business. Your BAS will help you report and pay your.

A Business Activity Statement BAS summarises the tax that your business has paid. Online through the Business Portal or Standard Business Reporting SBR software. To lodge your Company Tax Return you would need to submit this either through a Tax Agent or directly to the ATO by paper.

In the Lodge Online tab click Prepare Statement. Sign in to your MYOB account as you normally do when accessing your online AccountRight company files. The instalment rate on your activity statement shown at T2 is 17.

Lodge your BAS to the ATO at regularly intervals either monthly quarterly or annually. To view or revise an. How to lodge online.

Income tax return 0. Are you an individual or sole trader. Organize Your Financial Records.

A penalty may apply if you dont lodge on time. You can follow some important steps to complete your BAS before the given deadline. The Australian Taxation Office ATO will send your activity statement about 2 weeks before the end of your reporting period.

Even if you have a tax practitioner or agent lodge your statement on your behalf you can still access it yourself through ATO online services if you are registered. The Activity statement option in the Business Portal menu is your starting point for lodging or. How to lodge a BAS.

If you hired a registered tax practitioner or BAS agent to complete your BAS for you they can lodge your statement for you. Through a registered tax or BAS agent. Via your online accounting software.

Start AccountRight and open your online company file. By having a registered tax or BAS agent generally an accountant or bookkeeper submit it for you. Business activity statements BAS If you are a business registered for GST you need to lodge a business activity statement BAS.

Through the ATOs online business portal. Then lodge your activity statement and pay 341 by 28 October the due date for the first quarter. To set up your online activity statement.

You can lodge your BAS online. Through your myGov account if youre a sole trader. 2 Complete each step in the How to complete your activity statement section that is relevant to the method you choose to complete your activity statement.

You calculate the instalment amount as follows. Select Tax and then Activity statements from the menu. To keep on top of your BAS obligations remember to keep accurate records sort your accounts according to their relevant BAS category and be mindful of your BAS lodgement dates.

3 Mail your BAS using the pre-addressed envelope.

Fun Fact Small Business Accounting Accounting Fun Facts

Fun Fact Small Business Accounting Accounting Fun Facts

Key Factors Of Business Tax Planning Infographic Accounting Melbourne Capital Gains Tax Business Tax Accounting Services

Key Factors Of Business Tax Planning Infographic Accounting Melbourne Capital Gains Tax Business Tax Accounting Services

Lodging An Activity Statement Through The Business Portal Youtube

Lodging An Activity Statement Through The Business Portal Youtube

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

Fun Fact Fun Facts Social Responsibility Facts

Fun Fact Fun Facts Social Responsibility Facts

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

Profit Loss Statement Example Fresh Profit And Loss Statement P L Profit And Loss Statement Statement Template Profit

Profit Loss Statement Example Fresh Profit And Loss Statement P L Profit And Loss Statement Statement Template Profit

Tax Date Important Dates Dating Infographic

Tax Date Important Dates Dating Infographic

Printable Daily Schedule Templates Schedule Templates Daily Schedule Template Daily Schedule

Printable Daily Schedule Templates Schedule Templates Daily Schedule Template Daily Schedule

It Auditcertificate Programs Are Designed To Enhance The Internal Or External It Professional Small Business Accounting Accounting Firms Accounting Services

It Auditcertificate Programs Are Designed To Enhance The Internal Or External It Professional Small Business Accounting Accounting Firms Accounting Services

Govreports Brochure Payroll Taxes Brochure Tax Return

Govreports Brochure Payroll Taxes Brochure Tax Return

Working Capital Turnover Ratio Interpretation Ratio Financial Ratio

Working Capital Turnover Ratio Interpretation Ratio Financial Ratio

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

What Happens If I Don T Lodge A Tax Return Tax Help Tax Deductions Tax Prep

What Happens If I Don T Lodge A Tax Return Tax Help Tax Deductions Tax Prep

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures

How To Complete The Business Section In Mytax Youtube

How To Complete The Business Section In Mytax Youtube

How To Complete A Business Activity Statement With Pictures

How To Complete A Business Activity Statement With Pictures