How To Start A Sole Proprietorship In Kansas

The Kansas Business Filing Center offers access to the Kansas Secretary of States online business services through KanAccess. Unlike many other states Kansas does not even require or allow you to register your trade name.

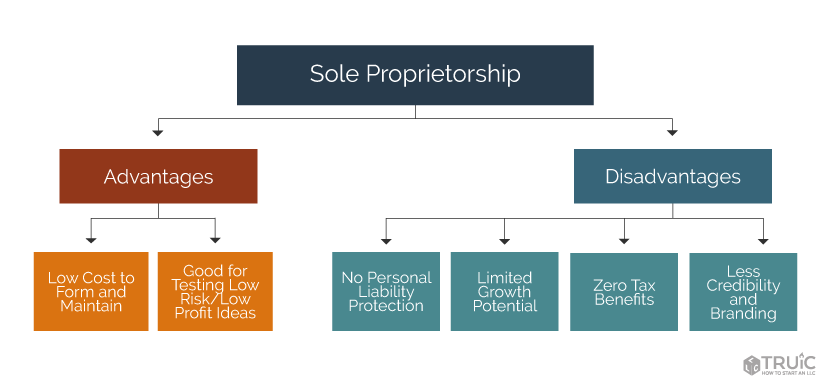

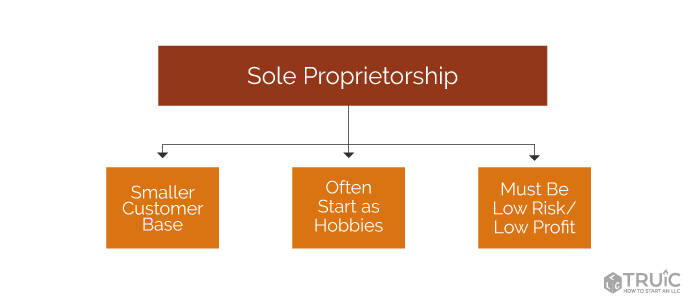

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

Sole proprietorships are not required to.

How to start a sole proprietorship in kansas. Obtain Licenses Permits and Zoning Clearance. This name has to be different from the other entities registered with the Kansas Secretary of State. A sole proprietor is entitled to 100 of the businesss profit but is also responsible for 100 of the debt and risk including lawsuits.

Draft a business plan. In addition unlike corporations or LLCs there arent any formation fees or ongoing maintenance fees associated with filings like annual reports. To find out how to establish a sole proprietorship in any other state see Nolos 50-State Guide to Establishing a Sole Proprietorship.

You do not have to notify or file any paperwork with the Kansas Secretary of State. In Kansas a sole proprietor may use his or her own given name or may use an assumed business. Please allow 3-5 days from the date of filing to receive the certified copy.

There are no requirements for forming a sole proprietorship in Kansas. If youre a Sole Proprietor you need a DBA to register your business name DBA is an abbreviation for doing business as Well prepare and file all required documents to start your DBA Get started Starting at 99 state filing fees. File a Trade Name.

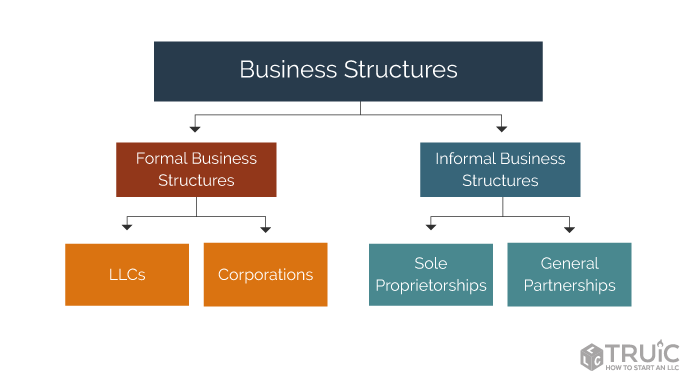

How to Start a Business in Kansas. A sole proprietorship is an informal unincorporated business that isnt legally separated from its owner. To form a Kansas general partnership you simply need to start working with your partner or partners.

Bob Smith they must register a trade. Registering a Kansas Business Name for a Corporation or LLC Corporations and LLCs will pick a name at the time of formation. The KanAccess sign-on enables businesses to submit filings online and access their records with the Secretary of State.

Kansas does not require sole proprietorships to register or file with the Secretary of State. Every successful business starts with a good idea. You can register online through the Kansas Department of Revenue or by mail with Form CR-16.

Decide on a legal business entity. Obtain an Employer Identification Number. You simply start doing business.

Topeka KS 66612 Once the paper registration is received and filed by the Secretary of State a certified copy of the registration is sent to the address provided. Ask yourself these questions. Start a Soe Prorietorshi in Ohio FORMS Sole proprietorships are not required to file paperwork with the Secretary of State in order to conduct business in the State of Ohio.

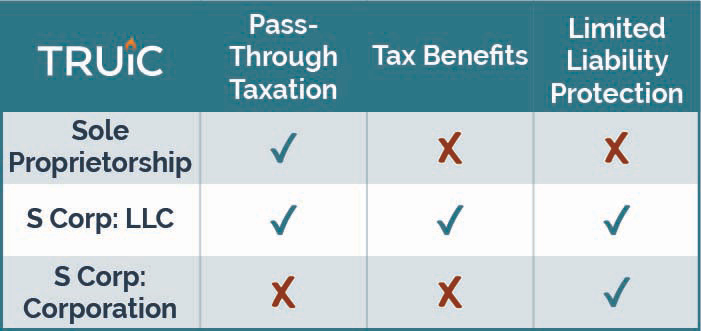

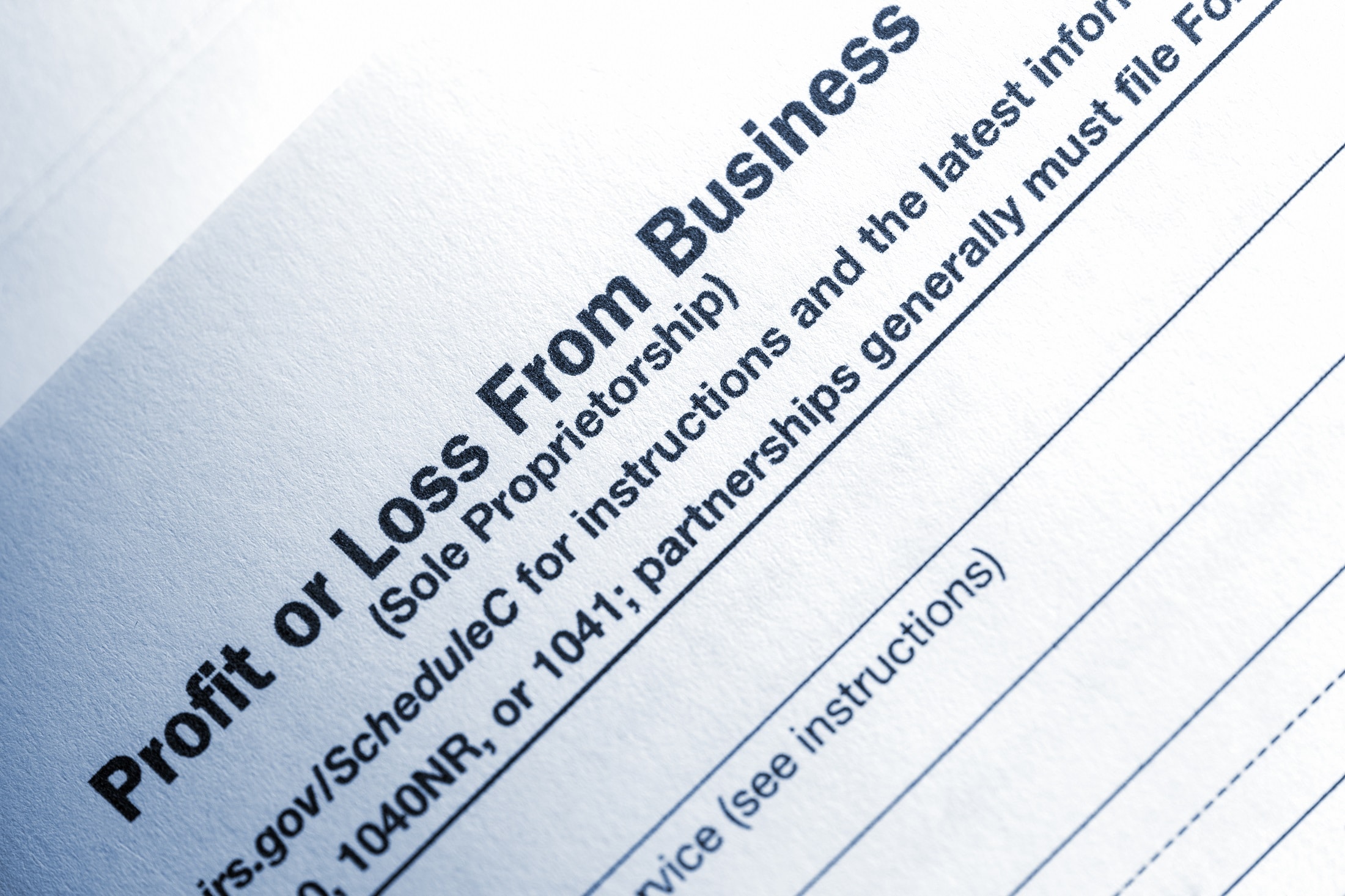

For this reason a sole proprietorship is usually not the best choice for most business owners. Sole proprietors need to file Form 941 Employers Quarterly Federal Tax Return or Form 944 Employers Annual Federal Tax Return for the calendar quarter in which they make final wage payments. What Business Licenses are Needed in Kansas.

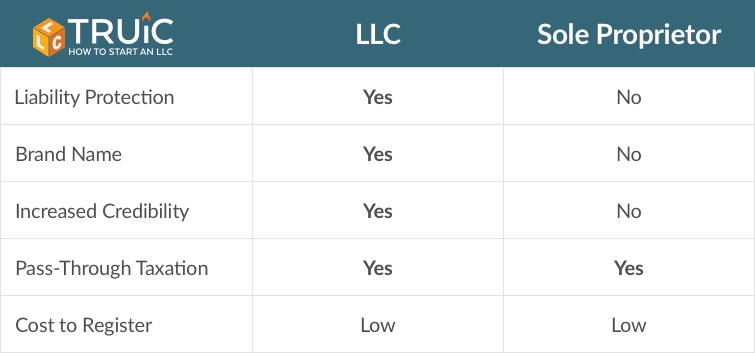

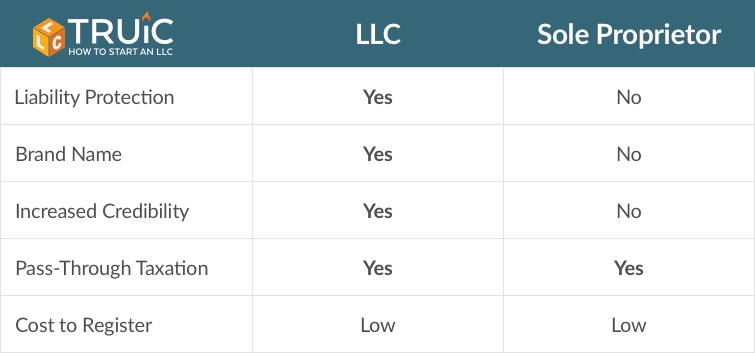

Visit our Sole Proprietorship vs LLC guide to learn. Obtain licenses permits and zoning clearance. Every year the LLC will need to file the Annual Report with the Kansas Secretary of State.

Sole proprietorships and general partnerships are not required to file an assumed business name in Kansas. If you use a business name that is different from your legal name Kansas does not have a method. Choose a Business Name.

This is because Kansas doesnt impose any state filing or. However if a sole proprietorship wishes to do business under a name different from that of the sole proprietor personal name ie. File an application for a fictitious name with the Secretary of State.

They check the box and enter the date final wages were paid on. As soon as you come up with a good business idea and are ready to get operations underway choosing to operate as a sole proprietor allows you to start the business immediately.

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

How To Change From A Sole Proprietor To An Llc

How To Change From A Sole Proprietor To An Llc

Sole Proprietorship In Kansas Legalzoom Com

Sole Proprietorship In Kansas Legalzoom Com

When Does A Sole Proprietor Need An Ein How To Start An Llc

When Does A Sole Proprietor Need An Ein How To Start An Llc

Register Texas Fictitious Business Name Texas Trade Name Texas Dba Business Names Sole Proprietorship Business Solutions

Register Texas Fictitious Business Name Texas Trade Name Texas Dba Business Names Sole Proprietorship Business Solutions

Sole Proprietorship Vs S Corp Truic

Sole Proprietorship Vs S Corp Truic

Sole Proprietorship Vs Llc A Truic Small Business Guide

Sole Proprietorship Vs Llc A Truic Small Business Guide

Ajcesquire Posted To Instagram Sole Proprietorship What Are Some Of The Advantages The Sole Prop Sole Proprietorship Sole Proprietor Small Business Advice

Ajcesquire Posted To Instagram Sole Proprietorship What Are Some Of The Advantages The Sole Prop Sole Proprietorship Sole Proprietor Small Business Advice

Pros And Cons Of Incorporating Your Ecommerce Business As A Sole Proprietorshiptaxjar Blog

Pros And Cons Of Incorporating Your Ecommerce Business As A Sole Proprietorshiptaxjar Blog

Why You Should Turn Your Sole Proprietorship Into An Llc

Why You Should Turn Your Sole Proprietorship Into An Llc

Comparison Chart Of Business Entities Startingyourbusiness Com Business Sole Proprietorship Comparison

Comparison Chart Of Business Entities Startingyourbusiness Com Business Sole Proprietorship Comparison

Sole Proprietorship Vs Llc What S The Difference Ideas

Sole Proprietorship Vs Llc What S The Difference Ideas

Sole Proprietorship Laws In Illinois Legalzoom Com

Sole Proprietorship Laws In Illinois Legalzoom Com

Should You Run Your One Person Business As A Sole Proprietorship Epw Small Business Law Pc Sole Proprietorship Business Law Small Business Law

Should You Run Your One Person Business As A Sole Proprietorship Epw Small Business Law Pc Sole Proprietorship Business Law Small Business Law

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

How To Start A Sole Proprietorship In Missouri

How To Start A Sole Proprietorship In Missouri

Economics Business Organizations Simulation Activities Distance Learning Student Activities Student Organization Activities

Economics Business Organizations Simulation Activities Distance Learning Student Activities Student Organization Activities

Should I Stay A Sole Proprietorship Kapitus

Should I Stay A Sole Proprietorship Kapitus

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide