What Is Future Maintainable Profit

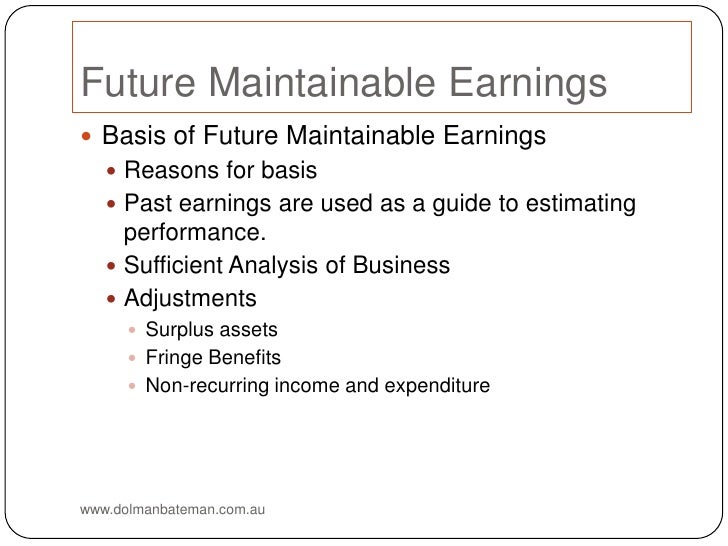

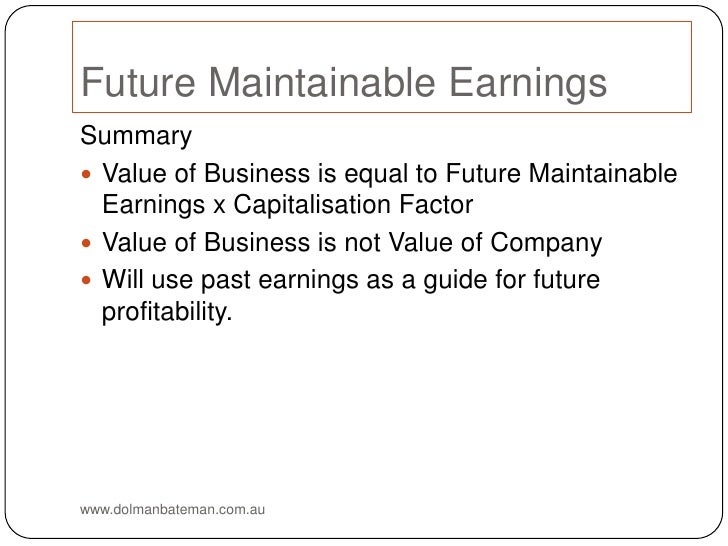

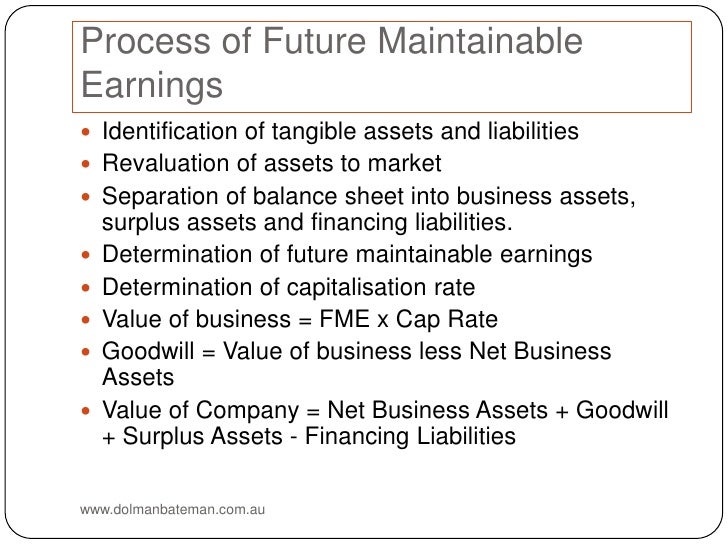

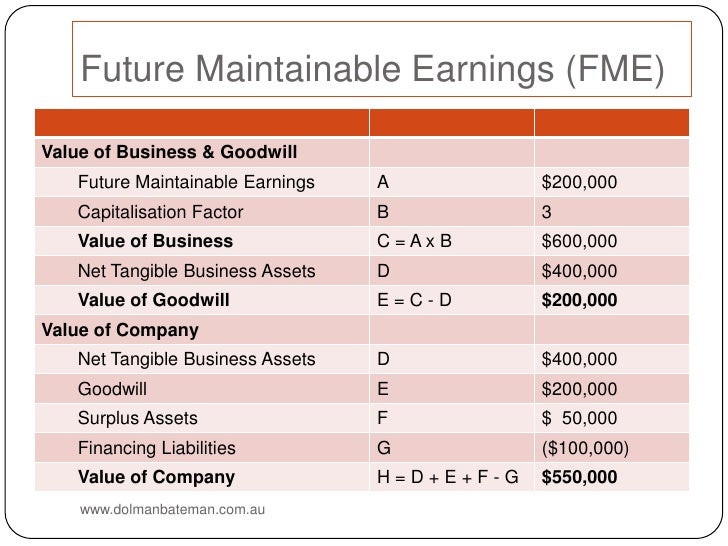

If the companys recent performance is not assessed to be maintainable into the future then the valuer may take a longer term view and may also incorporate. Perhaps the most generally accepted method that involves capitalizing the future maintainable earnings by the application of a suitably chosen capitalization rate or multiple.

Challenging Business Valuations In Family Law

Challenging Business Valuations In Family Law

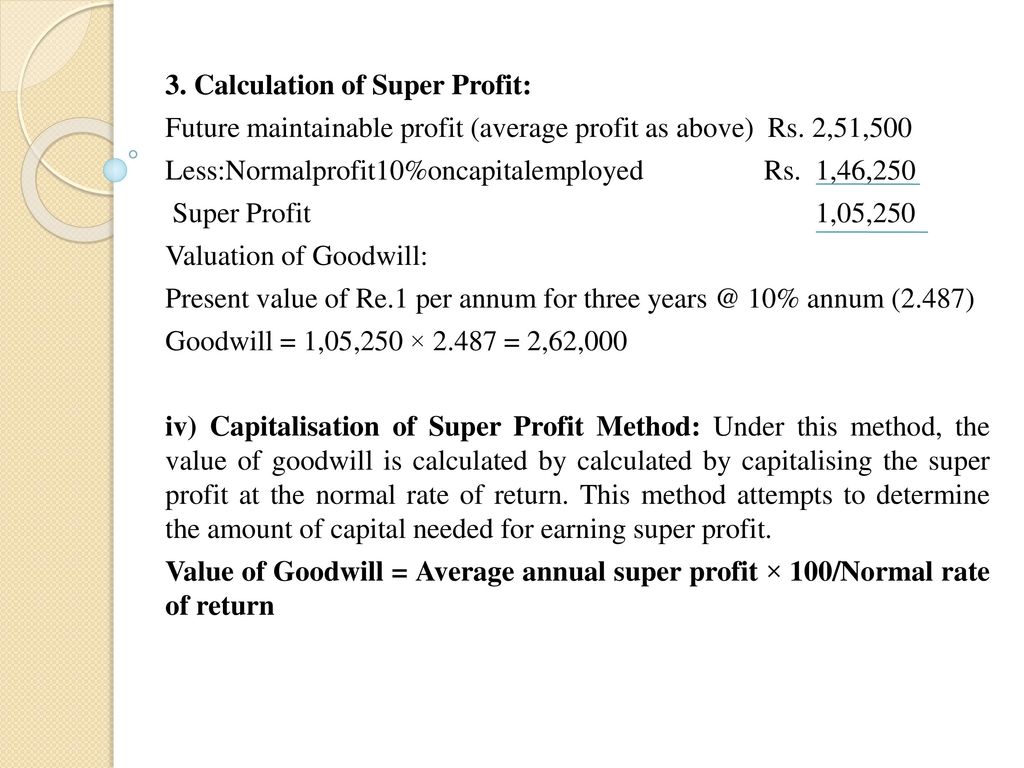

The formula for super profit method is given below.

What is future maintainable profit. This video will be helpful for Students of CA -. If there is permanent decline it should be deducted. The future maintainable earnings methodology is only appropriate where the level of future profits is expected to be stable.

Futur maintainable profits means certainity in generation of profits. The excess of actualaverage profit over normal or average profit is called a super profit method. Mutual maintainable profit is calculated for the partners.

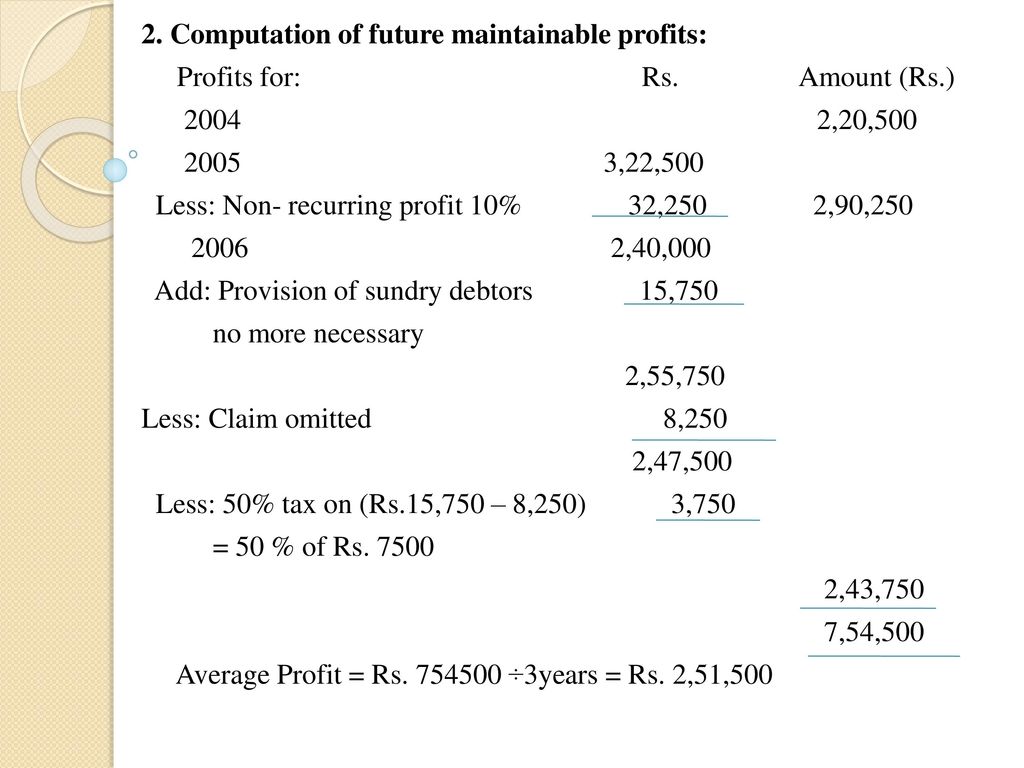

Temporary decline is not considered. The following points should carefully be considered at the time of estimating future profit. The definition of earnings may be profit after tax PAT or earnings before interest and tax EBIT.

This method or technique is a surplus of. Super Profits Method. The Future Maintainable Earnings FME methodology is the most common method of valuing profitable businesses in Australia.

The average profit earned by a company in the past could be normally taken as the average profit that would be maintainable by it in the future if the future is considered basically as a continuation of the past. It is a simplification of the Discounted Cash Flow Method. The valuer should always critically examine past performance and probable future events in relation to the business or entity being valued.

The future maintainable earnings methodology is a derivation or simplification of the Discounted Cash Flow DCF method. Normalized earnings help business owners. One of the difficulties in determining the future profitability of privately held companies is that the financial information is often unavailable and unreliable which.

Current liabilities are anything that are due and payable with in a _____ period twelve monthstwenty four months. It is nothing but the future profits likely to be earned. Whilst the discounted cash flow methodology is considered to be superior in determining the value of a business the information available in a small.

This video helps in understanding the calculation of Future Maintainlable Profit in Valuation of Goodwiil easily. The Future Maintainable Earning Method is commonly used to value a profitable business. Those items only we should consider.

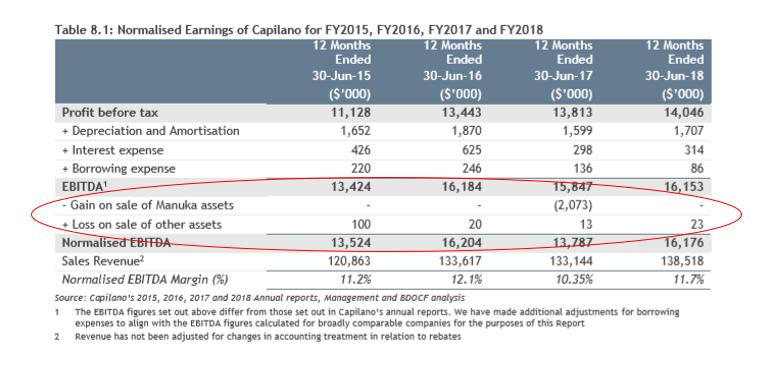

Super Profit Average Profit Normal Profit. If significant increases in profitability are expected into the future then the discounted cash flow model should be used. Maintainable earnings are calculated based on the historical profit of the business over a period of time commonly three years but exclude non-business and extraordinary items.

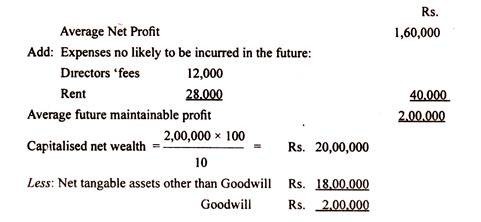

Adjusted current year profit or adjusted next year profit are common proxies for future maintainable earnings. For calculating the Future Maintainable Profits of a concern we should have a look into the profits earned by that concern in the few previous years say 234 or 5 years. Now the movement of the profit is introduced for the mutual interests of the people for all changes.

In This Video We Will Understand what is ADJUSTED OR FUTURE MAINTAINABLE PROFIT with the help of a numerical questionWhat is maintainable profitDETERMINATI. Value of a business is _____ the aggregate value of its assets equal todifferent from. Fluctuation in the value of trade investments is uncertain nature.

You should make sure either you are talking about the total owners income or income after all the wages salary and other expenses. Profit means different things to different people. This estimated future profit is to be ascertained on the basis of past profitswhich is very significant while calculating the value of goodwill.

Super profit is the excess of future maintainable profits over _____ expected profits normallyabnormally. Normalized earnings are adjusted to remove the effects of seasonality revenue and expenses that are unusual or one-time influences. So speculation profit and losses will not consider for FMP.

The business value is derived by capitalising the maintainable earnings by an appropriate multiple which is reflective of the inherent risk the business may have. If future performance as the company is viewed as departing significantly from the past then appropriate adjustments will be called for before accepting the past average profit as. As is clear from the name itself Future Maintainable Profits are the profits that are expected to be earned by the business in the coming future.

CAPITALIZATION OF MAINTAINABLE EARNINGS is a valuation method.

Challenging Business Valuations In Family Law

Challenging Business Valuations In Family Law

Valuation Of Goodwill Ppt Download

Valuation Of Goodwill Ppt Download

How To Calculate Business Maintainable Earnings Infographic

Challenging Business Valuations In Family Law

Challenging Business Valuations In Family Law

Valuations Perth Business Valuations Has Bank Finance Accreditation For Business Valuations Enabling Us To Provide Business Valuations For Lending Purposes For Most Major Finance Institutions About Us Contact Us Business Guides Guide To Valuations

Valuations Perth Business Valuations Has Bank Finance Accreditation For Business Valuations Enabling Us To Provide Business Valuations For Lending Purposes For Most Major Finance Institutions About Us Contact Us Business Guides Guide To Valuations

Business Valuation And Its Models Financial Management

Business Valuation And Its Models Financial Management

How To Calculate Future Maintainable Profit In Valuation Of Goodwill By Ca Gopal Somani Youtube

How To Calculate Future Maintainable Profit In Valuation Of Goodwill By Ca Gopal Somani Youtube

How To Calculate Fmp Capital Employed Youtube

How To Calculate Fmp Capital Employed Youtube

Nqla Conference 25 May 2011 Valuing Businesses And

Nqla Conference 25 May 2011 Valuing Businesses And

Valuation Of Goodwill Ppt Download

Valuation Of Goodwill Ppt Download

Challenging Business Valuations In Family Law

Challenging Business Valuations In Family Law

How Is Goodwill Calculated In The Real Business Quora

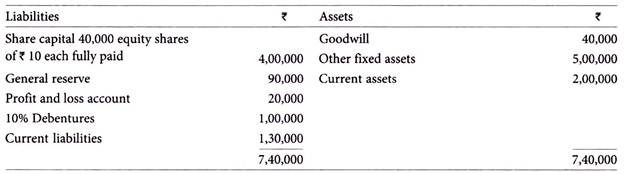

Average Profit Method Of Valuation Of Goodwill Indiafreenotes

Average Profit Method Of Valuation Of Goodwill Indiafreenotes

How Is Goodwill Calculated In The Real Business Quora

Valuation Of Goodwill Ppt Download

Valuation Of Goodwill Ppt Download

Valuation Of Goodwill By Ms P Maheswari Bcom Pa Snmv

Valuation Of Goodwill By Ms P Maheswari Bcom Pa Snmv

How To Determine A Company S Normalised Earnings

How To Determine A Company S Normalised Earnings

Pdf Valuation Of Goodwill Job At Dumdum Academia Edu

Pdf Valuation Of Goodwill Job At Dumdum Academia Edu