Where Do I Send 1099 Forms In Michigan

A Complete Form UIA 1920 Request to Correct Form 1099-G and submit it to UIA. When filing state copies of forms 1099 with Michigan department of revenue the agency contact information is.

E File Form 1099 With Your 2020 2021 Online Tax Return

E File Form 1099 With Your 2020 2021 Online Tax Return

Click on Forms for Workers.

Where do i send 1099 forms in michigan. Box 169 Grand Rapids MI 49501-0169. Filing deadline if e-filing. Send your Form 5081 along with your Form 1099 to the following mailing address.

This may delay processing of your return. When filing federal copies of forms 1099 with the IRS from the state of Michigan the mailing address is. Taxes Site - As a business entity in Michigan how do I file copies of 1099-MISC andor W-2 wage statements.

Filing deadline if paper filing. Some states require separate notification from the employer that they are filing 1099 forms through the CFSF Program. Here are the due dates for Form 1099-MISC for 2020 tax year.

Taxes Site - I am required to submit 1099-MISC to the IRS for Agricultural Services. Do not also send in federal Form 1099-R. Through the Combined FederalState Filing CFSF program the Internal Revenue Service.

Michigan Department of Treasury Return Processing Division Lansing MI 48930. Some have reported receiving a form from other states while people living in other states have received the form from the state of Michigan. IRS approved Tax1099 allows you to eFile Michigan forms online with an easy and secure filing process.

Mail completed forms to. Previously nonemployee compensation was reported on Box 7 of Form 1099-MISC but the IRS has recently released Form 1099-NEC to replace that option. The IRS acts as a forwarding agent only so it is your responsibility to contact your state to verify that they have received the form and to find if they need additional information.

The IRS address you should mail Form 1099-NEC to depends on your state. Do I attach w2 to my Michigan return If you are printing and mailing your Michigan return you would need to attach your form W-2 and any W-2Gs or 1099-Rs that have withholding. Unemployment Insurance Agency 1099-G PO.

Browsers that can not handle javascript will not be able to access some features of this site. Employers use Form 1099-NEC to report payments of over 600 to independent contractors or other nonemployees. Let us manage your state filing process.

Michigan Department of Treasury PO. Paper copies of income statements from issuers with fewer than 250 statements may be mailed to the following address. Send the 1099-NEC forms with a letter including your company name address and Federal Employers Identification Number FEIN or Treasury-assigned account number to.

Box 30401 Lansing MI 48909-7901. This form can be found at michigangovuia. Box 3330 Jefferson City MO 65105-3330.

Forms W-2 W-2C W-2G 1099-R 1099-MISC and 1099-NEC may be filed by magnetic media. We file to all states that require a state filing. You will need to file Form MO-96 with Forms 1099-MISC.

Yes Michigan requires you to file 1099s to the Department of Treasury. Department of the Treasury Internal Revenue Service Center Kansas City MO 64999. Details for mailing magnetic media can be found on Transmittal for Magnetic Media Reporting of W-2s W-2Gs and 1099s Form 447.

Keep it for your records. It is also important to send copies of the form to the recipients before the deadline. Here is your state-by-state address guide.

EFile Michigan 1099-MISC 1099-NEC and W-2 directly to the Michigan State agency with Tax1099. John Craig of Troy said he received a 1099-G form. How do I file with Michigan.

Missouri Department of Revenue Taxation Division PO. Due to sending recipient copies. Michigan Department of Treasury Lansing MI 48930.

TurboTax should print filing instructions with specific directions on how to file a printed return. If you have 250 or more income statements you must use MTO to electronically send a magnetic media formatted file. How do I send magnetic media to the State of Michigan.

No beginning with tax year 2015 if the 1099-R shows NYS NYC or Yonkers tax withheld you must copy the required information from federal Form 1099-R onto the New York State Form IT-1099-R Summary of Federal Form 1099-R Statements and submit it with your return. Michigan Department of Treasury Lansing MI 48930. Information Returns Branch IRSIRB will forward original and corrected Forms 1099 filed electronically to participating states free of charge for approved filers.

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

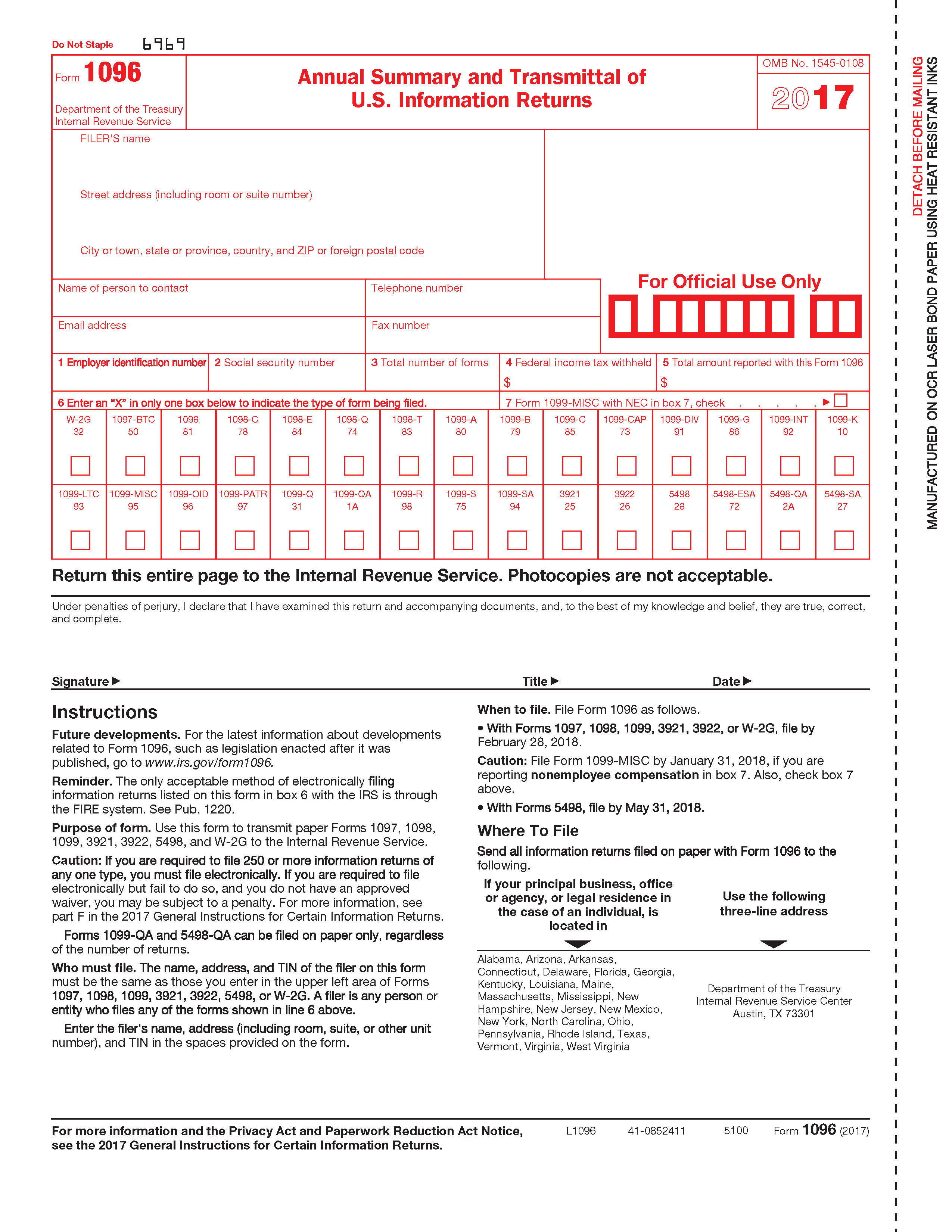

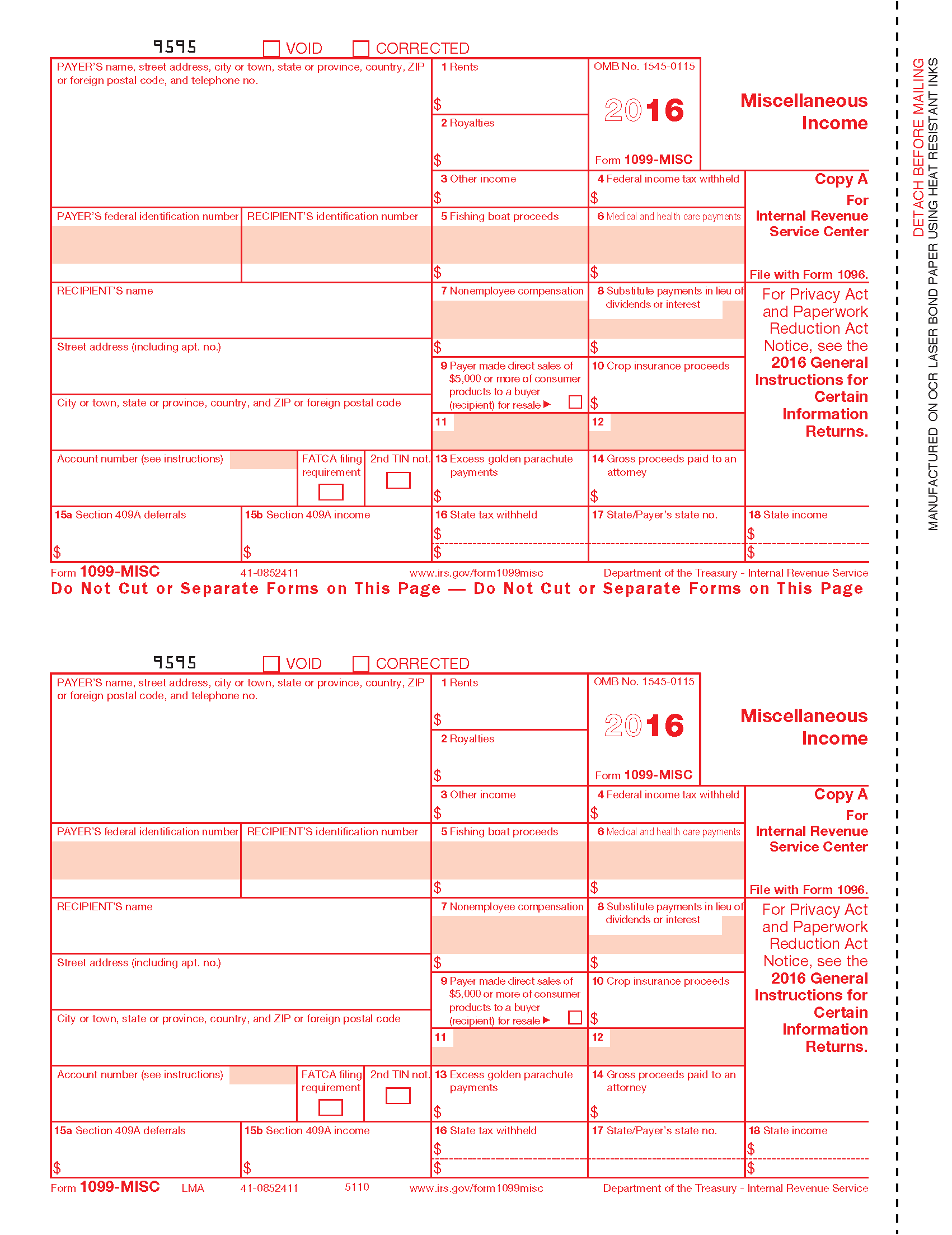

Laser 1099 Forms Archives Forms Fulfillment

Laser 1099 Forms Archives Forms Fulfillment

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog

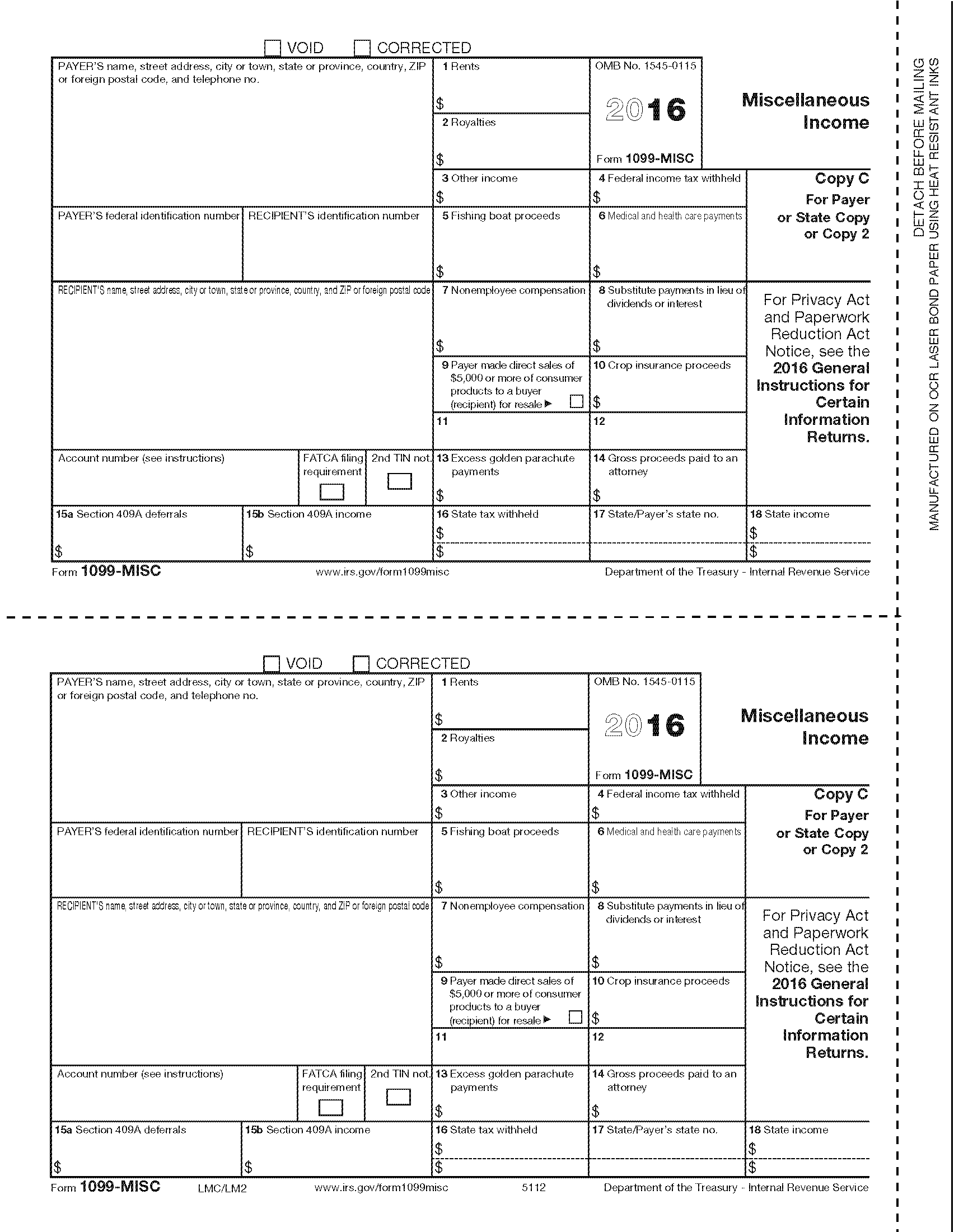

1099 Misc State Copy C Forms Fulfillment

1099 Misc State Copy C Forms Fulfillment

Fast Answers About 1099 Forms For Independent Workers 1099 Tax Form Fillable Forms Irs Forms

Fast Answers About 1099 Forms For Independent Workers 1099 Tax Form Fillable Forms Irs Forms

Instant Form 1099 Generator Create 1099 Easily Form Pros

Instant Form 1099 Generator Create 1099 Easily Form Pros

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contractors Or That Ha Business Tax Bookkeeping Business Small Business Bookkeeping

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contractors Or That Ha Business Tax Bookkeeping Business Small Business Bookkeeping

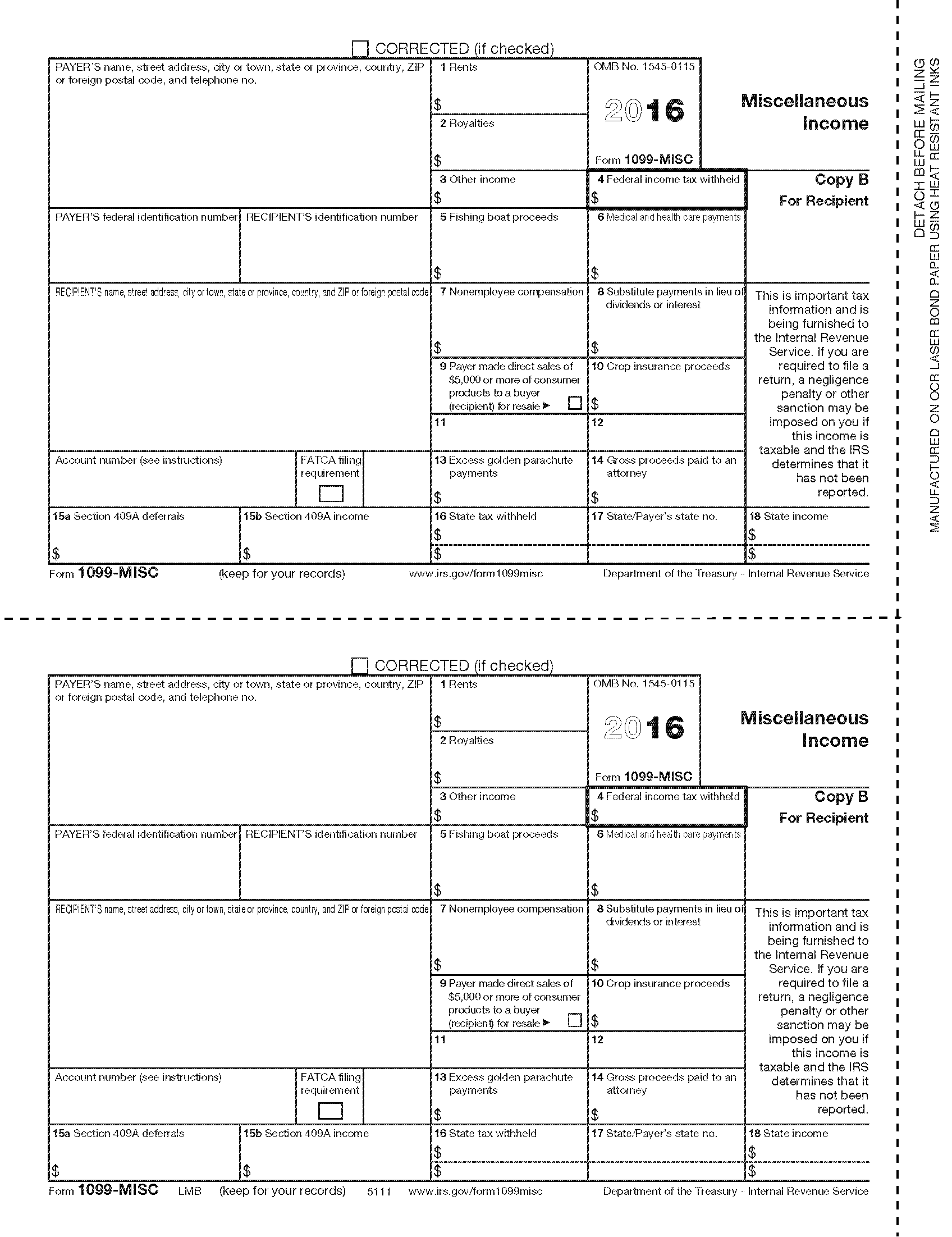

1099 Misc Recipient Copy B Forms Fulfillment

1099 Misc Recipient Copy B Forms Fulfillment

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Laser 1099 Forms Archives Forms Fulfillment

Laser 1099 Forms Archives Forms Fulfillment

1099 Misc Federal Copy A Forms Fulfillment

1099 Misc Federal Copy A Forms Fulfillment

How To Read Your 1099 Robinhood

How To Read Your 1099 Robinhood

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

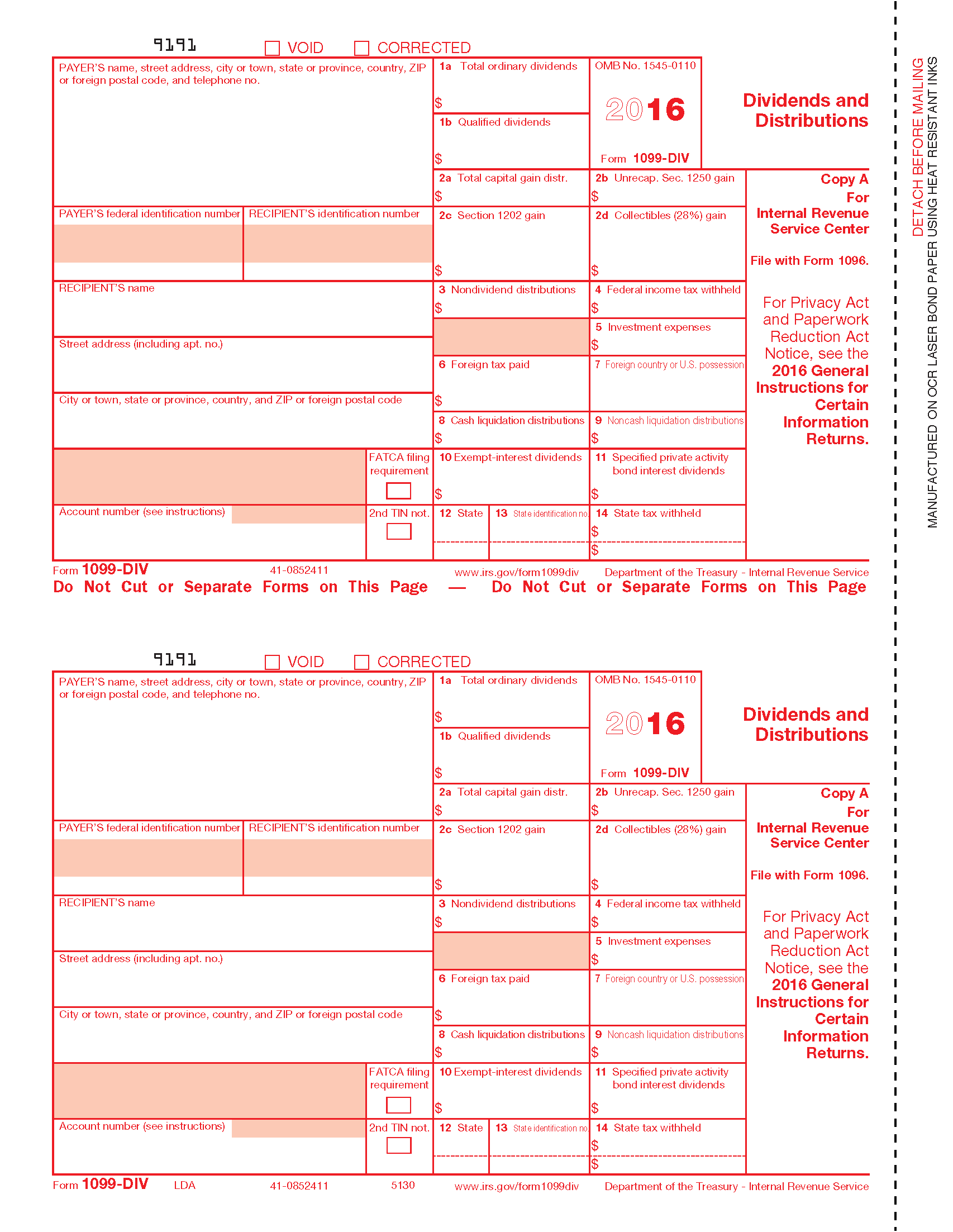

Laser 1099 Forms Archives Forms Fulfillment

Laser 1099 Forms Archives Forms Fulfillment

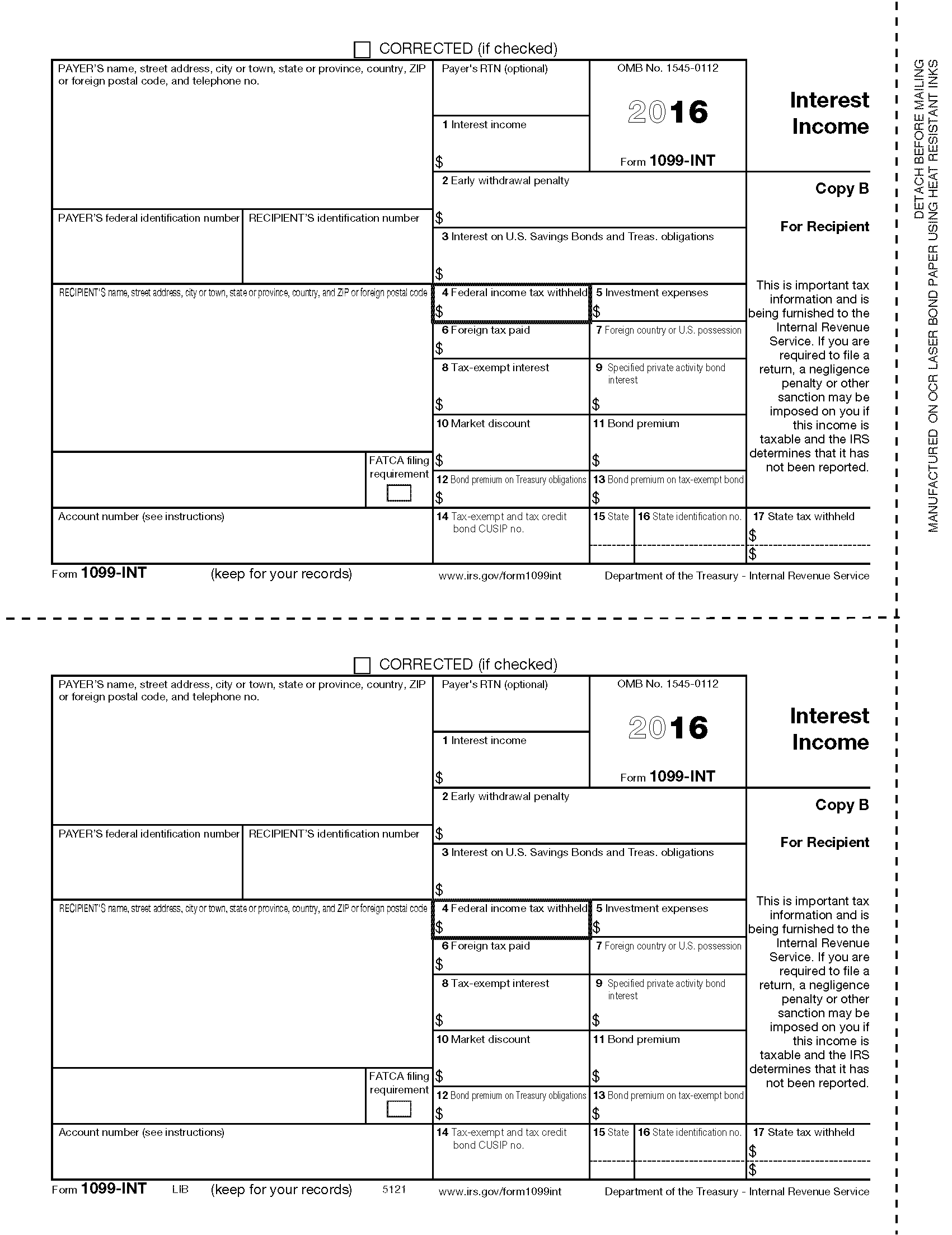

Form 1099 Int Irs 1099 Misc 1099 Misc Copy A