Should I 1099 Or W2 My Employees

Entities provide a Form 1099-Misc to independent contractors and Form W-2 to employees. For tax purposes if you classify a worker as an independent employee you must have a sound reason for that decision.

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

While a W2 employee considers themselves a part of your organization a 1099 worker is the owner and employee of their own business.

Should i 1099 or w2 my employees. Many employees get access to discounted health insurance often along with life insurance disability. Your tax obligations vary between 1099 contractors and W-2 employees. Independent Contractors on the other hand are usually provided with a completed copy of IRS Form 1099-MISC by the business that paid them.

You must also submit 1099 forms to the IRS by January 31. A W-2 employee has an indefinite relationship with the employer. When you are paid by clients and file a form 1099 at tax-time youll be required to pay the employers-share of these taxes meaning that the.

W-2 forms must also be sent to the Social Security Administration by this date. The W2 worker attends your office regularly and works only with your company. So be careful with your choice if the helpers you paid as 1099 contractors are determined later by the IRS as W2 employees then the Trust Fund recovery penalty which is federal income tax social security and Medicare taxes not withheld will be assessed to the owner.

1099 vs W2. However there may be instances where a worker may be serving as an independent contractor and an employee for the same entity. For 2019 use Form 1099-MISC.

When you hire people to work for you you should assume they are employees W2 unless you can prove that they are contractors 1099. The difference between a 1099 employee and others is usually easy to recognize. If you need a permanent employee the 1099 distinction is not correct.

Wages and other payments to employees are reported on Form W-2 while payments to independent contractors are reported on a Form 1099. This is over and above what the employee pays. If your employer refuses you can file Form SS-8 with the IRS.

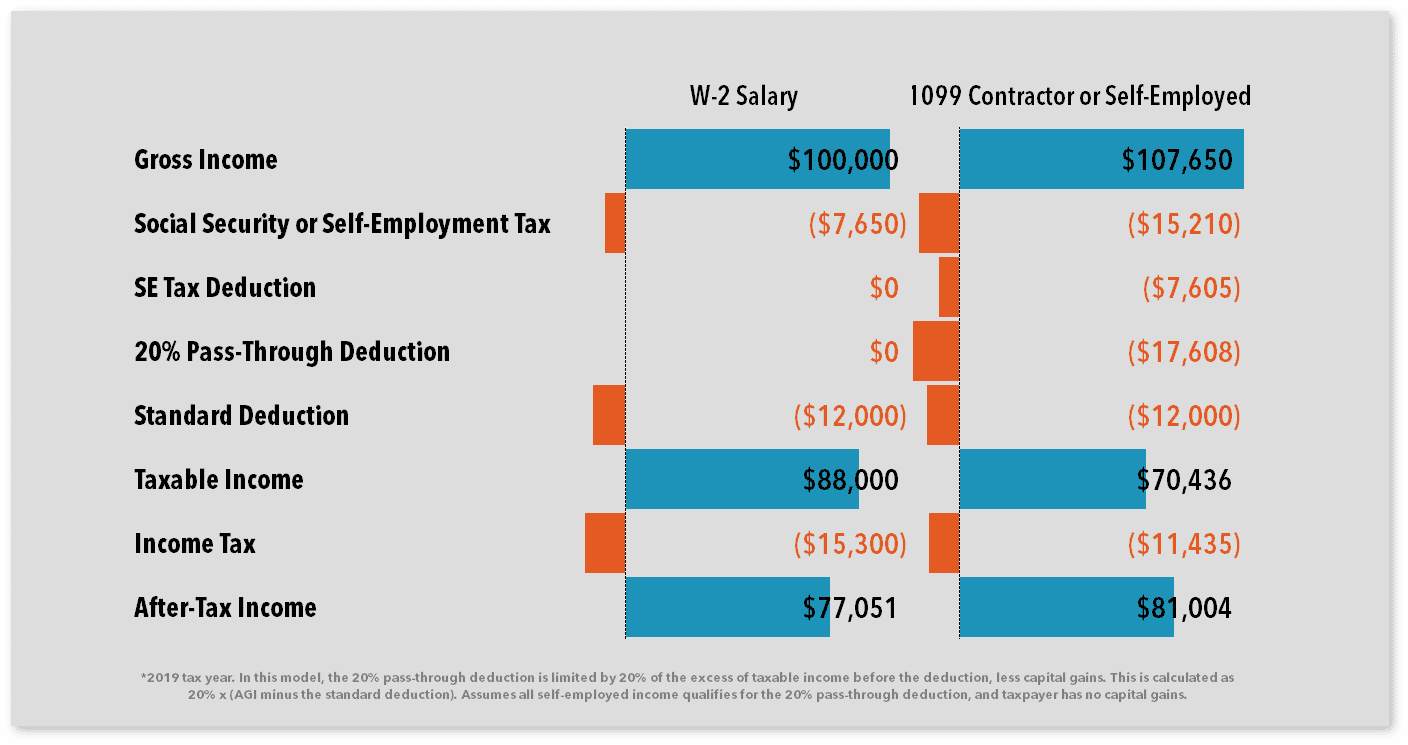

The tax differences between W-2s and 1099s. On the other hand employees that are doing core competency work of the business are likely to be W-2 employees. They must pay both employer and employee taxes on their income.

Note that filing a 1099 and a W-2 for the same worker could result in a tax audit. You also set their hours and schedules. Some business owners like hiring 1099 contractors because of certain advantages over W2 employees.

The IRS will perform such audits on employers if they suspect someone has misclassified an employee. They will not be your employee after finishing the job. The interesting part is on what basis does 1099 worker differ from a W2 worker.

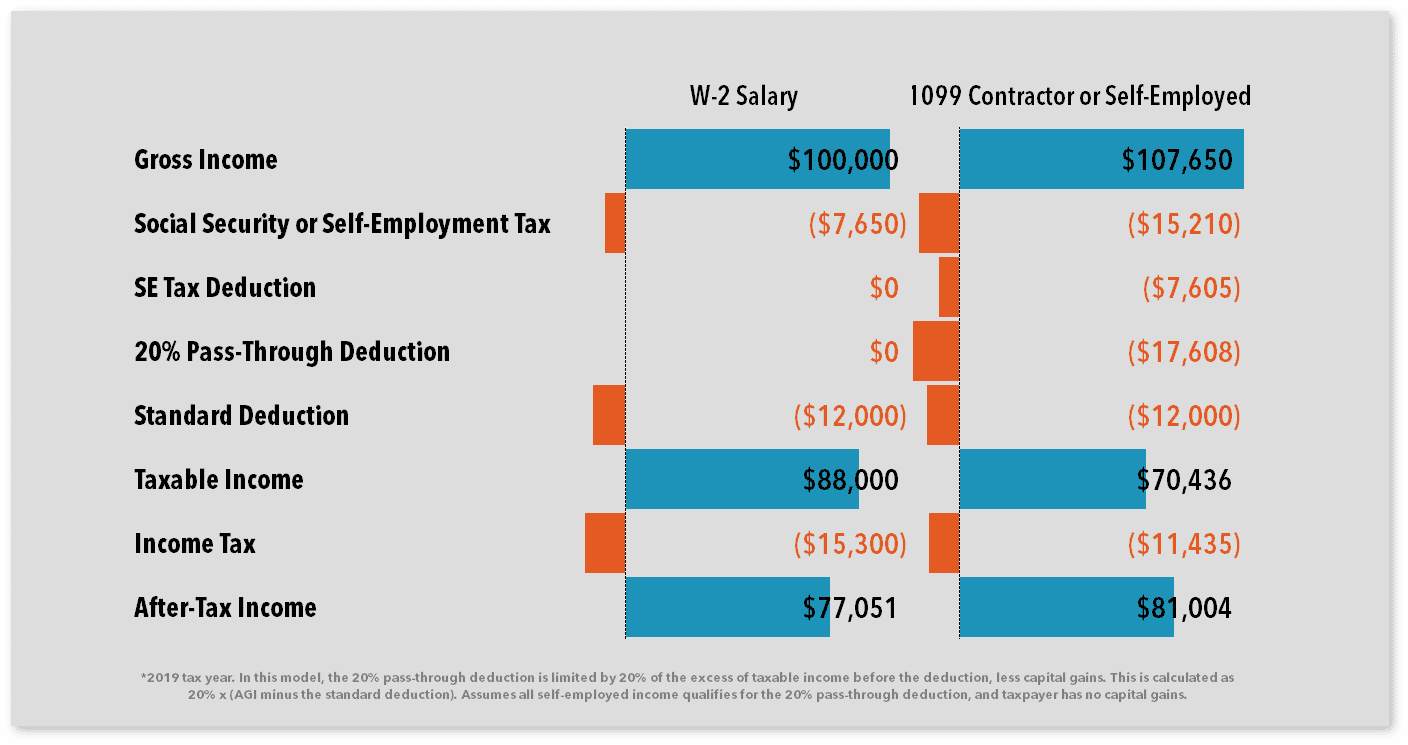

What happens if my employer sent a 1099 instead of a W2. For this reason many people refer to independent contractors as 1099 workers and traditional employees as. The self-employed pay twice as much Social Security and Medicare FICA taxes because employers normally pay.

The W2 workers take full accountability of the quality of work done for the company. In general the extent of employer or payer control over the workers time work methods and output determines if that persons compensation should be reported on a Form W-2 or 1099-MISC. 1099 represents the independent contractor whereas W2 represents the salaried employee.

Joe is a custodian who works for a county public school. With a W-2 employee you have the right to direct the work being performed. See this article on worker classification for more information.

For 2020 and later use Form 1099-NEC Each business must classify its workers as either employees or independent contractors to file the appropriate form. When hiring employees you not only have to withhold their taxes but your company also has to pay Social Security Medicare and unemployment taxes. The Department of Labor released an opinion letter in April 2019 to help companies determine whether a person should be hired as.

As a W2 employee your employer pays 765 of your Medicare and Social Security taxes and you pay 765. You pay 1099 workers per the terms of their contract. The biggest distinction between W-2 and 1099 workers is the amount of control you have over them.

The employee perspective 1. Type of services provided 1099 employees are often not doing work that is a core service of the employers business. If you do not agree with this classification you can speak with your employer to request to be treated as an employee and given a W-2.

W-2 forms are due to the employees no later than January 31 of the year after the tax year. One example of an independent contractor is a painter hired to paint your home. Defining the Employer-Employee Relationship.

That means giving instruction and providing the tools training and equipment to complete the work. The IRS has very specific guidelines for classifying workers into employees or contractors. 1099-NEC forms are due to non-employees by the same date.

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

W 2 Employees Vs 1099 Contractors Due

W 2 Employees Vs 1099 Contractors Due

When To Switch Employees From A W2 To A 1099

When To Switch Employees From A W2 To A 1099

1099 Vs W2 Be Better At Business Podcast Eagle Employer Services

1099 Vs W2 Be Better At Business Podcast Eagle Employer Services

Five 1099 Contractor Classification Myths Panacea Payroll Payroll Human Resources And Workforce Management Solutions For The Cannabis And Medical Medicinal Marijuana Industry

Five 1099 Contractor Classification Myths Panacea Payroll Payroll Human Resources And Workforce Management Solutions For The Cannabis And Medical Medicinal Marijuana Industry

16 Criteria To Determine Your Worker Status 1099 Or W 2 Independent Contractor Tax Advisors

16 Criteria To Determine Your Worker Status 1099 Or W 2 Independent Contractor Tax Advisors

Fillabletaxforms Create A Free W2 Form W2 Forms Tax Forms Credit Card Services

Fillabletaxforms Create A Free W2 Form W2 Forms Tax Forms Credit Card Services

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractors Or That Hav In 2021 Bookkeeping Business Business Tax Small Business Bookkeeping

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractors Or That Hav In 2021 Bookkeeping Business Business Tax Small Business Bookkeeping

1099 Vs W2 How 4 Different Agencies View Independent Contractor Relationships Infographic Employers Resource

1099 Vs W2 How 4 Different Agencies View Independent Contractor Relationships Infographic Employers Resource

Answered Independent Contractor 1099 Or W2 Employee Independent Contractor Employee Contractors

Answered Independent Contractor 1099 Or W2 Employee Independent Contractor Employee Contractors

Should You Choose 1099 Or W 2 Independent Contractor Tax Advisors

Should You Choose 1099 Or W 2 Independent Contractor Tax Advisors

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

1099 Vs W2 Employees Avoid Irs Trouble With Our Classification Tips Youtube

1099 Vs W2 Employees Avoid Irs Trouble With Our Classification Tips Youtube

Https Www Innovativeemployeesolutions Com Wp Content Uploads 2015 10 Clarifying 1099 And W 2 Employees Whitepaper Final Pdf

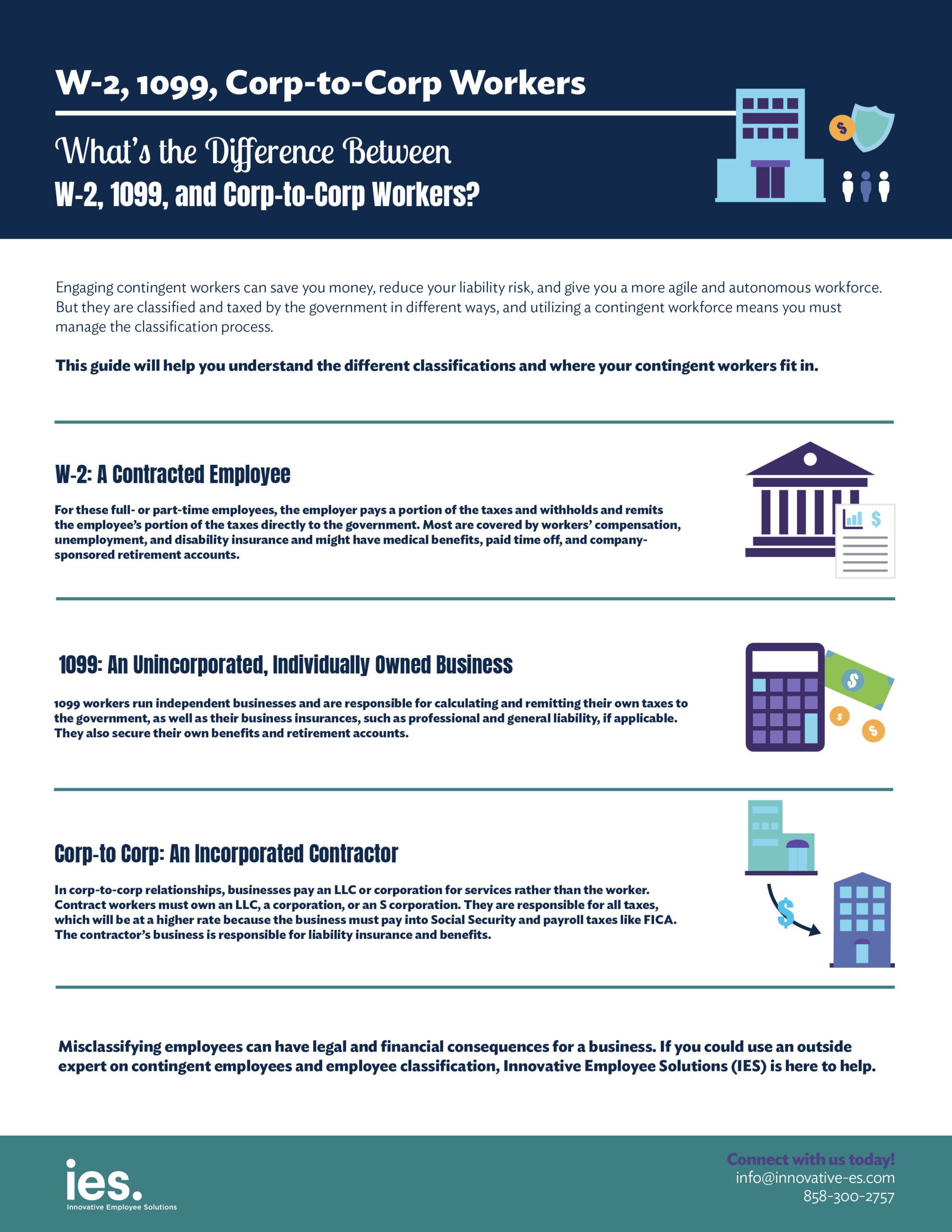

What S The Difference Between W 2 1099 And Corp To Corp Workers

What S The Difference Between W 2 1099 And Corp To Corp Workers

Do You Need A W 2 Employee Or A 1099 Contractor How To Start Grow And Scale A Private Practice Practice Of The Practice Small Business Bookkeeping Bookkeeping Business Small Business Accounting

Do You Need A W 2 Employee Or A 1099 Contractor How To Start Grow And Scale A Private Practice Practice Of The Practice Small Business Bookkeeping Bookkeeping Business Small Business Accounting

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms

1099 Vs W2 Difference Between Independent Contractors Employees

1099 Vs W2 Difference Between Independent Contractors Employees